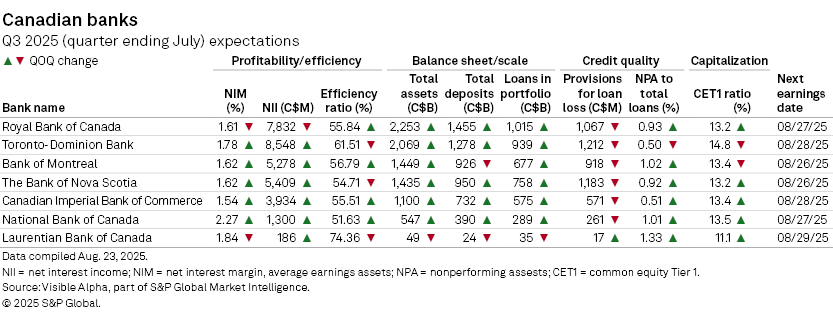

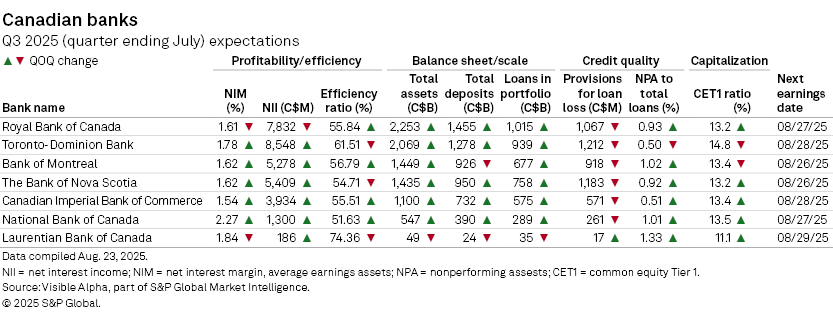

Canadian banks will kick off third-quarter (ending July) earnings season on Tuesday, August 26, with Bank of Montreal and Bank of Nova Scotia reporting first, followed by peers through to Laurentian Bank of Canada on Friday, August 29.

Visible Alpha’s consensus estimates highlight modest improvement in profitability, steady balance sheet expansion, and lingering credit quality pressures across the seven leading banks; Royal Bank of Canada (TSE: RY), The Toronto-Dominion Bank (TSE: TD), Bank of Montreal (TSE: BMO), The Bank of Nova Scotia (TSE: BNS), Canadian Imperial Bank of Commerce (TSE: CM), National Bank of Canada (TSE: NA), and Laurentian Bank of Canada (TSE: LB).

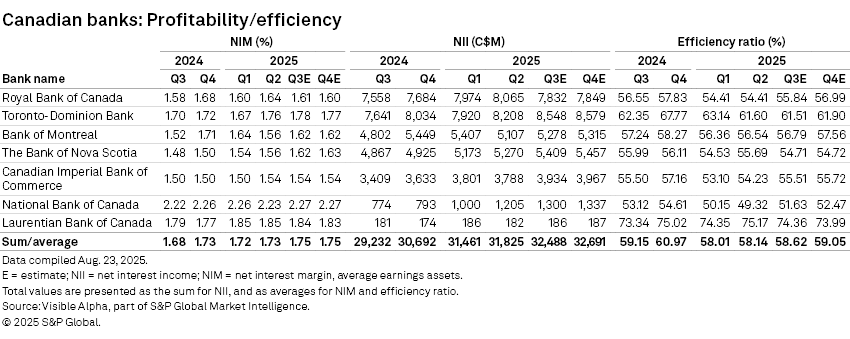

Profitability and efficiency: Stable margins amid rising interest income

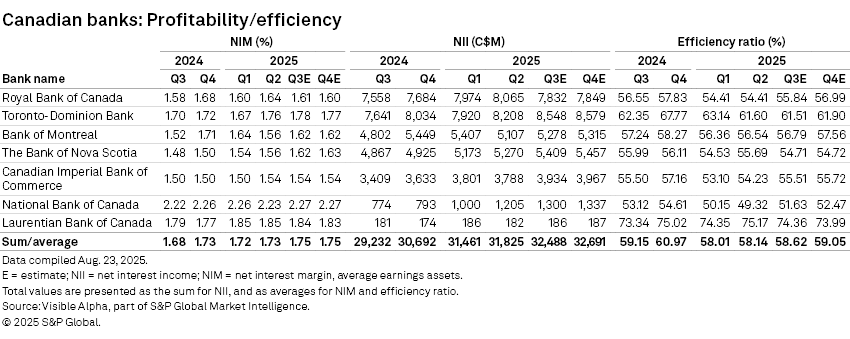

Canadian banks are expected to be heading into Q3 with stable profitability and modestly improving margins. The average NIM across seven banks is expected to rise slightly to 1.75%, for an aggregate total of C$32.5 billion in net interest income. Average efficiency ratio is expected to remain fairly steady at 58.6%.

Net interest margin (NIM)

- Even though the central bank cut interest rates seven times between June 2024 and March 2025, the reductions have not materially impacted NIMs.

- NIMs across the six banks are expected to average 1.75% in Q3 2025, slightly higher than the 1.68% in Q3 2024, indicating modest improvement in lending yields.

- National Bank of Canada remains an outlier with the highest expected NIM (2.27% in Q3’25), reflecting its stronger retail and commercial banking mix.

- Toronto-Dominion or TD Bank is expected to post the strongest year-over-year NIM expansion (from 1.70% in Q3’24 to 1.78% in Q3’25).

Net interest income (NII)

- The aggregate NII for the banks is forecast to rise to C$32.5 billion in Q3’25, up from C$29.2 billion in Q3’24, showing steady volume growth.

- TD Bank and Royal Bank of Canada or RBC continue to dominate in absolute NII terms, with TD’s NII forecast at C$8.6 billion and RBC at C$7.8 billion in Q3’25.

- Benefitting from the acquisition of Canadian Western Bank (XTSE: CWB), National Bank of Canada is expected to see a faster growth momentum (forecast NII up ~68% YoY to C$1.3 billion in Q3’25).

Efficiency ratio (lower is better):

- Efficiency is expected to remain broadly stable, averaging 58.62% in Q3 2025, up slightly from Q2, suggesting relatively stable cost-to-income dynamics.

- National Bank (51.6%) and Bank of Nova Scotia (54.7%) stand out as the most efficient, while Laurentian Bank remains persistently high (~74%).

- TD Bank’s ratio, though improving (67.8% to 61.5% YoY), is still the weakest among the Big 5.

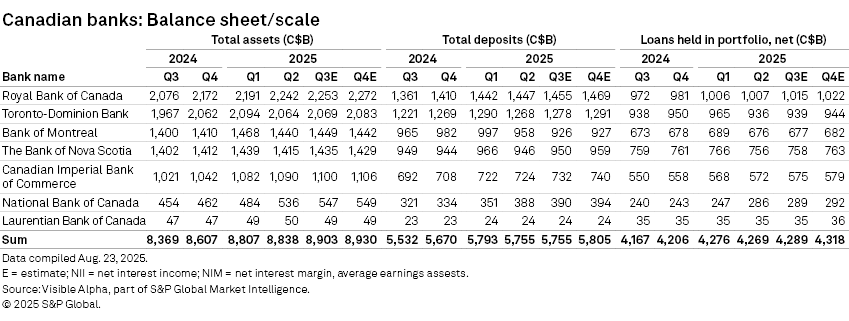

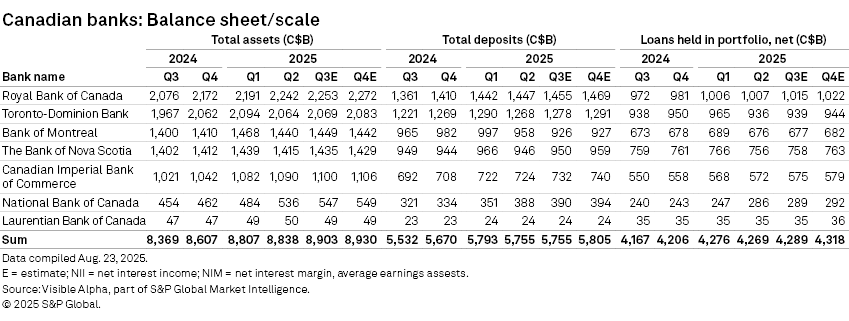

Scale and balance sheet: National Bank of Canada leads in growth, boosted by acquisition

The big banks remain scale-driven (RBC, TD, BMO), while National Bank's growth across assets, deposits, and loans is accelerated by the Canadian Western Bank deal completed in February 2025. Deposit growth remains muted, suggesting funding pressure and customer competition remain a theme.

Total assets:

- Aggregate sector assets are forecast at C$8.9 trillion in Q3’25, up from C$8.4 trillion a year earlier, showing ~6% YoY growth.

- RBC (C$2.3 trillion) and TD Bank (C$2.1 trillion) remain the largest by far, together accounting for nearly half of the group’s assets.

- National Bank assets are expected to expand from C$454 billion in Q3’24 (pre-acquisition) to C$547 billion (+20% YoY) in Q3’25.

Deposits:

- Deposits are expected to remain broadly flat at C$5.8 trillion in Q3’25, versus C$5.5 trillion a year earlier.

- RBC (C$1.5 trillion) and TD (C$1.3 trillion) continue to dominate deposit share, though BMO’s deposits are forecast to shrink YoY (C$965 billion in Q3’24 to C$926 billion in Q3’25).

- National Bank’s deposits are expected to rise to C$390 billion in Q3’25 (+22% YoY).

Loans:

- Loan portfolios are expected to edge up modestly to C$4.3 trillion in Q3’25, from C$4.2 trillion a year ago, indicating restrained lending growth.

- National Bank is also notable here, with loans expected to expand from C$240 billion in Q3 last year to C$289 billion in Q3’25 (+20% YoY), reflecting faster credit expansion, supported by its acquisition of Canadian Western Bank.

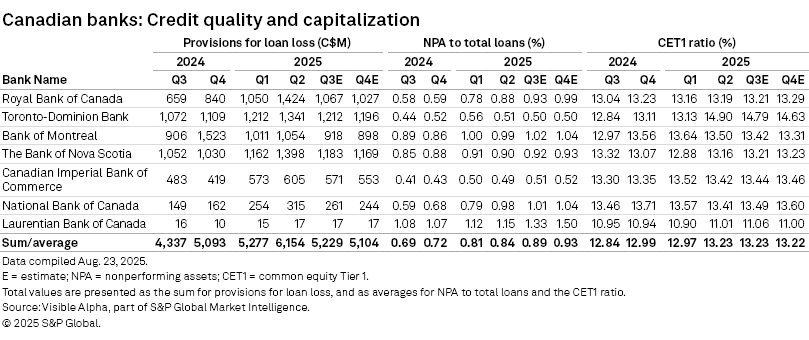

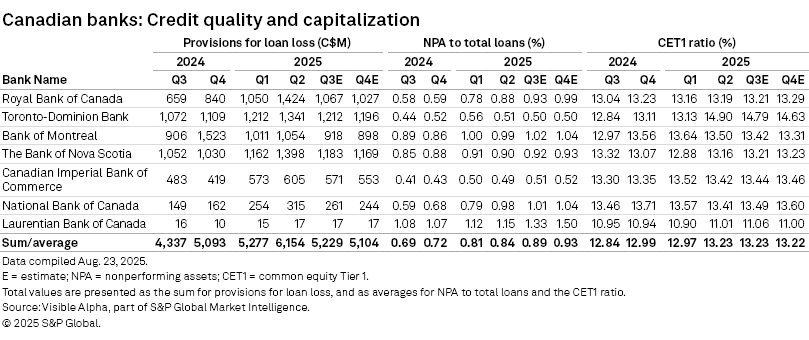

Credit quality and capital: Resilient but signs of strain

Q3 2025 expectations points to easing provisions and mild asset quality pressure, with average NPA ratio rising to 0.89%, led by smaller lenders. However, capital remains strong with an average CET1 at 13.23%.

Provisions for loan losses:

- Total provisions are expected to moderate slightly to C$5.3 billion in Q3’25, down from C$6.2 billion in Q2’25, suggesting some easing of credit stress.

- TD Bank (C$1.2 billion) and Bank of Nova Scotia (C$1.18 billion) remain the largest contributors, reflecting their larger loan portfolios.

- BMO is expected to see a sharp drop (C$1,054 million in Q2’25 to C$918 million in Q3’25), but its provisions remain volatile compared with peers.

Non-performing assets (NPA ratio):

- The average NPA ratio is expected to rise to 0.89% in Q3’25, from 0.69% a year earlier and 0.84% in Q2, indicating mild deterioration in asset quality.

- Laurentian Bank’s NPA ratio at an estimated 1.33% is the highest, highlighting elevated risk in smaller institutions.

- TD Banks and Canadian Imperial Bank of Commerce or CIBC remain at the lower end of risk, with NPAs estimated near 0.50%.

Capital ratio (CET1):

- The banks are expected to remain well-capitalized, with an average CET1 ratio stable at 13.3% in Q3’25, up from 13.1% a year ago.

- TD Bank is a standout, with CET1 projected at 14.8%, reflecting stronger capital generation.

- Laurentian Bank lags with a CET1 ratio expected near 11%, leaving it with the least cushion.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.