Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 25, 2025

Dell Technologies Inc. (NYSE: DELL) will report fiscal Q2 2026 results on Thursday, August 28, 2025, after the market close. Here are the key numbers that we’re watching.

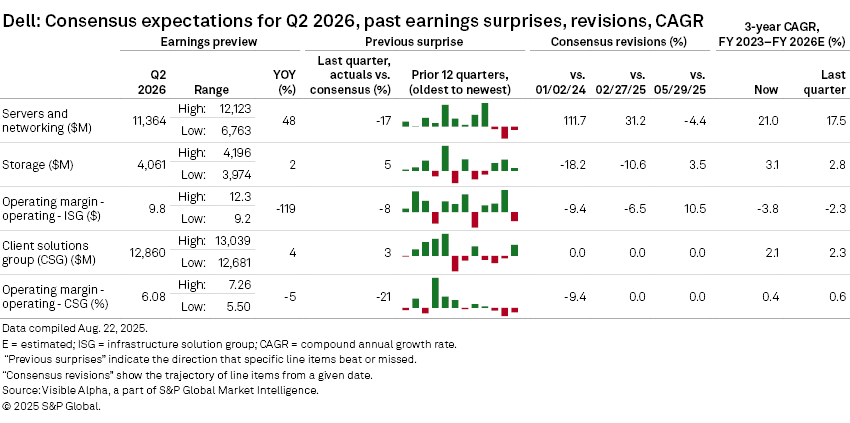

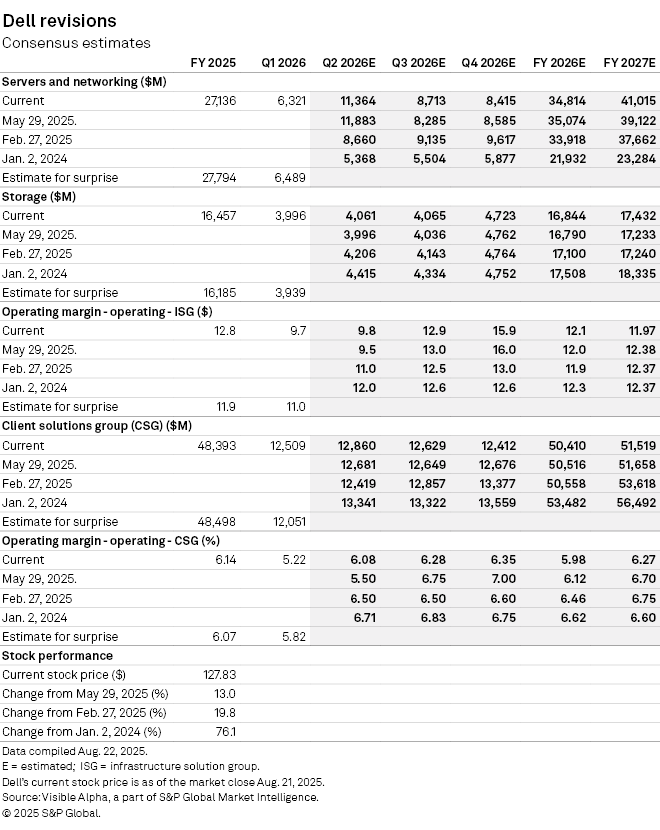

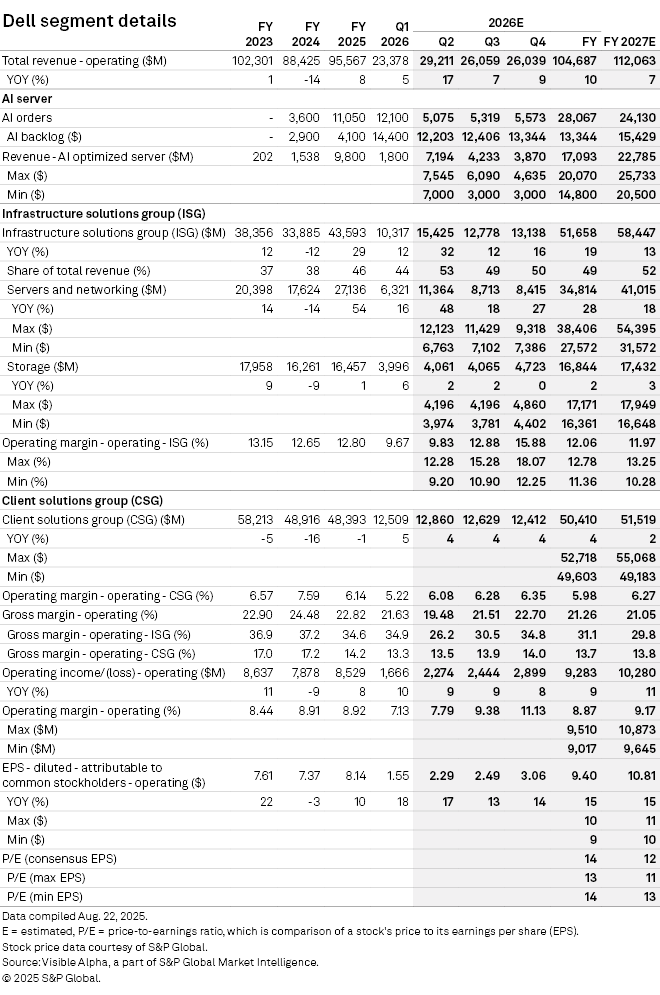

Dell Q2 2026 earnings preview

For fiscal Q2 2025, Dell guided to $28.5-29.5 billion in total revenue and diluted non-GAAP EPS of $2.25 (plus or minus $.10), in line with revenue expectations of $29.2 billion and slightly higher EPS of $2.28, ahead of the release next week. The ISG segment revenue is projected to ship $7 billion in AI servers, and to generate $11.3 billion in revenue. This segment’s gross margin is expected to dip to 26.2% quarter over quarter. The ISG consensus operating margin for Q2 is expected to be 9.8%, down from last year’s 11%. This margin is expected to increase in the H2 2025 to deliver a full year margin of 12.1%. Commentary on the company’s AI server backlog and any indications about the magnitude that enterprise customers are planning to refresh PCs will be important for assessing the outlook. In addition, it will be interesting to hear management’s perspective on the trajectory of demand for storage from the AI opportunity.

Last quarter, Management noted “in CSG, we expect the PC refresh cycle to continue as the installed base upgrades to new devices, resulting in improved profitability sequentially.” The potential timing of the refresh cycle and AI pipeline are worth watching in FY 2026 and FY 2027.

Will Enterprises upgrade to AI Laptops?

Dell’s New AI PC using Nvidia Blackwell

Source: Dell.com, August 2025.

Looking back at Dell Technologies World 2025 hosted in May, Michael Dell, Chairman and CEO of Dell Technologies emphasized the central role of data, declaring, “Data is at the center of everything, everywhere, all the time.” Crucially, he pointed out that much of this data is now being generated at the edge, where AI thrives. Dell highlighted personal computing as one of the company’s core strengths. As enterprises start to consider moving to Windows 11, organizations seem to face a pivotal transition question about whether to upgrade to next gen AI PCs. Dell’s AI-powered PCs, including the newly introduced Dell Pro Max with Nvidia Blackwell, can transform traditional workspaces into AI-driven innovation hubs. “Laptops are becoming AI workstations,” Dell said.

In the upcoming Q2 Dell earnings call, any Management commentary about the refresh cycle for laptops will likely provide some insight into demand. In the previous upgrade cycle in FY 2022, Commercial revenues for the CSG business line surged 29% year-over-year from $35.4 billion to $45.6 billion on Covid-related work from home demand. As those PCs enter their 4th and 5th years of use, they may be ready for upgrades. Based on Visible Alpha consensus, Commercial revenues within the CSG segment are projected to grow from $40.8 billion last year to $44.4 billion this year and then back to the peak of $45.6 billion by the end of next year.

Dell and Nvidia partnership key for Dell AI laptops

Source: Dell Technologies World 2025, May 2025.

On Demand | Dell Technologies World 2025 | Dell USA

AI Servers still in focus

Looking further out, analysts remain bullish on the demand for AI servers. Analysts expect to see AI server revenue generate $16.9 billion in FY 2026. ISG revenue is expected to grow to $51.6 billion in FY 2026, with nearly all the year-over-year increase coming from the AI servers. ISG’s operating profit margin is expected to be 12.1% this year and to remain at that level next year. Questions remain about how long it will take to return to the previous 13% levels. According to Visible Alpha consensus, EPS is expected to grow 15% from $8.14/share in FY 2025 to $9.39/share in FY 2026. Estimates range from $10.13/share to $11.34/share, putting the FY 2027 P/E consensus at 13x, and in the 12x-13x range. DELL stock has traded up around 20% since the last earnings release and is up 83.6% since January 2024. The consensus target price is $145.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment