Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 11, 2025

By Shaily Jain and Jueeli Kadam

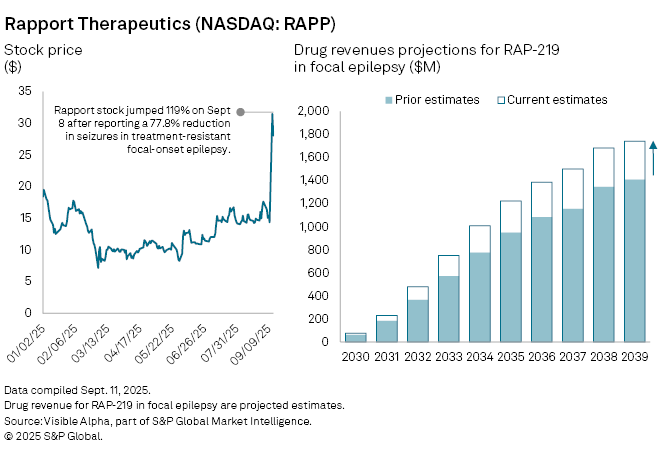

Shares in Rapport Therapeutics Inc. (NASDAQ: RAPP) jumped on Monday, September 8, after the US biotech reported encouraging mid-stage trial results for its experimental epilepsy treatment, RAP-219. The therapy, designed for patients with drug-resistant focal onset seizures, significantly reduced seizure frequency compared with placebo.

The news prompted analysts to raise their forecasts for RAP-219, with its probability of success in focal epilepsy increased to 54% from 43% prior to the announcement. Risk-adjusted revenues for the drug are now projected at $77 million in 2030, up 23% from earlier estimates of $62 million. The therapy is also expected to achieve blockbuster status — $1 billion in annual sales — by 2034, two years ahead of prior forecasts.

RAP-219, which targets receptor-associated proteins expressed in specific brain regions, is also being developed for bipolar mania and diabetic peripheral neuropathic pain, potentially broadening its commercial reach beyond epilepsy. Peak global sales across all three indications are estimated at $4 billion by 2041, subject to regulatory approval.

Rapport plans to meet the US Food and Drug Administration in late 2025 to discuss next steps for RAP-219. It also expects to present additional efficacy analyses in 2026 and launch a long-term safety trial later next year.

The upbeat trial data comes as biotech companies with promising neurology assets continue to see high valuations. If confirmed in late-stage studies, RAP-219 could become a meaningful entrant in a market for refractory epilepsy where treatment options remain limited.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment