Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 01, 2025

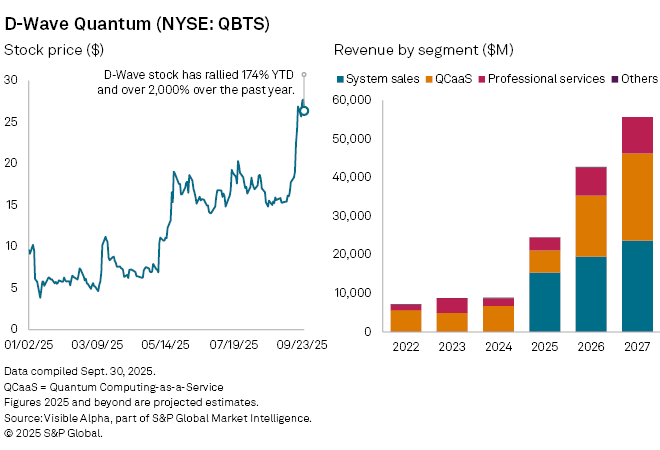

Quantum computing company D-Wave Quantum Inc. (NYSE: QBTS) has seen its stock jump 174% year-to-date, and over 2000% over the past year, buoyed by a mix of macro tailwinds and company milestones. A September interest rate cut by the US Federal Reserve lifted high-growth technology stocks, while the Canadian company’s latest system launch added enthusiasm around quantum computing.

According to Visible Alpha consensus estimates point to a sharp acceleration in revenues. Revenue is projected to surge 179% year-on-year to $24.6 billion in 2025, from $8.8 billion in 2024 when growth was muted. The bulk of that increase is expected to come from the debut of system sales, expected to generate $15.3 billion in 2025 and a further $19.5 billion in 2026, supported by early contracts such as one signed with Germany’s Jülich Supercomputing Centre earlier this year.

D-Wave’s existing Quantum Computing-as-a-Service (QCaaS) unit is forecast to contract 38% to $5.8 billion in 2025 but rebound to $15.8 billion in 2026 as demand for hybrid quantum applications develops. Professional services, underpinned by agreements with NTT Docomo, Mastercard and Ford Otosan, are expected to climb 70% to $3.3 billion in 2025 and more than double to $7.3 billion in 2026.

D-Wave is capitalizing on the growing interest in artificial intelligence by positioning itself as a player in quantum AI. D-Wave is one of the few listed pure-play quantum computing businesses, competing with IonQ Inc. (NYSE: IONQ), Rigetti Computing Inc. (NASDAQ: RGTI) and Quantum Computing Inc. (NASDAQ: QUBT), as well as indirectly with the deep pockets of IBM, Alphabet, Microsoft and Amazon.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment