Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 23, 2025

By Urvi Shah

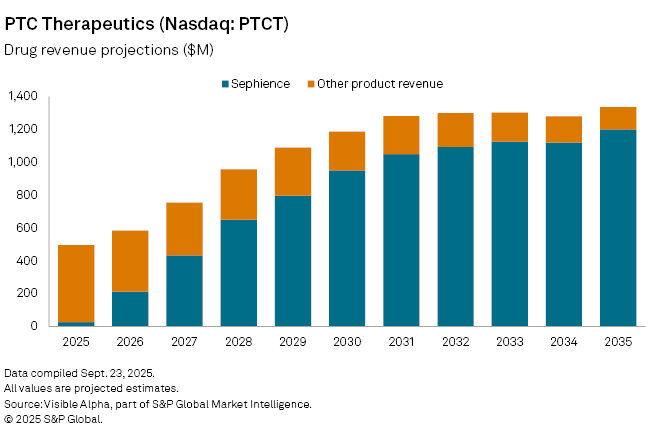

PTC Therapeutics Inc. (NASDAQ: PTCT) is pinning its next phase of growth on Sephience, a newly approved treatment for phenylketonuria (PKU), a rare inherited metabolic disorder. The drug, cleared by regulators in the US and EU this summer, was launched in Germany in July, with a US rollout expected in the coming months. Based on Visible Alpha consensus, analysts forecast sales of about $27 million in 2025, rising to $212 million the following year, with blockbuster revenues of more than $1 billion projected by 2031. At peak, Sephience could generate $1.2 billion in global sales and account for more than 60% of the pharma company’s revenue, giving PTC its first blockbuster franchise.

The launch marks a significant shift for PTC, which has until now relied on a narrow portfolio of rare disease drugs. Sephience offers once-daily dosing and improved convenience over BioMarin Pharmaceutical’s (NASDAQ: BMRN), Kuvan and Palynziq, the dominant therapies for PKU. Success would strengthen PTC’s foothold in a market where competition has historically been limited, while also reducing its reliance on products approaching the end of their patent life such as like Translarna and Emflaza.

The company, however, faces lingering questions over its broader pipeline. The US Food and Drug Administration recently issued a Complete Response Letter for vatiquinone, its Friedreich’s ataxia candidate, citing the need for additional data. The setback underscores the risks in PTC’s development portfolio and places greater pressure on Sephience to deliver.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment