Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 11, 2025

By Hardik Savla

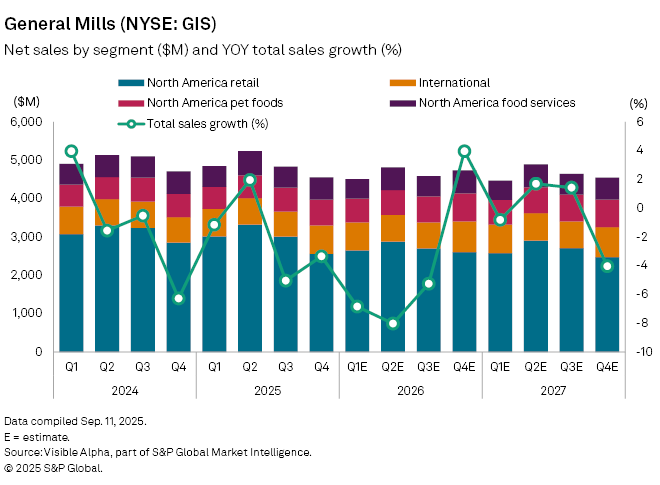

General Mills Inc. (NYSE: GIS) is forecast to report a 7% year-on-year decline in first-quarter fiscal 2026 sales on Wednesday, September 17. Visible Alpha consensus estimates point to net sales of $4.5 billion, down from $4.9 billion a year earlier. The packaged food giant has struggled to reignite growth after two lackluster years, with analysts expecting sales weakness to persist through the first half of 2026 before a modest rebound of about 4% in the fourth quarter.

The divestiture of General Mills’ US yogurt business — including Yoplait, Go-Gurt, and others — to French dairy group Lactalis in June 2025 is set to cut approximately 4% from first-quarter sales. Broader challenges remain as consumers continue to shift towards healthier, less processed foods amid persistent macroeconomic uncertainty.

Ahead of earnings, analysts expect North America retail, the company’s largest division, to record a 12% fall in sales to $2.7 billion, while foodservice revenue is expected to decline 5% to $512 million. By contrast, the international and pet food businesses are projected to grow, with sales reaching $724 million and $623 million, respectively.

Profitability is also under strain. Net income is forecast at $448 million, down 23% from a year earlier, while diluted earnings per share are expected to fall to $0.80 from $1.00 a year ago.

Analysts caution that input cost pressures and limited pricing power remain key risks, though pet food growth and brand innovation could provide support in the longer term.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment