Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept 26, 2025

By Alice Yu

Rio Tinto Group has been rapidly building a dominant position in the lithium market through acquisition. Its portfolio of assets appears to be strategically located to meet long-term demand growth in Europe and the US.

➤ Rio Tinto has deepened its lithium sector investment in 2025, building a leading position in the lithium market through acquisition.

➤ The company is now acquiring two additional lithium brine assets in Chile, adding much-desired brine assets to its rapidly growing lithium portfolio.

➤ The acquisition comes after the March completion of the largest M&A deal in lithium market history: The company successfully acquired Arcadium Lithium, catapulting Rio Tinto to the third-largest lithium producer in the world.

➤ The two latest deals in Chile would bring the company's lithium resources concentration in the Americas and Europe to 93%.

➤ Rio Tinto has invested even as many other major mining companies have not made large-scale investments in lithium, and while lithium sector players are struggling after years of low prices, systematic market surplus and demand uncertainties.

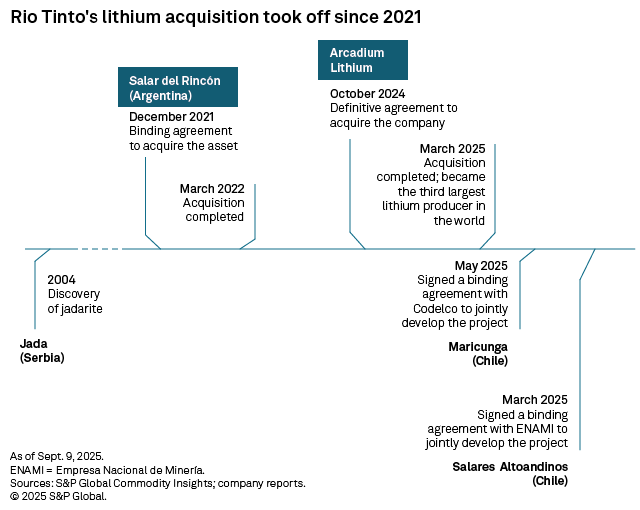

The company has shifted its lithium resource development approach from organic to acquisition. Rio Tinto had been developing the Jadar project in Serbia for the past 20 years. However, repeated community opposition to the project and the revocation of mining licenses stalled development. This meant the company lost out on the 2023 lithium bull cycle, and the production timeline at Jadar remains elusive even to this day.

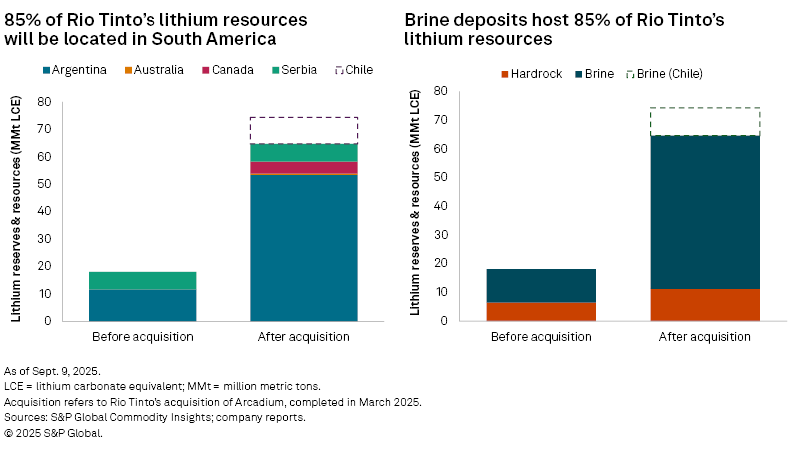

Rio Tinto's acquisition of Arcadium Lithium, just completed in March, catapulted the company from having no commercial-scale lithium production to becoming the third-largest lithium producer in the world. The Arcadium deal also more than tripled the company's total lithium reserves and resources to 64.6 million metric tons of lithium carbonate equivalent (LCE). To put this into perspective, Rio Tinto's lithium reserves and resources are now double those of Albemarle Corp., the world's largest lithium producer in 2024, which stands at 30.5 MMt LCE. The $6.7 billion deal marks the largest-ever M&A deal in the lithium industry.

The acquisition of Arcadium is also advantageous for Rio Tinto, given the company's expertise in Direct Lithium Extraction (DLE) technology. Outside of China, only Arcadium Lithium has years of experience in successfully utilizing DLE on a commercial scale at the Salar del Hombre Muerto brine operation by combining evaporation and adsorption DLE (A-DLE). Currently, only Eramet SA is utilizing pure DLE on a commercial scale at its Cuenca Centenario-Ratones brine operation; however, it has just started in December 2024 and is still ramping up production. This expertise will be instrumental for Rio Tinto as it plans to implement DLE technology in its Salar del Rincón project and the two new deals in Chile.

Since May 2025, Rio Tinto has entered two additional partnerships with Chile's state-owned mining companies to develop two lithium assets. On July 24, the company signed a binding agreement with Empresa Nacional de Minería (ENAMI) to jointly develop the Salares Altoandinos project, securing a 51% share after being confirmed as the preferred partner in May. Similarly, Rio Tinto signed a binding agreement on May 19 to jointly develop the Maricunga project with Codelco.

The two deals add much-desired Chilean brine resources to Rio Tinto's lithium portfolio and would further increase Rio Tinto's lithium reserves and resources by 15%. Chile's existing brine operations are known for having some of the lowest lithium carbonate operating costs globally, excluding royalties. Prior to the latest deals, Rio Tinto's brine resources were limited to its projects in Argentina. However, there are uncertainties regarding the costs associated with these new Chilean projects. While lithium extraction from existing operations at the Salar de Atacama brines is proven to be cost-effective, it does not necessarily imply that the two new projects will have equally low costs, especially given that these assets are in the early stages of development and are located at higher altitudes. The operating Atacama brines average an altitude of 2,300 meters, while the altitudes of Maricunga and Salares Altoandinos exceed 3,000 meters, the latter being above the threshold where altitude sickness typically begins. This could lead to operational challenges, such as access to infrastructure and labor.

Upon completion of the two deals in Chile, 91% of the company's lithium resources will be located in Europe and the Americas. Specifically, 85% of the resources will be located in the Lithium Triangle, with Argentina accounting for more than half, followed by Chile at 13%. Brine deposits will subsequently account for 85% of the company's lithium resources, up from 65% before the acquisition of Arcadium.

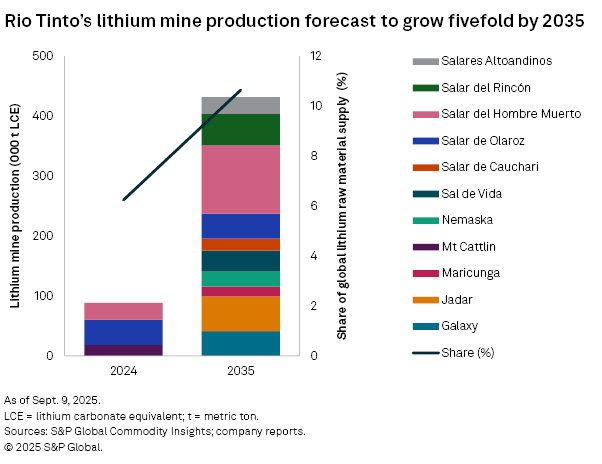

Most of Rio Tinto's projects target commissioning in the 2030s, reflecting a focus on the longer-term prospects for the lithium market. We forecast that Rio Tinto's total lithium raw material production will grow fivefold by 2035 to 400,000 metric tons LCE from 2024, its share of global lithium raw material supply rising to 11% from 5% over the same period.

In the near term, Rio Tinto is also responding to the price downturn and has followed through with Arcadium's earlier decision to place the higher-cost Mt Cattlin operation in Australia into care and maintenance by the first half of 2025. However, its two lower-cost Argentine operations — Salar del Hombre Muerto and Salar de Olaroz — continue generating positive margins despite the low lithium price environment.

Rio Tinto's continued commitment to lithium, the only one among the major diversified mining companies, reflects a strategy to secure a dominant position in an energy transition metal, taking a leap of faith on the low-cost nature of the brine assets and the ongoing rapid expansion of the lithium market size. Meanwhile, BHP Group Ltd. has opted not to enter the lithium market due to the relative abundance of lithium that could result in a "flat cost curve," something we have not seen and do not expect to. Glencore PLC does not own operating lithium assets but has made a couple of financing-for-offtake investments in early-stage lithium projects and invested in Li-Cycle Holdings Corp., a lithium-ion battery recycler.

Other major mining companies have established dominant positions in other energy transition metals. BHP was the world's second-largest copper producer in 2024, and copper accounted for 36.0% of its revenue in the 2024 fiscal year. Meanwhile, Glencore is the second-largest producer of mined nickel and cobalt production and the fourth largest in copper, with nickel and copper combined contributing 36.4% to its industrial revenue in 2024. In contrast, Rio Tinto ranks seventh in global copper production, which only constituted 17.3% of its revenue in 2024.

Lithium presents a strategic opportunity, a key energy transition metal that is growing rapidly from a small base. Prices are also at the bottom of the cycle, marking an opportune time to buy. Rio Tinto should be able to build on its position as the third-largest producer of lithium raw material as more of its assets become operational. The recent lithium deals also highlight Rio Tinto's strength in forming partnerships with governments on mining assets, a practice historically exemplified by collaborations with the government of Madagascar in developing the QMM (QIT Madagascar Minerals) ilmenite mine and the government of Mongolia for the Oyu Tolgoi copper mine.

Rio Tinto appears to have found a unique position in the lithium market that benefits the company's commodity portfolio and strategic goals. Unlike other major mining companies, Rio Tinto has demonstrated a strong commitment to lithium through its recent acquisitions, positioning the company as one of the top producers of the metal. The commitment of Rio Tinto, a major mining company, alongside oil companies such as Exxon Mobil Corp. and Chevron Corp., underscores confidence in the long-term outlook for lithium demand growth. Combined with government funding, this commits baseload capital to continue developing the lithium pipeline during the current low-price environment. We forecast a lithium market deficit beginning in 2034.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.