Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 18, 2025

By Jueeli Kadam

Prothena Corporation plc (NASDAQ: PRTA) is betting its future on Alzheimer’s treatments after the failure of a late-stage study forced the US biotech to abandon a key program for rare amyloid disease.

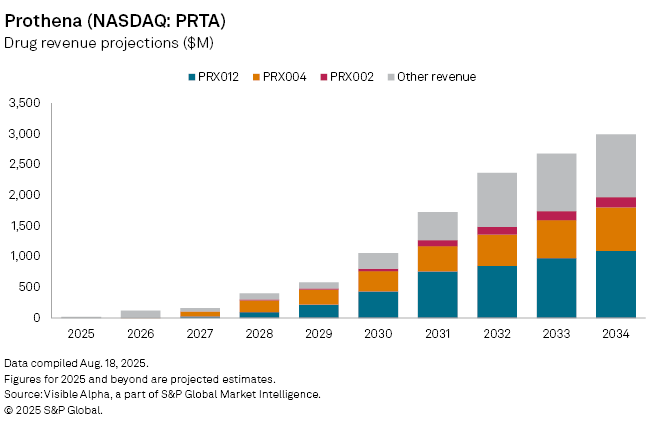

The Dublin-based company discontinued development of birtamimab following disappointing Phase 3 results in AL amyloidosis, shifting its focus to PRX012, an experimental Alzheimer’s therapy targeting amyloid beta. Analysts assign a 30% probability of success to PRX012, with consensus estimates suggesting potential approval by 2027. The drug could generate $27 million in launch-year sales and expand to more than $1 billion by 2034, eventually accounting for over a third of Prothena’s revenue.

A second growth driver lies in ATTR amyloidosis, where Novo Nordisk holds full rights to Prothena’s former candidate Coramitug (PRX004). Prothena is eligible for royalties tied to clinical and commercial milestones, with analysts projecting $82 million in royalty income by 2027, rising to $709 million by 2034.

While Prothena’s revenue is modest today, its valuation hinges on the Alzheimer’s pipeline — an increasingly competitive market with rivals such as Eli Lilly and Biogen also advancing late-stage therapies. Prothena’s prospects depend on converting experimental drugs into commercial successes.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment