Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 15, 2025

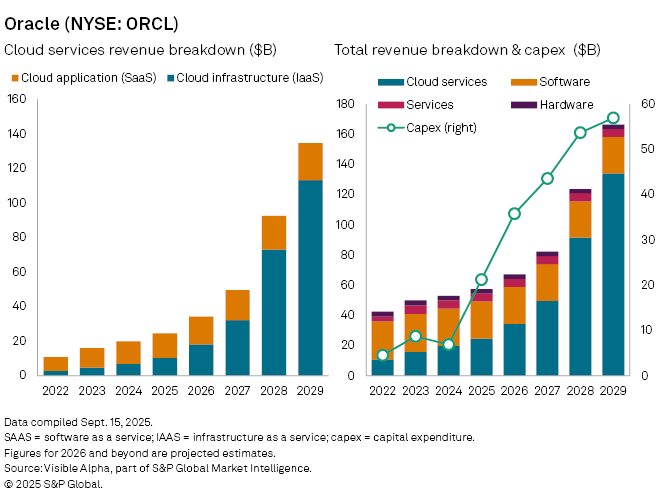

Oracle Corp. (NYSE: ORCL) shares jumped last week after the software group unveiled a string of multi-billion-dollar contract wins and reported a sharp increase in future revenue commitments. Remaining performance obligation — a measure of contracted sales yet to be recognized — swelled to $455 billion in the first quarter of fiscal 2026, a 359% rise from a year earlier.

The company is accelerating investment in its cloud infrastructure business, where demand from artificial intelligence customers has become the main engine of growth. Based on Visible Alpha consensus, analysts expect Oracle’s revenue to expand 17% year-on-year to $67 billion in fiscal 2026 and 23% in 2027, compared with just 8% in 2025.

Much of this momentum stems from Oracle’s cloud services, where its infrastructure-as-a-service (IaaS) business is emerging as a key growth driver, benefiting from the surge in AI workloads.

To keep pace, Oracle is dramatically increasing capital expenditure. Spending is projected to climb 69% in fiscal 2026 to $36 billion, after more than tripling in 2025 from a low base in 2024. The outlays are targeted at building new data centers and deepening partnerships with Amazon’s AWS, Microsoft Azure and Alphabet’s Google Cloud, enabling customers to run Oracle Cloud Infrastructure (OCI) workloads across multiple platforms.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment