Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 11, 2025

By Althea Liwanag

The global transition to a low-carbon economy is paradoxically dependent on materials whose extraction is increasingly carbon-intensive. Copper, a cornerstone of electrification, renewable energy generation and electric vehicles, exemplifies this challenge. In 2024, primary copper mines covered in the S&P Global copper emissions curve had an average Scope 1 and 2 greenhouse gas emissions intensity of 2,370 kilograms of CO2 equivalent per paid metric ton of copper (kgCO2e/t Cu). This represents an 8.0% decrease from 2023, with a further 2.0% decline projected for 2025. The primary driver of this improvement is the decarbonization of power grids, which lowers Scope 2 emissions. The next critical challenge for the industry is mitigating Scope 1 emissions, which will require operational changes like fleet electrification.

➤ Africa leads in low-carbon copper, with emissions intensity 38% below the global average, driven by access to hydropower.

➤ The top-producing region of Latin America also maintains below-average emissions, with Chile's national green policies accelerating the trend.

➤ The industry's focus is shifting from Scope 2 to Scope 1 emissions, as successful grid decarbonization highlights direct operational emissions as the next challenge.

➤ Major miners are now focused on tackling Scope 1 emissions by electrifying their fleets, replacing diesel-powered equipment with battery-electric alternatives.

In Africa, copper mining, unlike gold operations, demonstrates significantly lower emissions intensity. On average, copper mines in Africa have emissions intensity 38% lower than the global average, making the region the lowest among the six global regions analyzed. Mines in the Democratic Republic of Congo (DRC) generally have Scope 1 and 2 GHG emissions intensity below the global average. A good example is the Kamoa-Kakula mining complex, majorly owned by Ivanhoe Mines Ltd. and Zijin Mining Group Co. Ltd. Located in the Central African Copper Belt, the mine produced 437,000 metric tons of copper in 2024. Despite its massive output, Kamoa-Kakula ranks among the lowest-emitting assets in the dataset, with a combined Scope 1 and 2 emissions intensity of 648 kgCO2e/t Cu. This is largely attributed to its connection to national hydropower stations, which significantly reduce Scope 2 emissions and position the mine as a regional leader in low-carbon production.

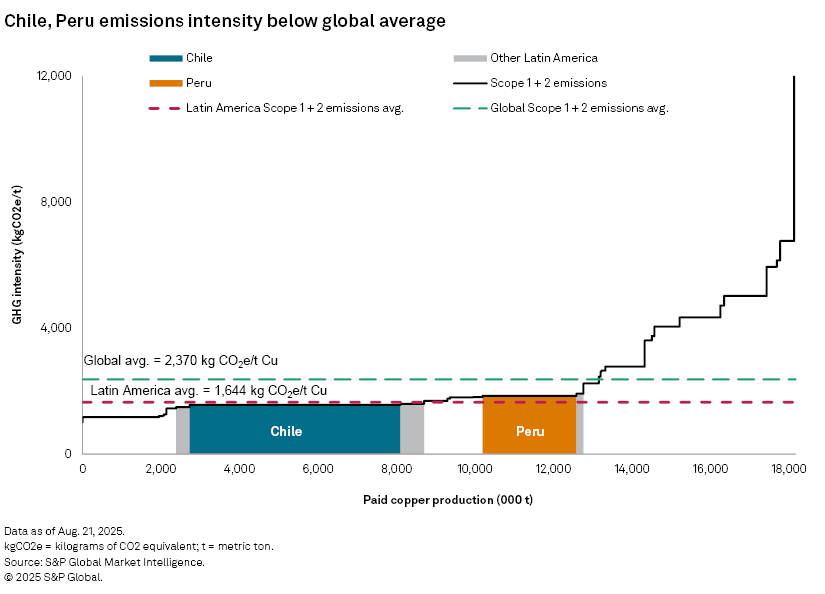

Performing positively, Latin America also has slower than global average emissions intensity of 1,644 kgCO2e/t Cu. The region accounts for almost half of the 18.3 million metric tons of total paid copper production in the 2024 primary copper pipeline. Chile and Peru together represent 43% of the global output, with emissions intensities of 1,559 kgCO2e/t Cu and 1,851 kgCO2e/t Cu, respectively.

Chile's commitment to climate action dates back to 2015, when it pledged to reduce its 2030 CO2 emissions per GDP unit by 30% against 2007 levels. Since then, Chile's government has implemented a range of policies to promote renewable energy, including the introduction of a green tax. Between 2019 and 2023, eight coal-fired power plants were decommissioned, with additional closures planned for 2025.

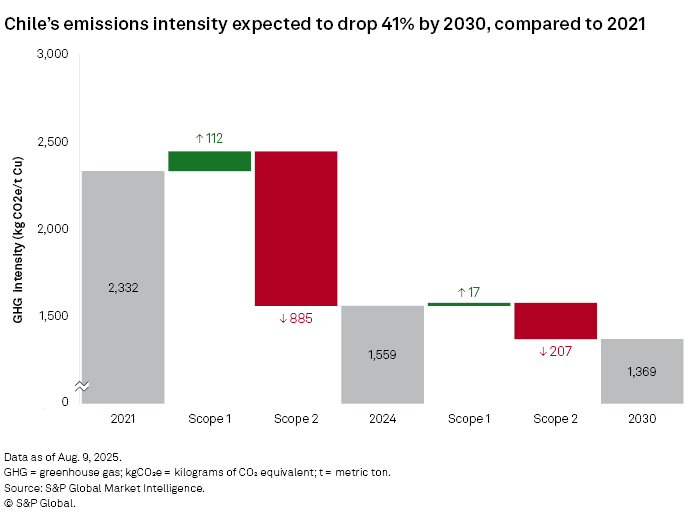

S&P Global's analysis of 378 primary copper mines globally reveals a consistent decline in Chile's Scope 1 and 2 emissions intensity since 2021, a trend expected to continue through 2030. By then, the country's average emissions intensity is projected to reach 1,369 kgCO2e/t Cu. With Chile's aggressive shift toward renewable electricity, its share of Scope 2 emissions intensity is expected to drop from 56% in 2021 to 15% in 2030. However, its Scope 1 emissions intensity is estimated to rise 12% over the same period, prompting leading copper producers to explore mitigation strategies.

BHP Group Ltd. a major copper producer, is actively working on the electrification of mining equipment and the utilization of low-to-zero GHG emissions electricity sources to reduce its Scope 1 emissions. The company is conducting operational trials of electric excavators and battery-electric haul trucks at its operations in Australia. Recently, BHP has partnered with Contemporary Amperex Technology Co. Ltd. (CATL) and Findreams Battery Co. Ltd. (FDB), a subsidiary of BYD Group, to bolster its diesel displacement initiatives. In Chile, BHP is replacing its diesel-fired boilers with zero-emissions heat sources by combining thermo-solar and electric boiler solutions in its Escondida and Spence mines.

Corporacion Nacional del Cobre de Chile (Codelco), the world's second-largest copper producer, is also committed to reducing its carbon footprint by 2030, including its Scope 3 emissions. To address Scope 1 emissions, Codelco is targeting 100% utilization of electric mining equipment. At its El Teniente mine, the company is deploying a fully battery-powered load-haul-dump (LHD) in semiautonomous mode. In 2024, a contract was awarded for industrial validation of this technology. Codelco has also partnered with leading academic institutions, including Universidad de Chile, Pontificia Universidad Catolica and Federico Santa Maria Technical University, to develop innovative decarbonization solutions, particularly for mining and processing operations.

To analyze the relationship between GHG emissions intensity and all-in sustaining costs (AISC), mines were first categorized into groups based on their AISC levels. The average emissions intensity was then calculated for each group to identify possible correlations between cost efficiency and environmental performance. The analysis reveals that lower-cost operations are likely to be lower emitters. In 2024, 74 out of 109 mines with AISC under global average of $2.64 per pound of paid copper had combined Scope 1 and 2 emissions intensity lower than 2,370 kgCO2e/t Cu.

Ore grades also play a critical role in emissions intensity, as there is a direct inverse relationship between a copper deposit's ore grade and its carbon footprint. Lower-grade deposits require significantly more material to be processed to yield the same amount of copper. This increase in material handling inevitably leads to higher consumption of diesel and electricity, making the unavoidable geological trend of declining ore grades a primary driver of rising GHG emissions for the industry.

While cleaner energy grids have delivered substantial emissions cuts for copper producers, the next frontier is within the mine itself. The industry's focus is now locked on tackling Scope 1 emissions, with fleet electrification emerging as the primary solution. The efforts of major miners to replace diesel with battery-powered alternatives will define the next phase of sustainable copper production, ensuring the metal's vital role in a low-carbon future.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.