Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 11, 2025

By Payal Verma

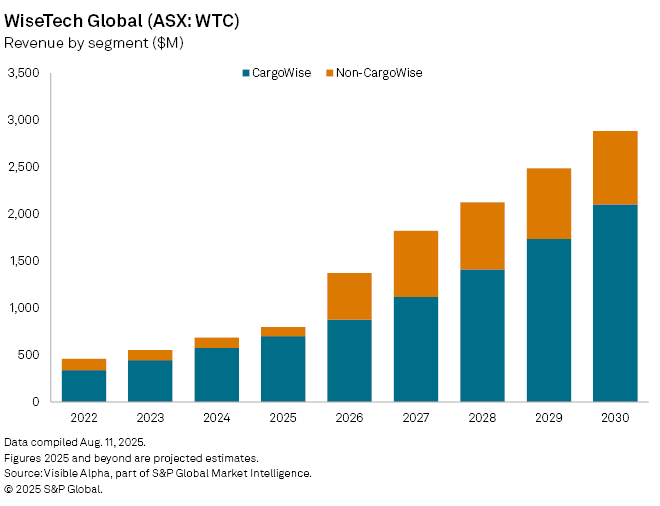

WiseTech Global Ltd. (ASX: WTC) acquisition of US supply chain software group e2open (NYSE: ETWO) is expected to breathe new life into its underperforming Non-CargoWise business. According to Visible Alpha consensus estimates, revenues from the segment are expected to fall -8% year-on-year to $97 million (A$147 million) in fiscal 2025, extending a two-year decline. But integration of e2open is forecast to sharply reverse this trend, lifting segment revenues to $496 million (A$763 million) in 2026.

The Non-CargoWise unit, which is expected to contribute12% of group revenue in 2025, could account for as much as 37% by 2026—highlighting the strategic importance of the deal.

WiseTech’s core CargoWise segment, which powers global logistics operations, remains the company’s growth engine. Revenues from the business are forecast to rise +21% in 2025 to $700 million (A$1.1 billion), accelerating to +25% growth in 2026.

Despite short-term headwinds, total revenue is expected to increase +17% in 2025 to $797 million (A$1.2 billion), before surging +69% in 2026 as e2open is fully absorbed into the broader platform.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Products & Offerings

Segment