Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 18, 2025

By Tim Zawacki

After a significant change in statutory accounting at the start of 2025 served as the driver of a material increase in US life insurers' holdings in a key category of alternative assets during the first quarter, a more traditional catalyst returned to the fore in the second quarter.

Our analysis of life industry other long-term invested assets reported on Schedule BA shows that sequential growth occurred in both absolute dollar value and relative allocation despite starting from a much higher base in the second quarter. Dynamics among P&C insurers are a bit more complex, but for the most part continued to show higher levels of investment.

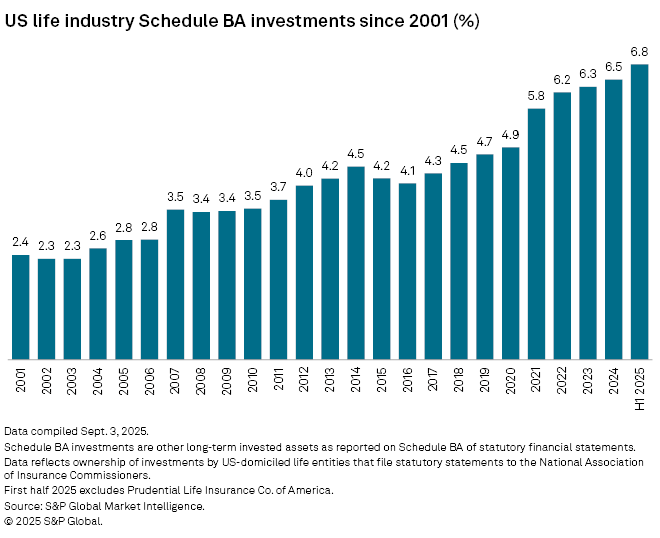

Allocations to Schedule BA among life insurers have been growing steadily during the past nine years, primarily driven by increased investments in limited partnership interests in leveraged buy-out, real estate and other private equity funds. The continuation of that trend drove the increase in life industry Schedule BA investments to more than $385 billion as of June 30, representing 6.8% of net admitted cash and invested assets, from approximately $373 billion, or 6.7%, as of March 31. In the first quarter, the one-time transfer of billions of dollars' worth of investments that they had previously classified as bonds to Schedule BA during turbocharged growth, boosting allocations by nearly 0.3 percentage points from year-end 2024.

Higher Schedule BA allocations come as part of a broad shift in investment approaches across the industry with a greater focus on alternative assets, including holdings of instruments such as privately placed corporate bonds, bank loans, collateralized fund obligations, rated note feeder fund structures and residential mortgage whole loans. Not only did Schedule BA show continued evidence of the trend in the second quarter, so, too, did various categories of bonds on Schedule D.

Under the National Association of Insurance Commissioners' Principles-Based Bond Definition project, Statement of Statutory Accounting Principles No. 26R, effective Jan. 1, 2025, indicates that a bond is "any security representing a creditor relationship, whereby there is a fixed schedule for one or more future payments, and which qualifies as either an issuer credit obligation or an asset-backed security." A debt instrument must have a creditor relationship in substance and, in the event of an asset-backed security, a "meaningful" level of cash-flow generation toward debt repayment as well as substantive structural credit enhancement.

To accommodate reporting for debt securities that no longer meet the definition for inclusion as a bond on Schedule D, Part 1 of statutory statements, Schedule BA featured three new categories beginning with the first quarter of 2025: debt securities without a creditor relationship in substance, that are lacking substantive credit enhancement and that are lacking meaningful cash flows. Our analysis of first-quarter acquisition activity found significant movement of investment holdings into the new Schedule BA categories as well as several existing categories, including capital notes and residual tranches.

The sum of the actual cost of new acquisitions and the amount of additional investment into existing holdings in the three new Schedule BA categories was $10.65 billion in the first quarter, but only approximately $975 million in the second quarter. For capital notes and residual interests, new and additional investments during the first quarter totaled $3.32 billion and $3.15 billion, respectively, but slid to approximately $1.44 billion and $1.88 billion in the second quarter.

As part of the bond reclassification process, debt securities no longer eligible for inclusion on Schedule D were reported on Schedule D, Part 4 of March 31, 2025, statutory statements as being divested to Schedule BA and, in some cases, Schedule D, Part 2, Section 1 as preferred stock and Schedule B as mortgage loans. Conversely, those schedules showed the transferred investments as acquisitions. In some cases, a change in the basis on which specific investments were valued — generally at amortized cost on Schedule D to, for certain holdings, the lower of amortized cost or fair value on Schedule BA — impacted surplus.

On a combined basis using a sum-of-the-parts analysis, we found that the three new debt securities categories, capital notes and residual interests accounted for 42.5% of the life industry's $40.32 billion in Schedule BA acquisitions and additional investments in the first quarter but only 17.2% of the more than $25 billion in acquisitions in the second quarter. Interests in limited partnerships and limited liability companies reemerged as the dominant source of new and additional investments, accounting for 55.8% of the second quarter's activity, up from 39.6% in the first quarter.

Net life industry additions to Schedule BA positions based on sequential changes in book value and accounting for new and additional investments as well as disposals totaled $18.36 billion for the first quarter and approximately $12.20 billion for the second. Lincoln National Corp.'s $4.66 billion in net additions ranked highest among the 25 largest US life groups in the first quarter, reflecting Lincoln National Life Insurance Co.'s reclassification of more than $4.60 billion in debt securities due to the new bond definitions. For the second quarter, The Northwestern Mutual Life Insurance Co.'s net additions of $2.67 billion ranked highest, in large part reflecting a $1.48 billion investment in an affiliated limited liability company. This position ranked as the largest new or additional investment in a single Schedule BA holding by a US life insurer as reported on June 30, 2025, statutory statements. Lincoln National Life's $1.50 billion in new and additional investment in White Capital V LLC, which the company categorized among debt securities without a creditor relationship in substance, ranked as the sector's largest addition to Schedule BA in the first quarter.

Allocations to Schedule BA bottomed out among life insurers in the middle of 2016 at just under 4% of net admitted cash and invested assets, increasing sequentially in 29 of the 35 quarters from the last three months of 2016 onward.

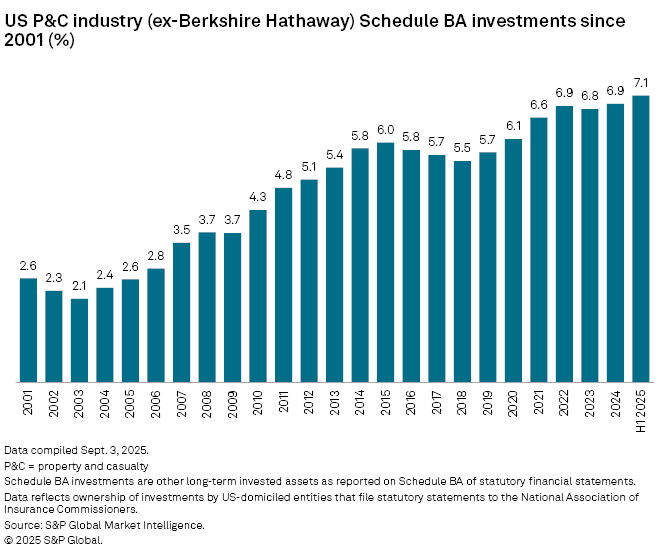

In the P&C sector, Schedule BA allocations have incrementally fallen since peaking in the first quarter of 2017 at more than 9.1% of net admitted cash and invested assets. But this largely reflects various activities affecting the P&C subsidiaries of Berkshire Hathaway Inc., which at one point accounted more than 45% of the sector's Schedule BA investments but more recently has maintained a share of less than 16% as it shifted equity interests in BNSF Railway to a noninsurance intermediate holding company. For the rest of the P&C industry, Schedule BA allocations peaked at 7.2% of net cash and invested assets as of March 31 then slipped to 7.1% as of June 30 even as the absolute amount of investment rose.

Sector-level data shows evidence of a modest impact on Schedule BA holdings from bond reclassifications in the first quarter, with new and additional investments in the three debt securities categories, capital notes and residual interests totaling $1.35 billion. New and additional second-quarter investments in those categories were approximately $1 billion lower.

The group led by State Farm Mutual Automobile Insurance Co. and the P&C subsidiaries of Liberty Mutual Holding Co. Inc. had the largest sequential net increase in Schedule BA book value during that period. Everest Reinsurance Co. showed a series of large additional investments followed by sizable disposals of interests in an entity called Base Camp LLC, leading to only a modest net increase in its Schedule BA holdings.

State Farm's activity included the $400 million surplus note issued to the top-tier mutual by embattled California-focused subsidiary State Farm General Insurance Co. Various Liberty Mutual entities added to their investments in affiliated limited partnerships.

Both the P&C, excluding Berkshire, and the life sector are on track to shore their highest relative allocations to Schedule BA assets at the end of a calendar year in 2025.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.