Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 09, 2025

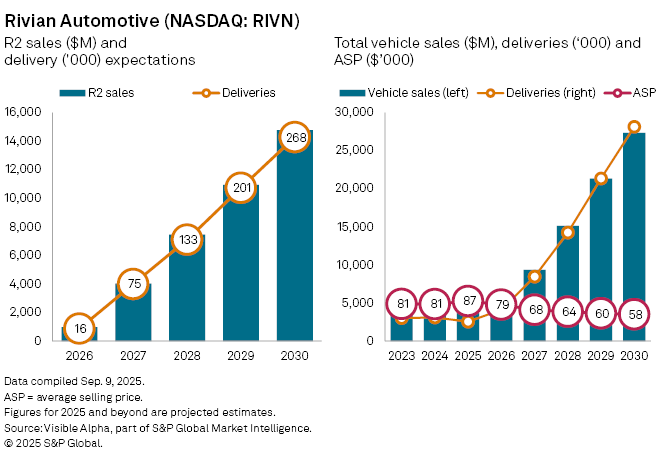

Rivian Automotive Inc. (NASDAQ: RIVN) is gearing up for the launch of its most affordable electric SUV yet, the R2, in 2026. Priced at an average $45,000—roughly half the cost of its premium R1T pickup and R1S SUV ($91,000)—the R2 is expected to significantly broaden Rivian’s customer base. Analysts forecast the new model could generate around $969 million in its first year, accelerating to $4 billion by 2027.

To prepare for the R2, Rivian will temporarily shut its Illinois factory for three weeks in September 2025 to install a dedicated assembly line.

However, the retooling comes as the company faces a challenging 2025, marked by the scheduled end of the $7,500 federal EV tax credit on September 30, which is expected to weigh on fourth-quarter demand.

Visible Alpha consensus estimates point to an estimated 12% year-on-year decline in vehicle sales to $3.7 billion in 2025, with deliveries down 17.9% to 42,000 units. The premium R1T and R1S models are projected to see sales fall 8% and 7% to 10,000 and 22,000 units respectively, while EDV commercial van deliveries could drop 23% to roughly 12,000 units.

Despite the temporary slowdown, analysts are looking to 2026 as a year of recovery, with the R2 launch expected to drive volume growth and a rebound in revenue across Rivian’s vehicle lineup.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment