Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 12, 2025

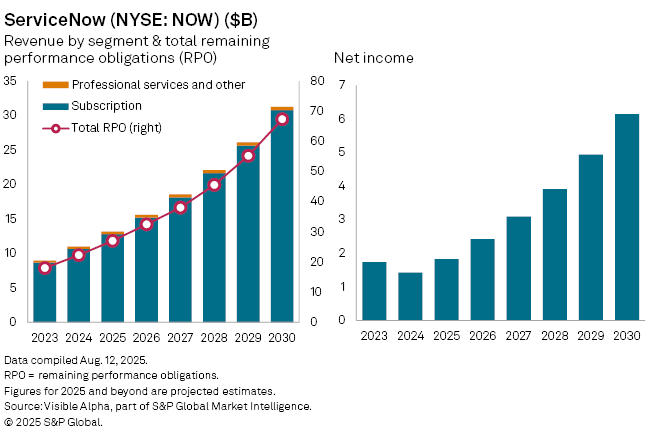

ServiceNow Inc. (NYSE: NOW), the cloud software firm specializing in digital workflows and enterprise automation, is poised for another strong year in 2025, with revenue expected to rise +20% year-on-year to $13.2 billion. This growth is underpinned by accelerating adoption of artificial intelligence, steady performance across its enterprise customer base, and early contract renewals from key on-premises clients.

Visible Alpha consensus forecasts show the company’s remaining performance obligations—a forward-looking measure of contracted revenue—to increase +21% to $26.7 billion in 2025, signaling robust demand ahead. Subscription revenue, which represents 97% of total sales, is set to climb +20% to $12.8 billion, driven by strong uptake in digital workflow solutions and expanding IT operations management offerings. Professional services and other revenue streams are expected to add $374 million.

Having decline -18% in 2024, ServiceNow’s net income is forecast to grow +28% to $1.8 billion in 2025, benefiting from margin expansion, high renewal rates, and monetization of its AI products Pro Plus and Now Assist, launched in September 2023.

The company is also bolstering its ecosystem by deepening its strategic partnerships with Amazon’s AWS, Nvidia, UKG, and Cisco, enhancing its AI capabilities with better data integration, faster processing, and secure governance.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Products & Offerings

Segment