Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 13, 2025

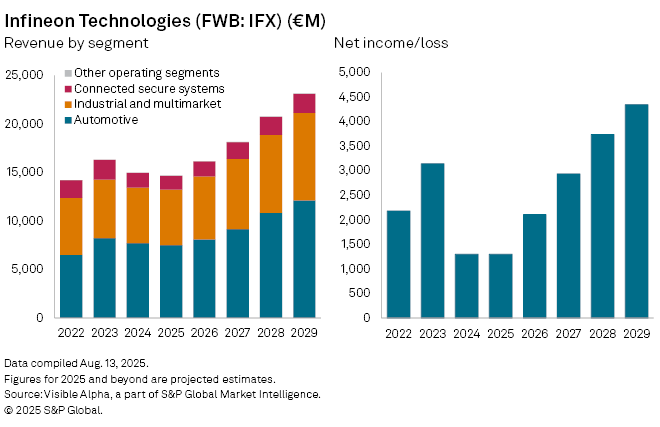

Infineon Technologies AG (FWB: IFX) is expected to face another year of sluggish demand before a recovery takes hold in 2026, according to Visible Alpha consensus estimates.

The German semiconductor group’s revenues fell -8% year-on-year in 2024 to €15 billion, weighed down by weakness across most of its end markets, with artificial intelligence one of the few bright spots. A delayed cyclical recovery left the automotive, industrial and connected systems segments struggling to generate momentum.

For 2025, revenues are forecast to dip a further -2% to €14.7 billion, marking a softer decline than last year. Demand is set to remain weak across key markets, though the pace of contraction is expected to ease.

Analysts anticipate a stronger turnaround in 2026, with revenues projected to climb +11% year-on-year to €16.4 billion on the back of broad-based growth. The automotive and connected secure systems divisions are each forecast to rise +8%, while the industrial and multimarket segment is expected to expand +14%. Net income is projected to rise to €2.1 billion, supported by improving demand conditions and a potential easing of macroeconomic headwinds.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Products & Offerings

Segment