Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 09, 2025

By Kanika Garg

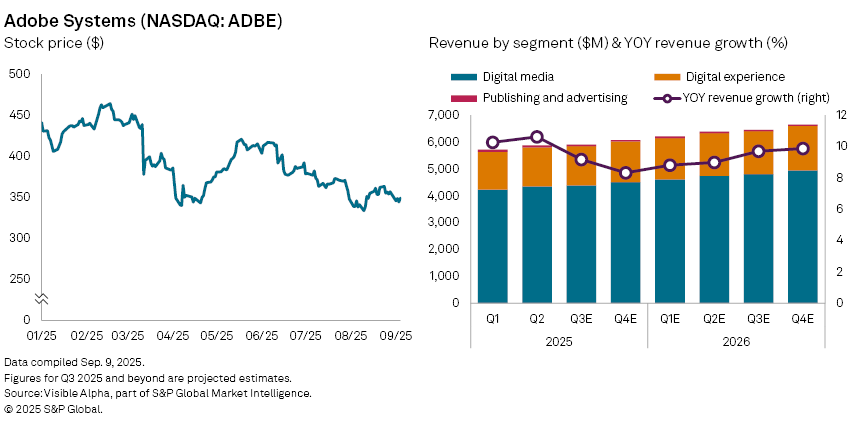

Adobe Inc. (NASDAQ: ADBE) will report third-quarter results on Thursday. The stock has fallen nearly 20% year-to-date, amid concerns over intensifying competition in artificial intelligence and signs of slowing growth in its core creative software business.

Visible Alpha consensus shows analysts expect Adobe to post revenue of $5.9 billion for the quarter, up 9% from a year earlier. Growth is expected to be led by its Digital Media unit — home to flagship products Photoshop, Illustrator, and Acrobat — where sales are projected to climb 10% to $4.4 billion. Total Digital Media annual recurring revenue (ARR) is forecast to reach $18.6 billion, up nearly 12% year-on-year, buoyed by demand for AI tools such as Firefly, Acrobat AI Assistant, and GenStudio.

Adobe’s Digital Experience segment, which sells marketing and analytics software to enterprises, is projected to generate $1.5 billion in revenue, up 8% from the prior year. By contrast, the smaller Publishing and Advertising business continues to contract, with revenues expected to fall 11% to $52 million.

The group raised full-year guidance after a strong second quarter, and analysts expect fiscal 2025 sales to rise almost 10% to $23.6 billion. Net income is projected to climb 25% to $7 billion, compared with a 2% gain last year, while earnings per share are forecast at $16.20, up from $12.40 last year.

Despite its leadership in creative software, Adobe faces mounting competition from emerging AI challengers such as Canva and OpenAI, as well as established players including Microsoft and Alphabet. It remains to be seen whether the company’s latest results can reassure the market that AI innovation is driving growth faster than competitive threats are eroding it.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment