Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 01, 2025

BioNTech SE (NASDAQ: BNTX) and Bristol-Myers Squibb Co. (NYSE: BMY) reported encouraging early data from a Phase II trial of BNT327, a next-generation cancer immunotherapy, in patients with small cell lung cancer (SCLC) that has begun to spread. Interim results showed that 76.3% of the 38 participants evaluated experienced tumor shrinkage, bolstering confidence in the drug’s potential.

BNT327, also known as pumitamig, is being developed under a strategic partnership formed in June 2025, in which BioNTech and Bristol Myers Squibb equally share development, manufacturing, and commercialization costs and profits. Analysts view the trial outcomes as validation of this collaboration and its aim to deliver a potential new standard of care for aggressive solid tumors.

The drug is also under investigation in other indications, including non-small cell lung cancer (NSCLC), triple-negative breast cancer (TNBC), and others.

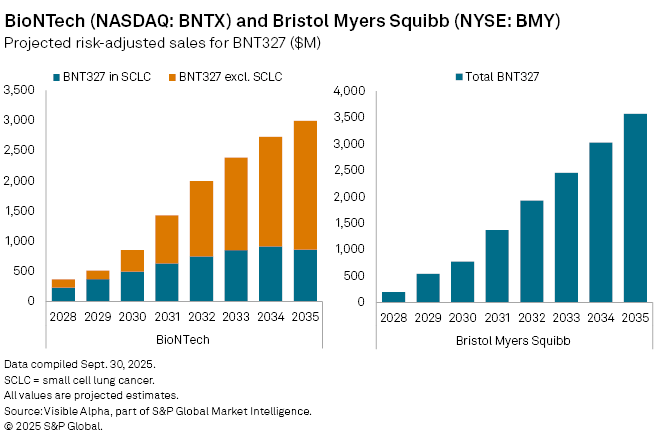

From a financial perspective, Visible Alpha consensus forecasts BNT327 could generate risk-adjusted sales of $231 million for BioNTech in SCLC by 2028, rising to $373 million in 2029 and reaching $1.1 billion by 2038. Analysts assign a 60% probability of success (POS) for BNT327 in SCLC. Across all indications, peak global sales for BioNTech are projected at $4.5 billion by 2038.

For Bristol Myers Squibb, consensus estimates indicate risk-adjusted sales of $198 million in 2028, growing to $541 million in 2029 and surpassing $1.4 billion by 2031. Peak global sales are expected to reach $5.2 billion by 2039, with analysts currently assigning a 50% POS.

The Phase II data reinforce the strategic rationale for the joint development effort, highlighting BNT327’s potential to expand both companies’ oncology offerings and address unmet needs in difficult-to-treat cancers.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment