Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 10, 2025

By Santosh Saha

Hewlett Packard Enterprise Co. (NYSE: HPSE) is poised for accelerated growth in 2025 as it integrates Juniper Networks and taps rising demand for AI-powered and hybrid cloud solutions. In its recent third quarter earnings, the company reported net revenue of $9.1 billion, up 18% year-on-year, fueled by strong momentum in AI systems and resilient server demand.

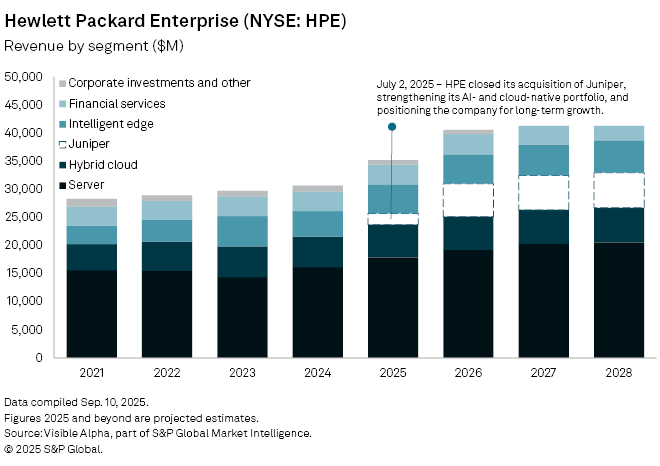

According to Visible Alpha consensus estimates, HPE’s net revenue is forecast to climb 15% year-on-year to $34.5 billion in 2025, followed by a further 17% increase to $40.2 billion in 2026. This compares with a modest 3% rise in 2024.

Hewlett Packard’s acquisition of Juniper Networks, completed in July, is a key driver of this growth as the company repositions itself for the AI and hybrid-cloud era. Analysts expect Juniper to contribute $2 billion in sales in 2025, almost tripling to $5.9 billion in 2026.

Hewlett Packard’s hybrid-cloud business is also gaining traction, buoyed by demand for its GreenLake platform, Alletra MP storage systems, and private-cloud AI deployments. The segment expanded 14% in the third quarter and is forecast to grow 7% to $5.8 billion in 2025, a turnaround from a 1% contraction last year.

Beyond Juniper and hybrid cloud, Hewlett Packard Enterprise is set for steady gains across its core businesses. The server segment, which makes up 51% of revenue, is projected to rise 11% to $17.9 billion in 2025. The intelligent edge unit is expected to rebound with 15% growth to $5.2 billion, after a steep 16% decline last year. By contrast, financial services revenue is forecast to remain flat at $3.5 billion.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment