Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 15, 2025

By Jay Rathod and Govinda Patwa

KalVista Pharmaceuticals Inc. (NASDAQ: KALV) is preparing to capture a potentially lucrative niche in rare disease drugs following the approval of its hereditary angioedema (HAE) therapy, Ekterly (sebetralstat). The treatment, cleared by the US Food and Drug Administration in July and the UK’s Medicines and Healthcare products Regulatory Agency shortly after, is the first and only oral on-demand medicine for acute HAE attacks in patients aged 12 and older.

The European Medicines Agency’s Committee for Medicinal Products for Human Use recently issued a positive opinion, with a final European Commission decision expected by October. Analysts assign a 95% probability of approval, paving the way for Ekterly to become the first oral option in Europe as well.

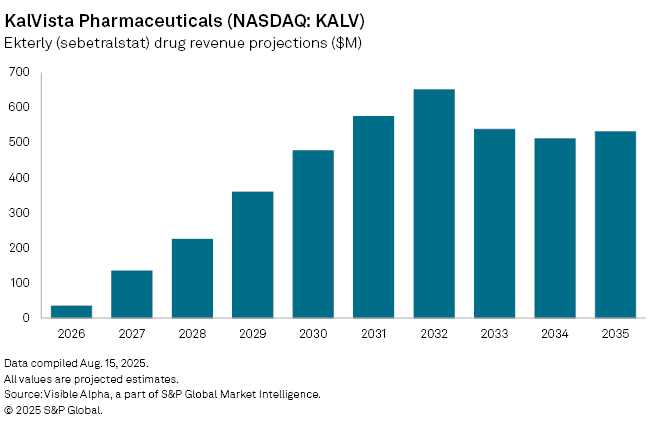

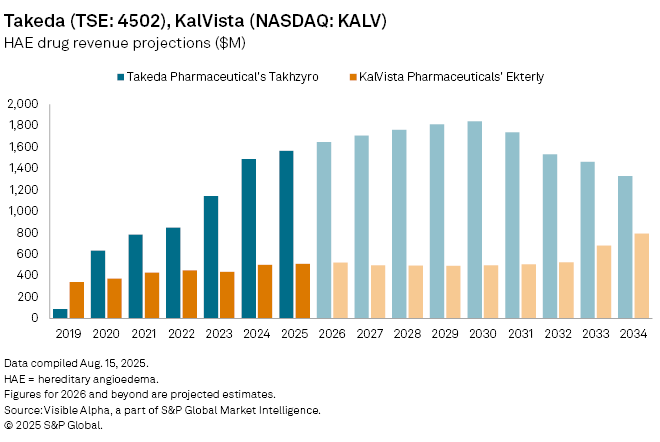

Consensus forecasts put Ekterly sales at $34.5 million in 2026, with peak revenues projected at $651 million globally by 2032. Though small relative to blockbuster oncology and cardiology therapies, such growth would transform KalVista, which has no other marketed products. The launch also positions KalVista in competition with existing injectable HAE treatments including Takeda Pharmaceutical's (TSE: 4502) Takhzyro, where pricing power and patient convenience could be decisive.

KalVista’s market opportunity lies in HAE’s ultra-rare profile—affecting only a very small patient population worldwide—where therapies can command premium pricing and rapid uptake. Whether Ekterly’s oral delivery can shift market share away from entrenched injectable rivals is to be seen, although Ekterly remains one of the closely watched orphan drug launches of the year.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Products & Offerings

Segment