Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — July 29, 2025

By Paul Manalo

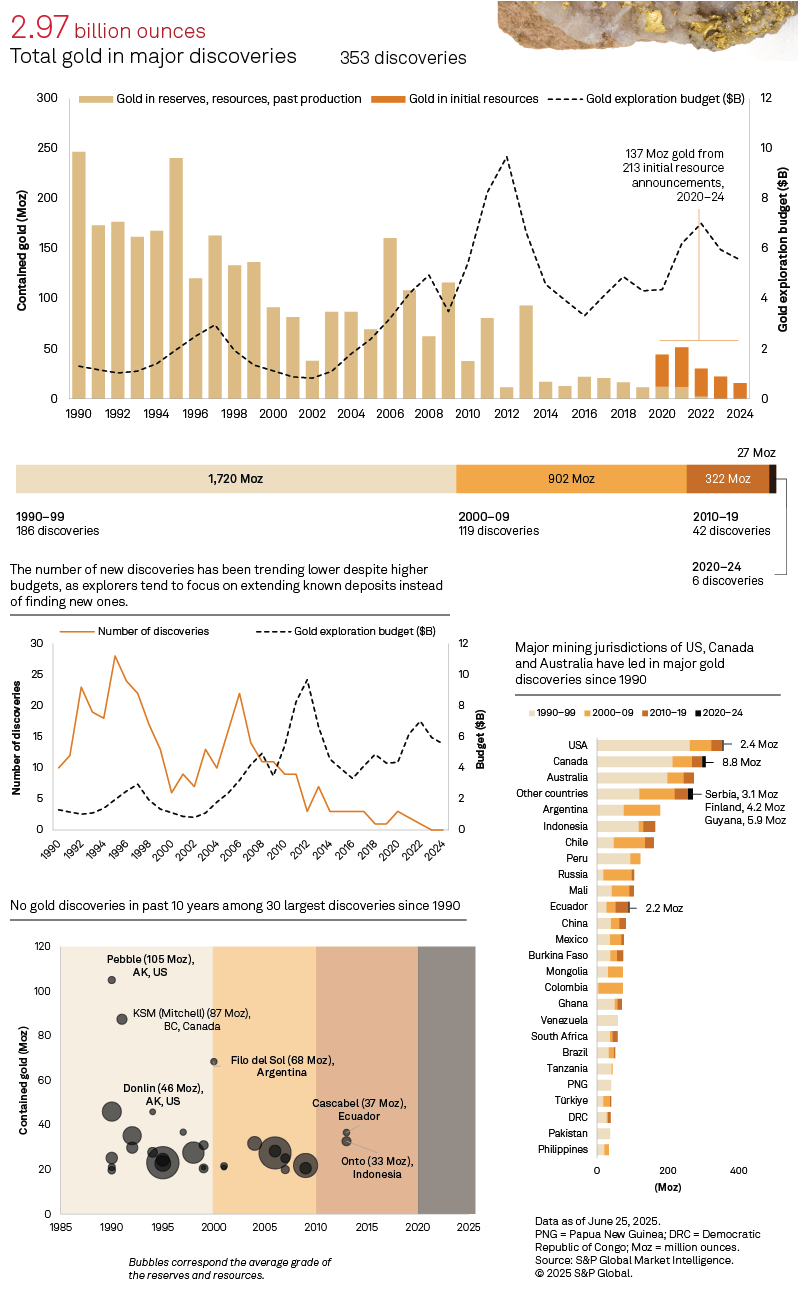

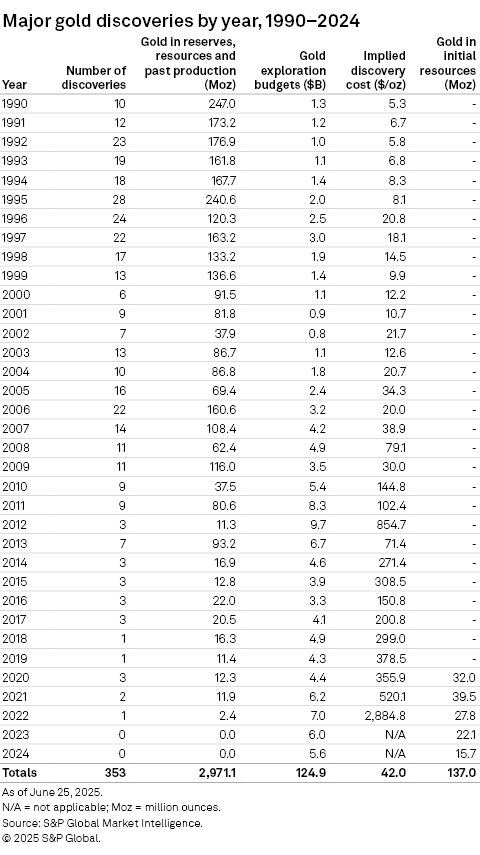

S&P Global Commodity Insights' annual analysis of major gold discoveries reveals that between 1990 and 2024, 353 deposits were identified, holding a total of 3 billion ounces of gold in reserves, resources and past production. This represents a 3% increase, or 82 million ounces, compared to our 2024 analysis, which recorded 350 deposits containing 2.89 Boz of gold.

Detailed data on these gold discoveries can be found in the accompanying Excel spreadsheet.

Many of the insights from our 2024 analysis still hold true. Almost all newly added assets were discovered decades ago and have only recently met the criteria of containing at least 2 Moz of gold in reserves, resources and past production. Notably, no major discoveries occurred in 2023–24. Since 2020, only six major discoveries have been made, contributing a total of 27 Moz in reserves and resources.

Gold prices experienced a substantial rally in 2022–25. Since the December quarter of 2022, prices have risen uninterrupted, breaching the $2,000 per ounce mark in late 2023, driven by geopolitical tensions in the Middle East. By the 2025 March quarter, gold prices surpassed the $3,000/oz mark for the first time amid ongoing conflicts in Europe and the Middle East, along with increasing US tariffs.

Despite higher gold prices, exploration budgets fell 15% in 2023 and 7% in 2024, ending the uptrend that began in 2017. This decline was primarily driven by reduced allocations by junior companies, which faced tighter financing conditions due to central banks raising interest rates to combat inflation.

In addition to the lower budgets in 2023–24, the share of grassroots or early-stage exploration within the total budgets continued to decline, reaching just 19% in 2024 — a significant drop from a 50% share in the mid-1990s. While part of this decrease is attributable to the natural progression of assets from early-stage exploration to production, explorers have become more risk-averse over the past couple of decades. They have increasingly focused on known assets, which are safer yet offer lower potential rewards compared to riskier, more rewarding ventures — a shift contributing to fewer discoveries over the years.

Recent gold discoveries have become increasingly scarce and smaller, with an average size of 4.4 Moz in 2020–24, down from 7.7 Moz in 2010–19. Moreover, none of the discoveries made in the past 10 years have ranked among the largest 30 gold discoveries. It is important to note that while significant recent discoveries are limited, reserves and resources tend to grow over time.

In addition to analyzing past discoveries, S&P Global Commodity Insights have examined prospects using data on initial resource announcements, which is monthly tracked in the Industry Monitor series. By excluding announcements of new zones at discoveries already included in our list, we identified 213 initial resource announcements containing a total of 137 Moz of new gold in 2020–24. Notably, only 93 of these announcements, or 44%, are from greenfield assets, while the remainder come from newly discovered zones or deposits within existing projects, highlighting the industry's preference for exploring known assets.

With gold prices lingering above the $3,000-mark and expected to remain above that point for the next several years, we can anticipate increased interest in gold exploration. While the larger companies will be able to fund their programs from internal revenue, the smaller companies will have to rely on the financial markets, which continue to be difficult to access. However, even an increase in exploration spending may not contribute to increased discovery rates. As we have seen over the past decades, the industry is reluctant to allocate funds to untested areas, preferring to instead expand known deposits. Even the industry's marked shift in strategy of going back to generative programs would take time to produce results. All signs point toward the discovery low continuing for the next several years.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.