Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 26, 2025

By Nathan Stovall and Zain Tariq

While peak funding costs are in the rear-view mirror, investors and bank acquirers continue to assign higher values to institutions with lower-cost deposit franchises.

Funding pressures have eased significantly from the fervor witnessed in the aftermath of the liquidity crunch in 2023. Rate cuts by the Federal Reserve late in 2024 also offered banks some relief from higher deposit costs, which have fallen from the recent high point recorded in the third quarter of 2024. Still, the premium awarded to stronger deposit franchises remains on full display even as the Fed is expected to cut rates further by year-end 2025.

Investors continue to place greater value on bank franchises with less rate-sensitive funding bases, particularly institutions with higher concentrations of non-interest-bearing deposits. For instance, the median price-to-tangible book value on Aug. 29 was 136.0% for major exchange-traded banks with non-interest-bearing deposits that exceeded the industry median at the end of the second quarter. That is nearly 29 percentage points higher than institutions below the industry median. The outperformance among publicly traded banks with higher concentrations of non-interest-bearing deposits has been greater than 25 percentage points since the third quarter of 2022, when the Fed began accelerating its rate hike campaign to tame inflation.

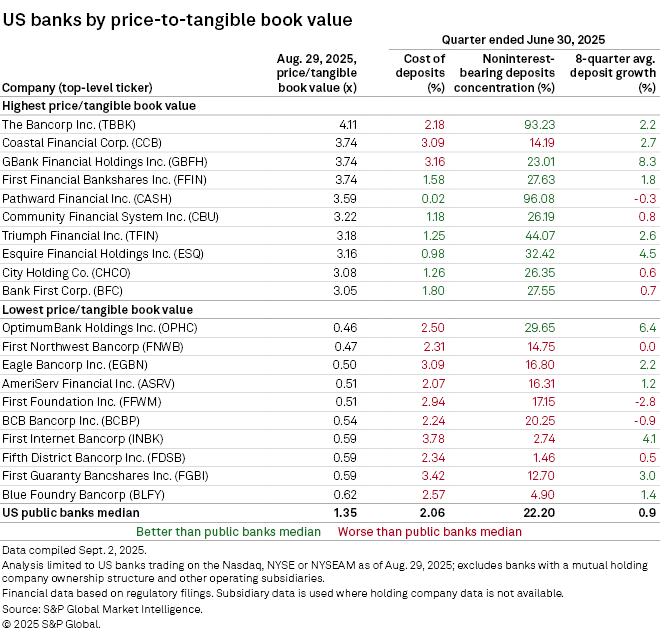

Looking at the top 10 banks trading at the highest price-to-tangible book multiple on Aug. 29, nine of the franchises boasted a non-interest-bearing concentration higher than the publicly traded median. Meanwhile, 9 of the 10 banks trading with the lowest price-to-tangible had a non-interest-bearing deposit concentration below the publicly traded median.

The valuation disparity is also quite wide based on institutions' cost of deposits. As of Aug. 29, the median price was 135.4% of tangible book value for publicly traded banks with a cost of deposits below the industry median in the second quarter. That is 28.8 percentage points higher than for banks with more rate-sensitive deposit bases. Seven of the top 10 banks trading with the highest price-to-book multiple carried a cost of deposits below the industry median, while 10 of the banks trading with the lowest price-to-tangible book multiple had a cost of deposits above the industry median.

Bank acquirers have also assigned a higher value to sellers with higher levels of non-interest-bearing deposits. Targets whose non-interest-bearing deposit concentration exceeded the industry median have fetched a median deal value of 160.6% of tangible book value in 2025 — nearly 29 percentage points higher than targets whose non-interest-bearing deposit concentration was below the industry median.

It is no surprise that non-interest-bearing deposits are prized by investors and acquirers alike. Non-interest-bearing deposits have been harder for banks to retain since the Fed's first rate hike in the recent tightening cycle early in 2022. In fact, the banking industry's non-interest-bearing deposits have fallen 29% since year-end 2021 through the end of the second quarter, while interest-bearing deposits have risen nearly 14%.

A target's cost of deposits have also been a strong indicator of the values targets have received. Targets whose cost of deposits were below the industry median received a median deal value of 161.0% tangible book value in 2025. That is more than 23 percentage points higher those targets whose cost of deposits was above the median.

Looking at the 15 highest priced deals announced in 2025, based on the deal value to the target's tangible common equity, 11 of the targets boasted a cost of deposits below the industry median. The highest priced transaction — FirstBank Holding Co. planned to $4.1 billion sale to PNC Financial Services Group Inc. — was included in that group. FirstBank reported a cost of deposits of 1.45% at the end of the second quarter, compared to the industry median of 2.06%. FirstBank's non-interest-bearing deposit concentration also stood out at 33% of deposits — 11 percentage points above the industry median.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.