Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 15, 2025

By Aarti Karwa and Dharmang Sapariya

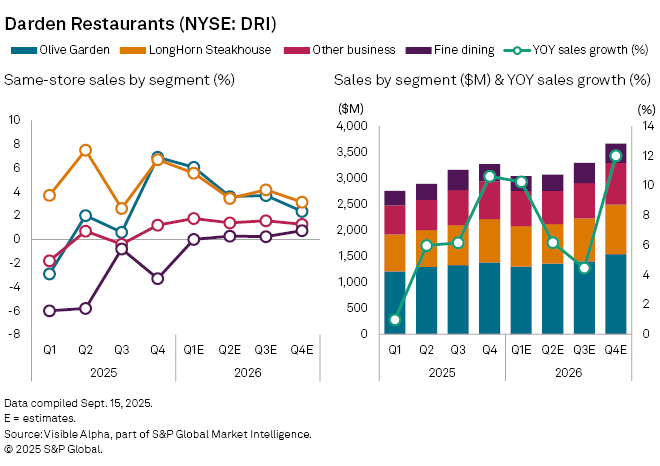

Darden Restaurants Inc. (NYSE: DRI) is expected to deliver a strong start to its fiscal year 2026 when it reports first-quarter results on Thursday, September 18, with sales and profit set to climb despite persistent consumer caution about discretionary spending.

Visible Alpha consensus points to revenue of $3 billion, up 10.3% from a year earlier, compared with just 1% growth in the same quarter of 2025. Net income is projected to rise 14% to $236 million, with earnings per share of $2.

Darden, the owner of popular restaurant chains Olive Garden and LongHorn Steakhouse has benefited from resilient demand for casual dining, even as shifting consumer preferences and economic uncertainty loom as risks in the months ahead. Analysts expect same-store sales to rise 6.1% at Olive Garden and 5.6% at LongHorn.

By revenue, Olive Garden is forecast to grow 7% year-on-year to $1.3 billion, LongHorn 8% to $773 million, and other brands — including Cheddar’s Scratch Kitchen, Yard House, and the newly acquired Chuy’s Tex-Mex locations — 22% to $679 million. The fine dining unit, comprising Ruth’s Chris, The Capital Grille and Eddie V’s, is set to post a more muted growth of 3% to $287 million.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment