Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 10, 2025

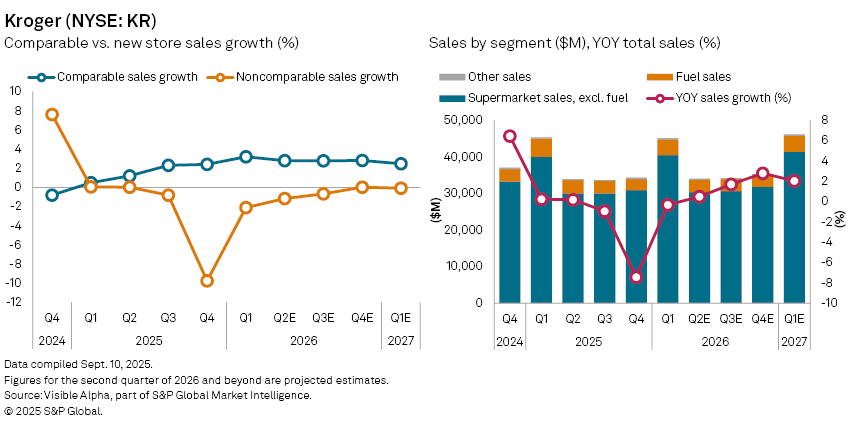

The Kroger Co. (NYSE: KR) is expected to report second-quarter results on Thursday, September 11, with total sales forecast to edge up 0.5% year-on-year to $34.1 billion. The US grocery chain is relying on steady gains in core supermarket sales and efficiency measures to offset pressures from falling fuel revenues and a stalled expansion strategy.

According to Visible Alpha consensus, supermarket sales excluding fuel are expected to rise 1% to $30.3 billion, while comparable sales growth is estimated at 2.8%. Non-comparable sales are expected to contract 1.2%, reflecting a marginal decline in the company’s supermarket footprint to an estimated 2,728 outlets. Fuel revenue is set to drop 7.2% to $3.4 billion, in line with softer fuel demand and lower prices.

By contrast, other revenue streams — including pharmacy, e-commerce, and ancillary services — are forecast to grow 9.5% to $297 million, underlining Kroger’s efforts to diversify beyond traditional groceries. Quarterly earnings are forecast at $0.99 per share, a 6.8% increase from a year earlier.

Last month, Kroger announced plans to cut hundreds of corporate roles as part of a wider restructuring. Management intends to reinvest the savings into price reductions, increased store staffing, and enhanced real estate capabilities.

For the full year, analysts anticipate total sales of $149 billion, up 1.1% after a 1.9% decline in fiscal 2025. Excluding fuel, comparable sales growth is projected at 2.9%, while non-comparable sales are expected to dip 0.9%.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment