Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 25, 2025

LVMH Moët Hennessy - Louis Vuitton Société Européenne (ENXTPA: MC)

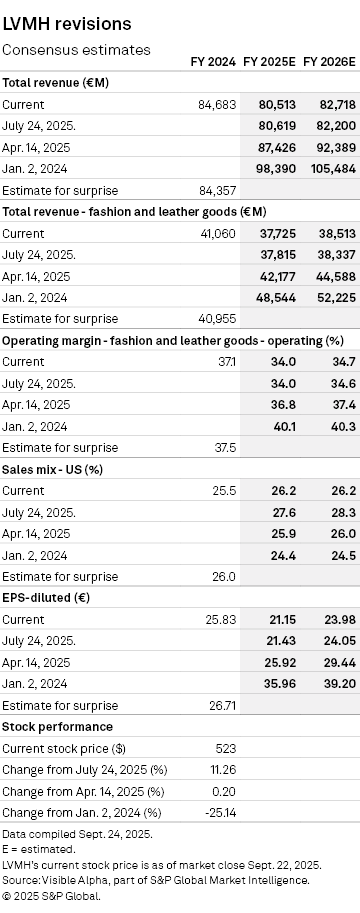

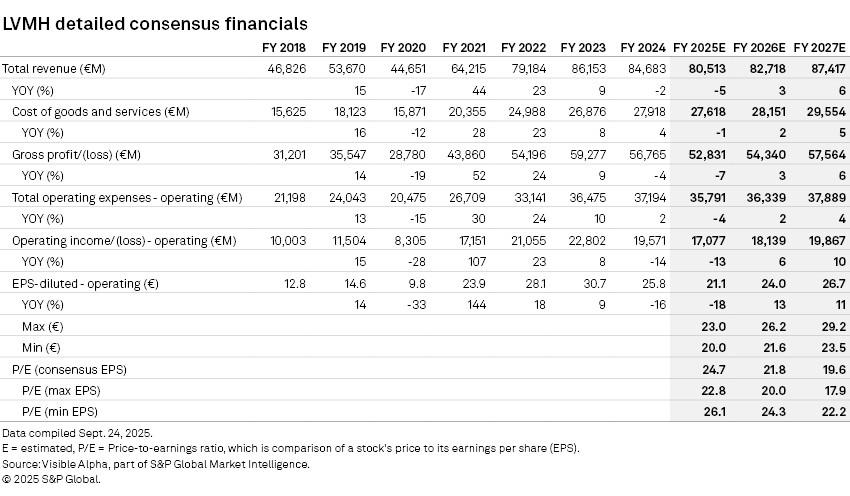

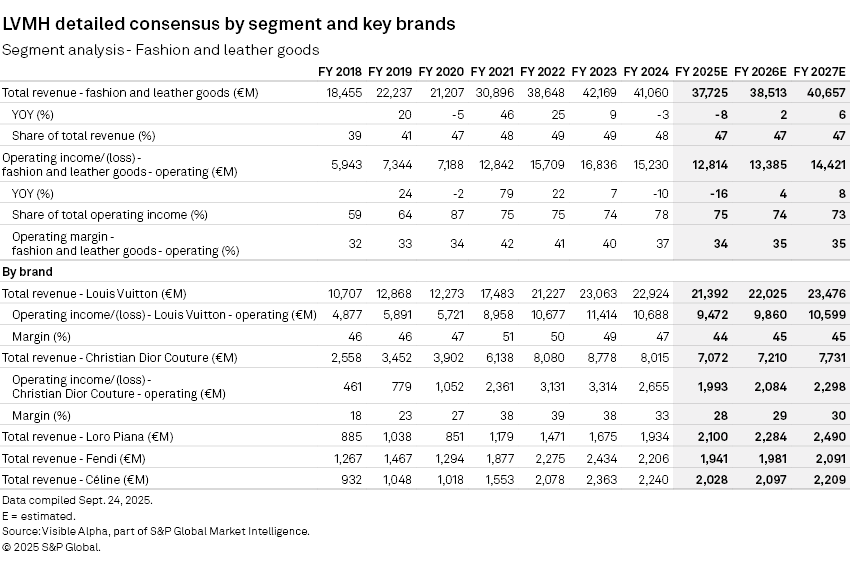

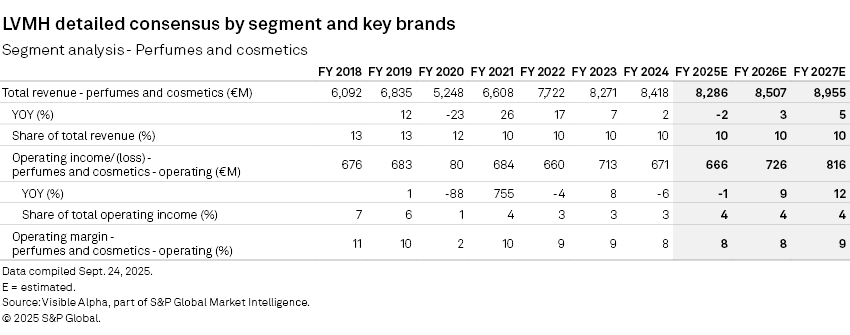

FY 2026 may see luxury trends turn a corner, after being in the doldrums since the Covid-era demand surge. The Fashion and Leather Goods segment contributes 75% of LVMH’s total operating profit. Based on consensus, the company should generate a 33.9% operating profit margin in 2025. While this margin is unlikely to return to the 40% peak seen a few years ago anytime soon, it could stabilize and shift up, with FY 2027 operating profit margin for the segment forecast to increase to 35.4%. Sales in this critical division should stop falling and slowly return to low single-digit growth by next year.

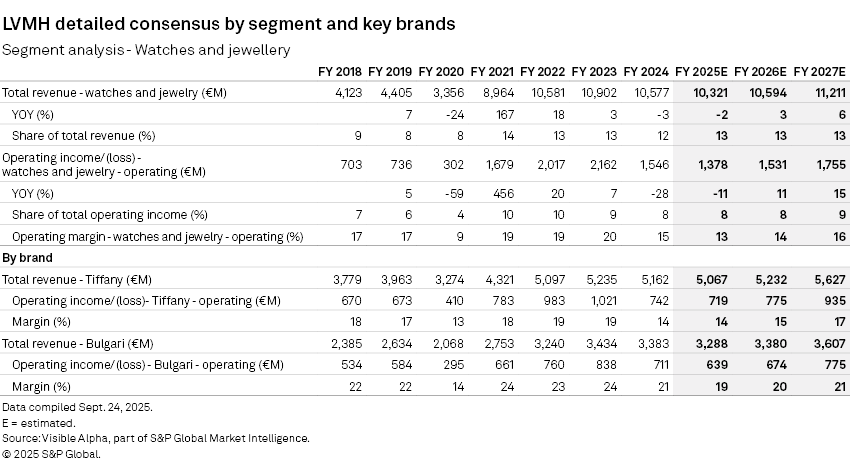

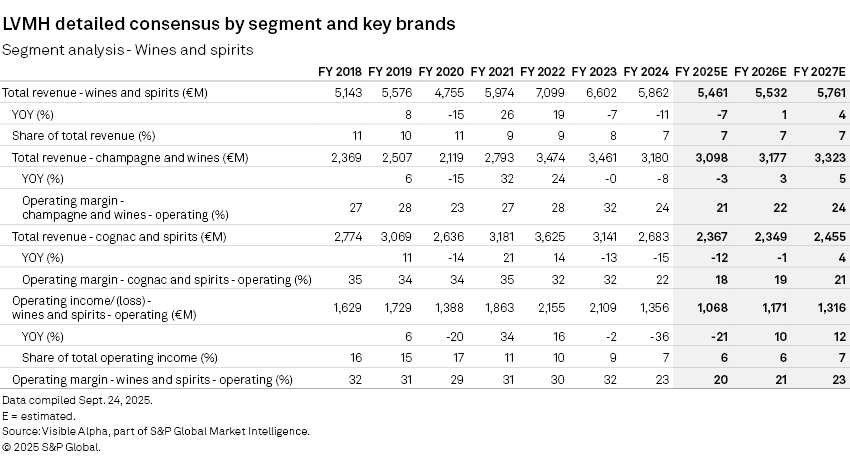

The Wine and Spirits and Watches and Jewelry segments, which contribute a smaller portion of total group profitability, should bottom out this year and grow operating profit by over 10% in FY 2026. For the LVMH group, sales in these segments have been impacted by tourism trends, foreign exchange and China’s macro-economic slowdown. Looking out to FY 2026, these macro trends should shift, as the US began cutting rates and China started to show signs of improvement.

Louis Vuitton Monogram Bag for fall 2025

Key macro

Tourism Trends: With Japan normalizing in 2025 following its peak weak yen-driven tourism surge in 2024, questions have emerged about the impact a weakening US dollar will have on tourism, and whether this could be a catalyst for the important Fashion and Leather Goods segment in 2026 and beyond. Based on Visible Alpha consensus, Japan's contribution to total revenue should decline to 8.7% and Asia to 27.1% this year.

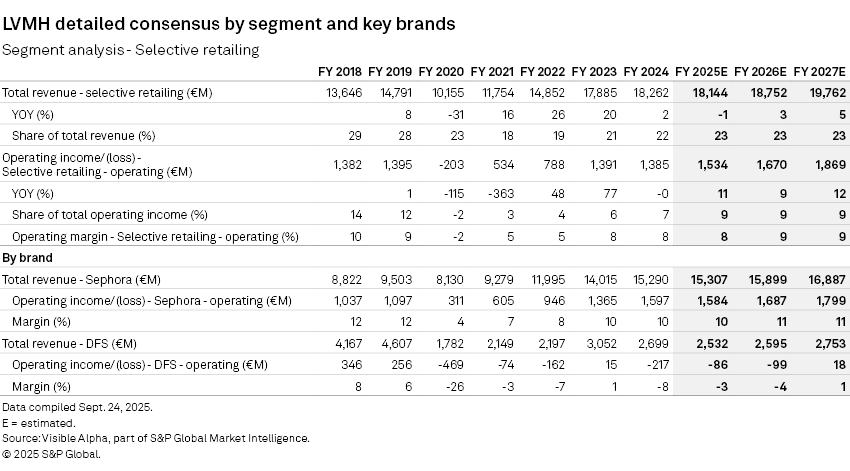

Tariffs: As tariffs take hold and the economic backdrop becomes increasingly murky, the extent to which brands can pass on the tariffs is unclear. US luxury consumers may travel to Europe to make tariff-free purchases. Based on consensus, Europe should offset the decline in Asia and grow its contribution to total revenue to 27% by the end of 2026. The US accounts for more than 26% of total revenue, and this should remain steady. The Selective Retail (Sephora) and Fashion and Leather Goods segments together generate around €5 billion in the US, and may be at risk.

China: Demand in the local Chinese market is challenging, but management commentary in the July earnings call suggests the market is showing early signs of improvement as Chinese consumers make purchases at home rather than in Japan. In addition, comps get easier in the Chinese market.

Management changes and the increasing role of technology

With New York’s Fashion Week behind us and Milan and Paris coming up, LVMH could be at an interesting inflection point entering the holiday season and 2026. Fashion is going through some notable changes, including a slew of new leaders at luxury brands and a new editor at Vogue, Chloe Malle, who is the former leader of Vogue.com and podcast host. With shifts in top creative and management, new trends and innovations in luxury may emerge. Social media is also playing an increasingly important role in brand positioning, and most young consumers identify trends on TikTok, Instagram and other social media platforms. A fresh, relevant presence in the digital world has become a core dimension to advertising and competitiveness. Maintaining the tradition and culture of the core brands, while embracing newness and technology, may shift the business models of key luxury product categories.

Armani for sale?

At a consensus FY 2026 P/E of 21x, the LVMH multiple ranges from 20x to 24x, with the most bullish analysts forecasting a 37-38% operating profit margin for the Fashion and Leather Goods business. According to sources, LVMH was named as a preferred buyer for a stake in the Armani group following the death of founder Giorgio Armani in September 2025.

Armani is a private company, so its financials are limited and opaque. Based on S&P Global Market Intelligence FY 2024 private company data on Armani, the company generated over €2 billion in revenue at around an 80% gross margin. In FY 2024, the EBIT margin dropped to 2.9% from historically higher 8-9% levels due to lower revenues and higher operating expenses. Based on the FY 2024 numbers, acquiring a stake is likely to be accretive.

Armani has around €1 billion of total debt on its balance sheet and interest expense that nearly doubled from FY 2023 to FY 2024, pushing the Net Debt/EBITDA to 1.6x, suggesting a restructure may be needed. Optimizing store locations, reducing debt and driving freshness in the brands is critical know-how LVMH could bring to Armani.

Giorgio Armani with models

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment