Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 19, 2025

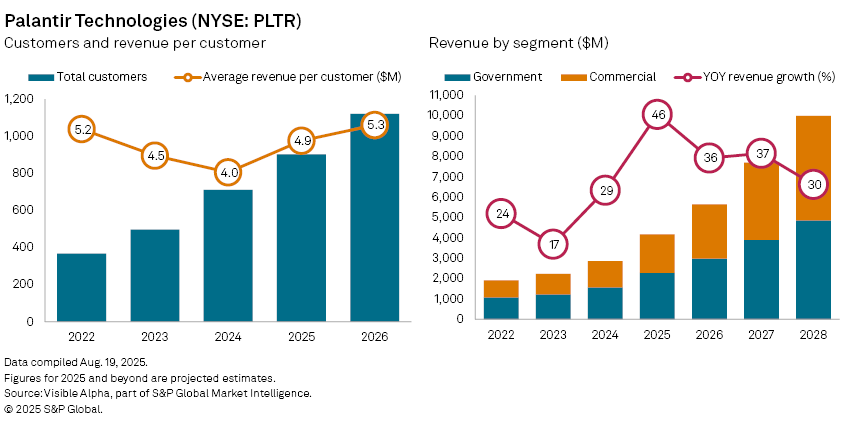

Palantir Technologies Inc. (NYSE: PLTR) has emerged as one of the strongest performers in US technology stocks, lifted by enthusiasm for artificial intelligence and a string of high-profile contract wins. Shares recently closed at $187, extending a rally underpinned by accelerating revenue growth.

The data analytics group is forecast to report a 51% year-on-year jump in third-quarter revenue to $1.1 billion, following a 48% rise in the previous quarter. That compares with 30% growth a year earlier, underscoring momentum behind its Artificial Intelligence Platform (AIP) as well as its Gotham and Foundry software, which are being adopted across defense, healthcare, energy, finance and logistics.

For the full year, revenue is projected to climb 46% to $4.2 billion, split between $2.3 billion from government contracts and $1.9 billion from commercial clients. Analysts forecast revenue of $10.1 billion by 2028, suggesting durable demand for its AI-driven platforms. Net income is expected to more than double to $1.1 billion in 2025, highlighting improving profitability as Palantir scales.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment