Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 24, 2025

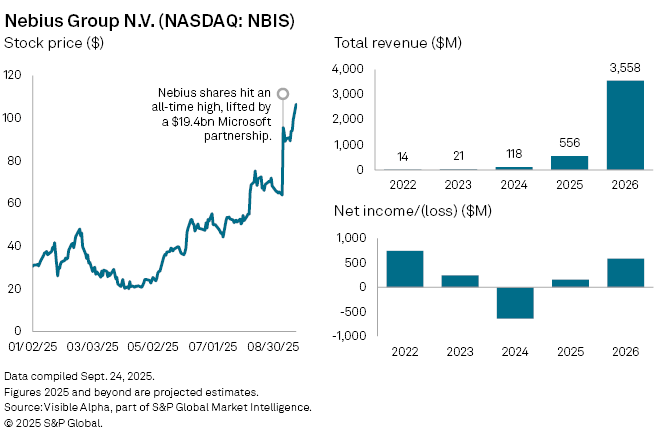

Nebius Group NV (NASDAQ: NBIS) has emerged as one of the most closely watched names in artificial intelligence after striking a $19.4 billion deal with Microsoft Corp. (NASDAQ: MSFT) to supply GPU-based infrastructure from its new data center in Vineland, New Jersey. The agreement, announced this month, has fueled a sharp rally in Nebius’s shares, which have climbed 249% year-to-date to a record $106.6 as of September 23, giving the company a market value of $27 billion.

The deal places Nebius inside Microsoft’s expanding cloud network, ensuring a steady flow of revenue while reducing its exposure to the swings that have characterized the AI hardware market. Services under the contract are expected to commence later this year.

The company, which generated $118 million in revenue in 2024, is forecast to grow rapidly. Analysts expect sales to climb more than threefold to $556 million in 2025 and to reach $3.6 billion in 2026, according to Visible Alpha consensus estimates. Nebius is also projected to swing back into profit in 2025, with net income of $155 million, compared with a net loss of $641 million in 2024. Profitability is forecast to accelerate further, with earnings rising to $586 million by 2026 as operating leverage improves.

The Microsoft partnership strengthens Nebius’s hand in the AI infrastructure market, where competition is intensifying against rivals such as CoreWeave Inc.(NASDAQ: CRWV). For Microsoft, which already counts CoreWeave among its biggest suppliers, the deal diversifies its access to scarce GPU capacity—a key bottleneck in the AI boom.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment