Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 16, 2025

By Neha Jain and Mrunalini Mandore

FedEx Corp. (NYSE: FDX) reports first-quarter results on September 18, with analysts expecting little top-line growth as global trade pressures and softer business demand weigh on performance.

Shares of the US delivery group are down 16% so far this year, reflecting concerns that macroeconomic headwinds and the expiry of its US Postal Service contract in September last year are offsetting savings from its DRIVE and Network 2.0 cost-cutting programmes.

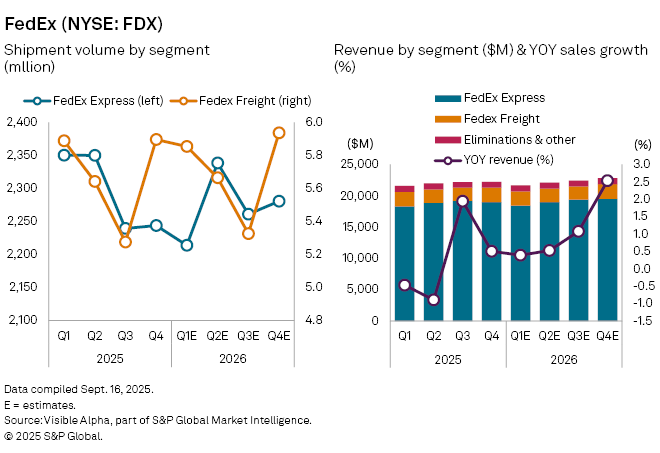

Revenue is forecast to be flat at $21.7 billion in the three months to August, with FedEx Express — its largest unit — expected to rise 0.8% to $18.5 billion. Freight revenue is projected to fall 2.3% to $2.3 billion.

Operating income at FedEx Express is estimated to climb 5% to $1 billion from $953 million a year earlier, while Freight earnings are set to slip to $402 million from $439 million. Shipment volumes remain under pressure across both divisions, with Express volumes projected at 2.21 billion, down from 2.35 billion last year, and Freight shipments seen at 5.85 million versus 5.89 million.

FedEx is also pushing ahead with a planned break-up of its freight business, announced in December 2024. The unit is scheduled to be spun off by mid-2026, leaving it to target small businesses, e-commerce and grocery customers as a standalone company. Management argues the separation will give both groups greater flexibility to cope with volatile demand, trade frictions and higher tariffs, while keeping cost discipline at the center of strategy.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.