Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 13, 2025

By Jimit Bhatia

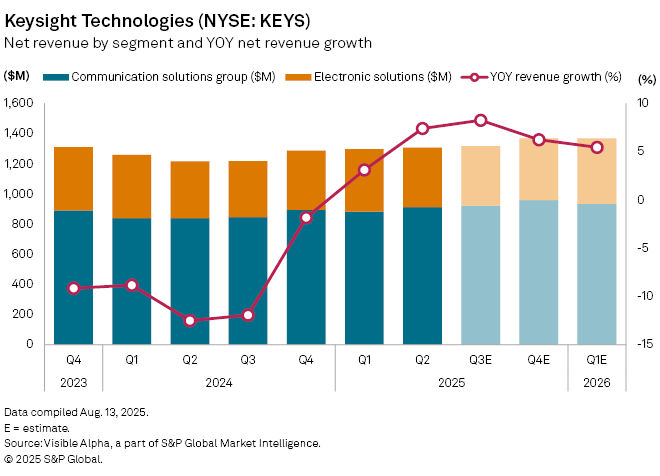

Keysight Technologies Inc. (NYSE: KEYS) is expected to post an +8% year-on-year rise in third-quarter revenue to $1.3 billion, according to Visible Alpha consensus estimates, marking a continuation of the recovery that began in early 2025 after a prolonged downturn that began in late 2023.

The communications solutions group — which accounts for 70% of sales — is forecast to grow +9% to $922 million, supported by strong demand from aerospace, defense, government, and commercial communications markets. The company has stepped up investment in AI infrastructure, next-generation 5G/6G wireless systems, and defense modernization.

Revenue from the electronics solutions segment, which contributes the remaining 30%, is projected to climb +7% to $395 million, buoyed by orders from semiconductor foundries and integrated device manufacturers.

For full-year 2025, Keysight’s revenue is forecast to rise +6% to $5.3 billion, reversing the -9% decline in 2024. Communications solutions revenue is expected to increase +8% to $3.7 billion, while electronics solutions is set to advance +3% to $1.6 billion. After two years of shrinking profits, net income is projected to surge +46% to $897 million, with diluted earnings per share hitting $5.18 — signaling stronger execution and a firmer market position.

The company reports third-quarter earnings on Tuesday, August 19.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.