Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 17, 2025

By Ashish Negi

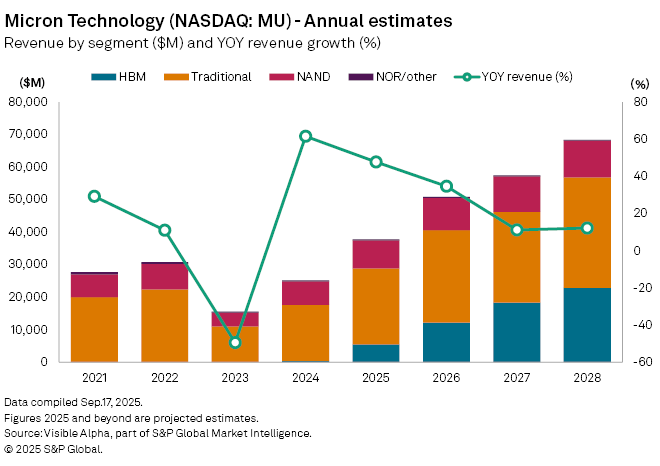

Micron Technology Inc. (NASDAQ: MU) is poised for a sharp jump in revenue and profits as its reports fourth-quarter 2025 results on Tuesday, September 23, driven by accelerating demand for advanced memory chips.

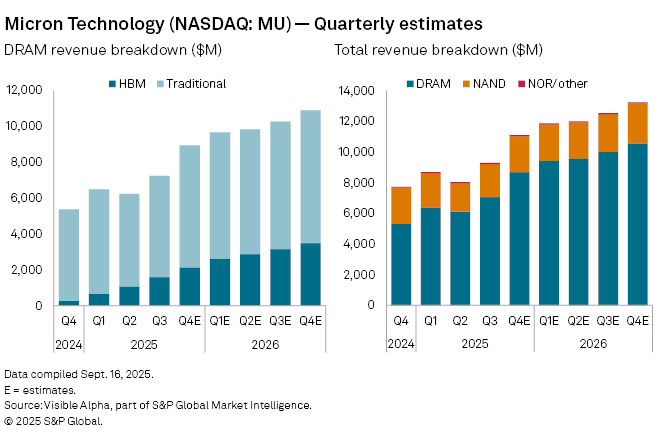

Visible Alpha consensus points to Q4 revenue of $11.1 billion, a 43% rise from a year earlier, driven by strength in its DRAM business. DRAM sales, which accounts for nearly four-fifths of company’s revenue, are forecast to climb 63% year-on-year to $8.7 billion, driven by soaring adoption of high-bandwidth memory (HBM).

HBM, a premium memory used in AI and high-performance computing systems, is emerging as a key growth driver for Micron. Revenue from HBM is projected to surge more than sixfold to $2.1 billion, while traditional DRAM sales are expected to rise 34% to $6.8 billion. The premium pricing of HBM highlights its importance to Micron’s earnings profile: analysts estimate average selling prices of $1.49 per unit—almost four times that of traditional DRAM and compared to $0.07 for NAND flash.

Micron entered the HBM market in recent years and is now the only US-based player, competing with South Korea’s Samsung and SK Hynix. Its HBM3e products are integrated into NVIDIA’s GB200 systems, while HBM4 is slated for production in 2026 for NVIDIA’s Rubin platform, ensuring exposure to next-generation data center deployments.

NAND flash, Micron’s other major memory segment, remains under pressure, with revenue expected to decline 1% year-on-year in Q4, after growth slowed to 4% in the previous quarter.

For the full year, Micron’s sales are projected to climb 48% to $37.1 billion. Net income is forecast to increase nearly tenfold to $8.4 billion, with diluted EPS surging to $7.40 from $0.70 in 2024.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings