Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 18, 2025

Nuvation Bio Inc. (NYSE: NUVB) has become a commercial-stage biotechnology company following US FDA approval of its oral lung cancer therapy, Ibtrozi, in June. The therapy, aimed at patients with ROS1-positive non-small cell lung cancer (NSCLC), is now approved in the US and China, with additional regulatory filings under way.

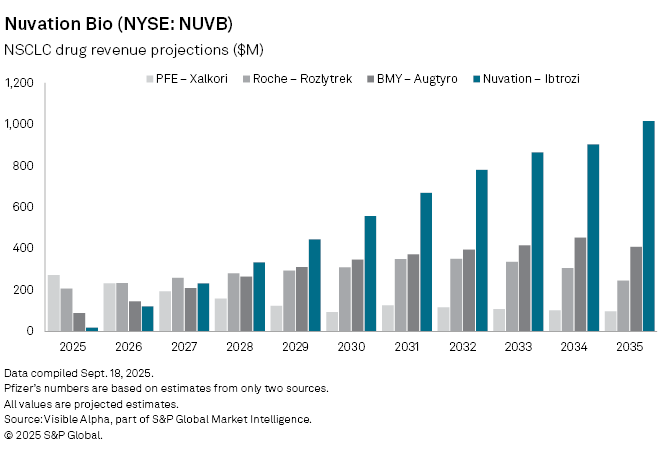

Analysts expect a rapid ramp-up: revenue is forecast to climb from an estimated $20 million in 2025 to $122 million in 2026, reaching $233 million in 2027 and potentially $1 billion by 2035. Uptake is expected to be boosted by the National Comprehensive Cancer Network, which added Ibtrozi as a preferred treatment option shortly after approval.

Ibtrozi will compete with established therapies, including Pfizer Inc. (NYSE: PFE), Xalkori, Roche Holding AG (SWX: ROG) Rozlytrek, and Bristol-Myers Squibb Co. (NYSE: BMY) Augtyro.While Pfizer’s drug is nearing peak before an expected decline, Roche’s Rozlytrek is projected to generate $208 million in 2025 and peak at $351 million by 2032. Augtyro, approved in 2023, is forecast to bring in $89 million in 2025, rising to $453 million at peak in 2034.

Beyond ROS1-positive NSCLC, Ibtrozi is being evaluated in metastatic breast cancer, solid tumors, and neurological cancers, which could broaden its market opportunity.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment