Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 17, 2025

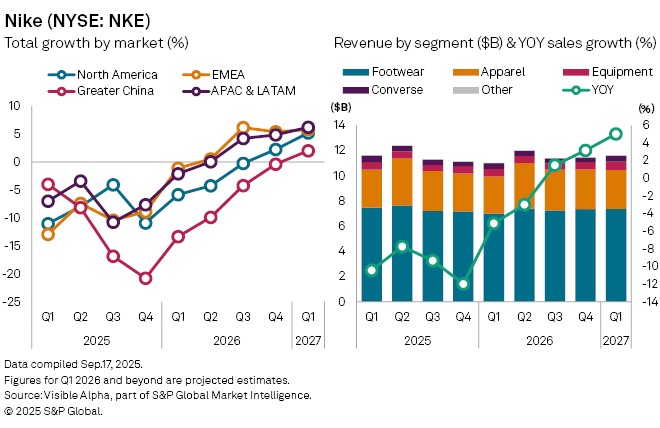

Nike Inc. (NYSE: NKE) is set to report first-quarter fiscal 2026 results on September 30, with sales and profit expected to remain under pressure as weakness in key markets collides with shifting consumer preferences, intensified competition, and the short-term costs of its strategic “Win Now” plan.

The initiative, aimed at clearing excess inventory and curbing discount-led sales, is designed to restore brand strength and pricing power. But in the near term, it is expected to weigh on revenue growth. Analysts expect the sportswear giant to return to growth only in the second half of the fiscal year, with momentum building into 2027.

Visible Alpha consensus points to Q1 revenue of $11.0 billion, down 5% year-on-year — the sixth consecutive quarter of contraction. Nike brand revenue is projected to fall 5% to $10.5 billion, with broad-based weakness across regions. Greater China remains a key drag, with sales forecast to tumble 13% to $1.4 billion, while North America is expected to decline 4% to $4.5 billion. Asia-Pacific and Latin America is also under pressure, with sales projected to fall 2% to $1.4 billion. Europe, Middle East and Africa should be more resilient, slipping 1% to $3.1 billion.

By category, footwear sales — which account for nearly two-thirds of revenue — are projected to fall 6% to $7 billion, while apparel is set to decline 3% to $2.9 billion. Converse, a smaller but closely watched brand, is forecast to drop 9%. Equipment sales are a rare bright spot, rising 1%.

Wholesale revenue, historically Nike’s backbone, is expected to contract 4% to $6.2 billion, suggesting that retail partners may be experiencing reduced demand. Direct-to-consumer sales, a core pillar of Nike’s long-term strategy, are projected to fall 8% to $4.3 billion, though analysts expect a rebound later in the year supported by new store openings and stronger digital growth.

Despite near-term headwinds, analysts are watching whether Nike’s efforts to rein in discounting and improve margins can support a sustained recovery. By the first quarter of fiscal 2027, consensus forecasts growth to accelerate as the strategy takes hold.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment