Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 23, 2025

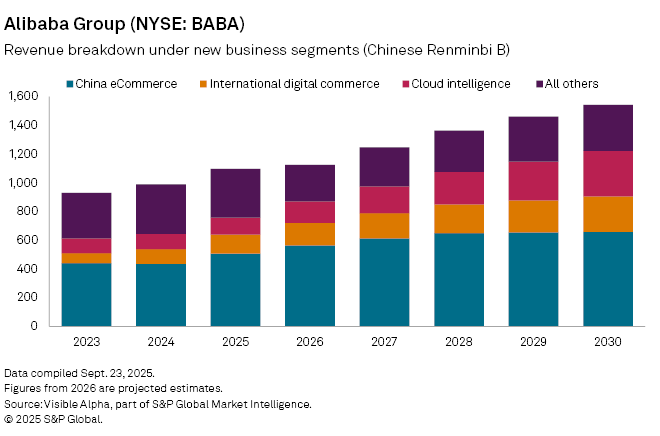

Alibaba Group Holding Ltd. (NYSE: BABA) has consolidated its business into four operating divisions in an effort to simplify its structure and sharpen strategic focus. The shift, announced last month, reduces the number of reporting lines from six to four: China eCommerce, International Digital Commerce, Cloud Intelligence, and a catch-all “All Other” segment.

China eCommerce remains the company’s cash engine. The division, which includes Taobao, Tmall, 1688 and food delivery platform Ele.me, is forecast to generate about CN¥565 billion in 2026, up 11% year-on-year and accounting for more than half of group revenue. While the business remains dominant, margins face pressure from heavy discounting, slowing consumer demand and fierce competition from rival JD.com and PDD.

International operations are becoming an increasingly important growth driver. The International Digital Commerce group — which houses Lazada in Southeast Asia, AliExpress in Europe and Latin America, and Trendyol in Turkey — is forecast to expand 17% to CN¥155 billion in 2026, accounting for around 15% of group revenue. Expansion into emerging markets, particularly in the Gulf region and Latin America, is fueling growth, though logistics costs and regulatory hurdles remain obstacles to sustained profitability.

Cloud Intelligence, which covers Alibaba Cloud and workplace app DingTalk, is expected to be the sharpest growth contributor. Revenues are projected to climb 27% to CN¥150 billion in 2026, or about 14% of the total, as paying customers rise to 5.5 million and average revenue per user rebounds after two years of decline. The division is supported by rising demand for AI-powered services and Alibaba’s commitment to invest CN¥380 billion ($52.5 billion) over three years in cloud and AI infrastructure. Partnerships, such as a recent tie-up with German software group SAP, are designed to bolster its enterprise capabilities. Analysts estimate cloud could represent more than one-fifth of total group revenue by 2030, making it central to Alibaba’s long-term growth.

The “All Other” division, which bundles together Freshippo supermarkets, Cainiao logistics, Alibaba Health, mapping app Amap and digital media assets, is expected to shrink by a quarter to CN¥254 billion in 2026 before rebounding in 2027. These businesses remain volatile and, in many cases, loss-making, but stabilization could reduce the drag on group margins.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment