Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 06, 2025

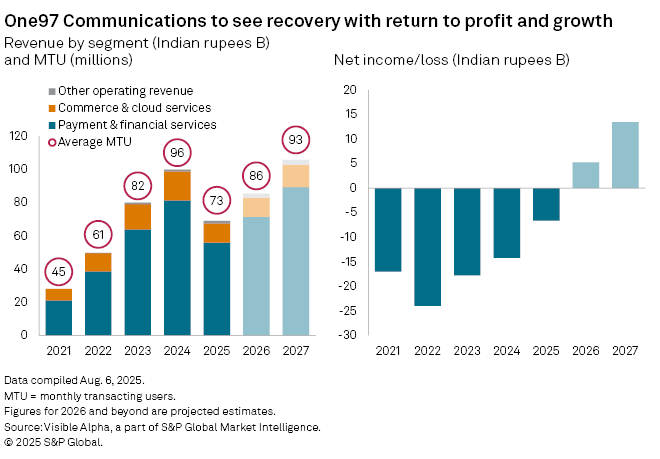

One97 Communications Ltd. (NSE: PAYTM), the parent of Indian digital payments group Paytm, posted a 28% year-on-year increase in revenue in the first quarter of fiscal 2026, marking a sharp turnaround after regulatory action derailed its business last year. Net income came in at ₹1.23 billion ($14.2 million), reversing a loss in the same period a year earlier.

Analysts expect the recovery to continue. Paytm’s revenue is projected to rise 23% year-on-year to ₹85 billion in fiscal 2026, following a 31% decline in the previous year. The company is also forecast to turn its first annual profit, with net income estimated at ₹5.4 billion, compared with a ₹6.6 billion loss in fiscal 2025. Average monthly transacting users are expected to climb to 79 million from 73 million last year.

The return to growth follows five consecutive quarters of revenue decline after the Reserve Bank of India barred Paytm Payments Bank—its affiliated banking entity—from conducting transactions. The ban effectively froze operations at the bank and disrupted Paytm’s core payments business, including its widely used UPI (Unified Payments Interface) services, which relied on the bank as a partner.

Since then, the company has implemented cost-cutting measures, refocused on its core payments operations, and expanded into higher-margin financial services such as lending, mutual funds and insurance distribution. Further boosting sentiment, the Ministry of Finance recently approved foreign direct investment into Paytm Payments Services, Paytm’s wholly owned subsidiary, while the National Payments Corporation of India allowed the company to resume onboarding new UPI users.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Products & Offerings

Segment