Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 18, 2025

By Bhavya Gala and Nitin Kansal

India’s two largest online food delivery platforms — Zomato’s parent Eternal Ltd. (NSE: ETERNAL) and @Swiggy Ltd.(NSE: SWIGGY) — are escalating their push into quick commerce, betting that 10-to-20-minute grocery and essentials delivery will be the next engine of growth.

The shift reflects both changing consumer behavior and intensifying competition for market share. Quick commerce, powered by small “dark stores” in densely populated neighborhoods, is becoming a more meaningful driver of revenues.

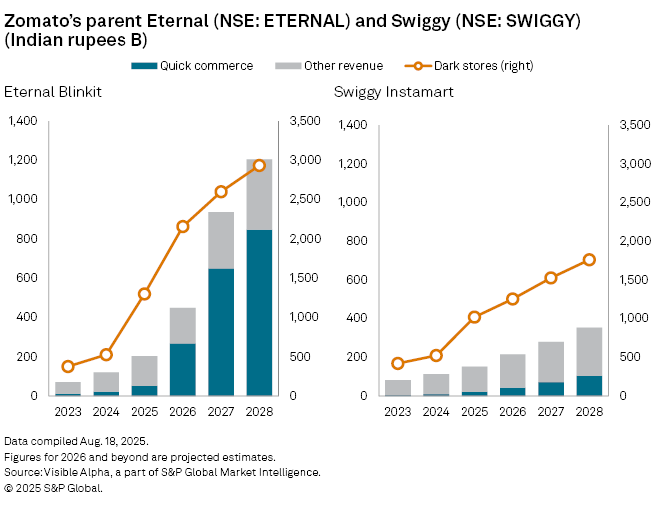

Eternal’s unit Blinkit already outpaces Swiggy’s Instamart. Quick commerce contributed 19% of Eternal’s sales in 2024, rising to 26% in fiscal 2025. Analysts expect the share to reach 60% in 2026 and as high as 75% by 2031, according to Visible Alpha consensus. Swiggy lags, with quick commerce accounting for 14% of its fiscal 2025 sales and projected to rise to 20% in 2026 and 36% by 2031.

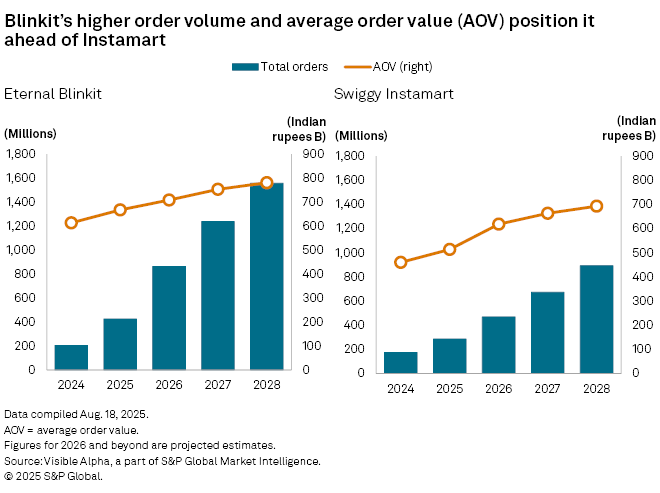

Expansion is central to this growth. Blinkit’s dark store network is expected to more than double from 1,301 in 2025 to 2,157 in 2026, compared with Swiggy’s 1,254 stores by the same year. Order volumes show a similar trend: Blinkit processed 424 million orders in fiscal 2025 against Instamart’s 286 million, with total order expected to climb to 863 million and 469 million respectively in 2026.

Blinkit also benefits from stronger monetization. Its average order value is projected to rise to ₹709 in 2026, about ₹90 higher than Instamart’s ₹619, suggesting higher spending per transaction.

By revenue, Blinkit’s growth is striking, widening the gap. Analysts forecast Blinkit’s quick commerce sales will reach ₹268 billion in 2026, a fivefold jump from ₹52 billion in 2025. Swiggy’s Instamart is expected to generate ₹43.5 billion in 2026, up from ₹21 billion a year earlier.

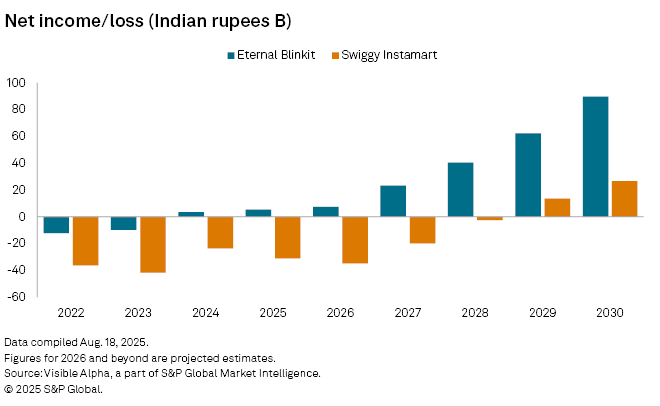

Quick commerce is capital-intensive, with margins still thin given high logistics and warehousing costs. Analyst estimates show that while growth prospects are strong, profitability remains uneven.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.