Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 16, 2025

By Jigar Saiya

Robinhood Markets Inc. (NASDAQ: HOOD) is set to join the S&P 500 on September 22, marking a milestone for the retail trading platform that became synonymous with the pandemic-era investing boom. The stock has rallied in recent weeks, buoyed by the index inclusion, and amid plans to introduce a social feature allowing users to post trades, follow peers and track the moves of high-profile investors. At its recent HOOD Summit 2025, the company also set out ambitions to become a full-service financial super App.

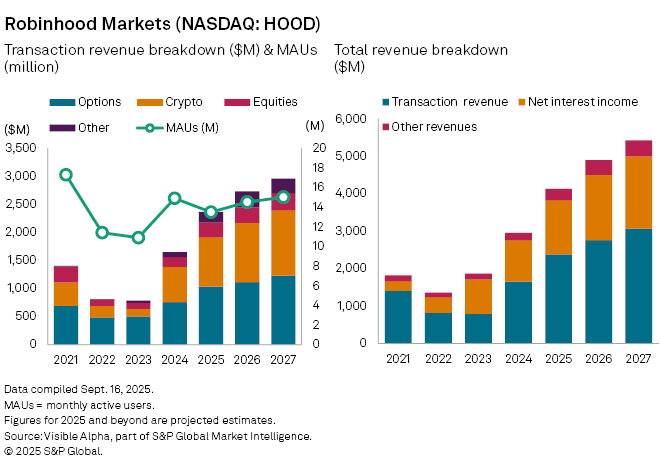

Robinhood’s reliance on trading remains central. According to Visible Alpha consensus, transaction-based revenue — the company’s largest income stream — is forecast to rise 44% year-on-year to $2.4 billion in 2025, after more than doubling in 2024. Options trading remains the mainstay, with revenue expected to increase 36% to $1 billion. Crypto is projected to grow 40% to $879 million, boosted by the acquisition of Bitstamp and new offerings. Equities revenue is set to climb 46% to $258 million, while other transaction revenue is estimated at $195 million. Overall trading volumes are expected to expand, led by a 68% jump in equities and solid growth in options and crypto.

Beyond trading, Robinhood is steadily building a more predictable earnings stream. Net interest income is projected to rise 31% to $1.5 billion in 2025, although a fall in US interest rates could weigh on this line of business.

Robinhood’s user engagement, however, is showing signs of weakness. Monthly active users declined in the first half of 2025, and analysts expect the trend to continue, projecting MAUs to fall to 13.5 million this year from 14.9 million in 2024.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment