Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 11, 2025

By Afaque Zia

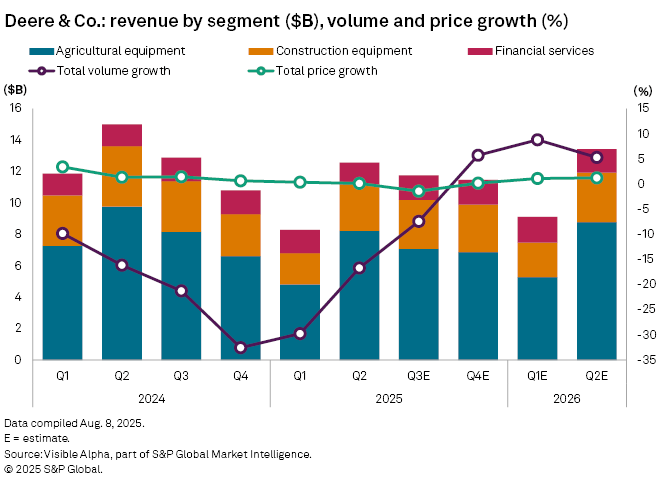

U.S. agricultural manufacturer Deere & Co. (NYSE: DE) is expected to post an -11% year-on-year drop in third-quarter revenue to $11.7 billion, as weakening demand and elevated inventories continue to weigh on performance.

The downturn, which began in late 2023, has been exacerbated by falling crop prices, trade tensions, and elevated borrowing costs—factors that have triggered reluctance to invest in high-cost machinery, impacting manufacturers like Deere. According to Visible Alpha consensus, Deere’s agricultural equipment division, its largest segment, is forecast to see a -13% year-on-year revenue drop to $7 billion in the third quarter. Sales in the construction and forestry equipment segment are expected to fall -3% to $3.1 billion, both divisions pressured by softer shipment volumes and an unfavorable pricing mix.

One relative bright spot remains the company’s financial services arm, which accounts for 13% of total revenue and is projected to grow +4% to $1.6 billion in Q3.

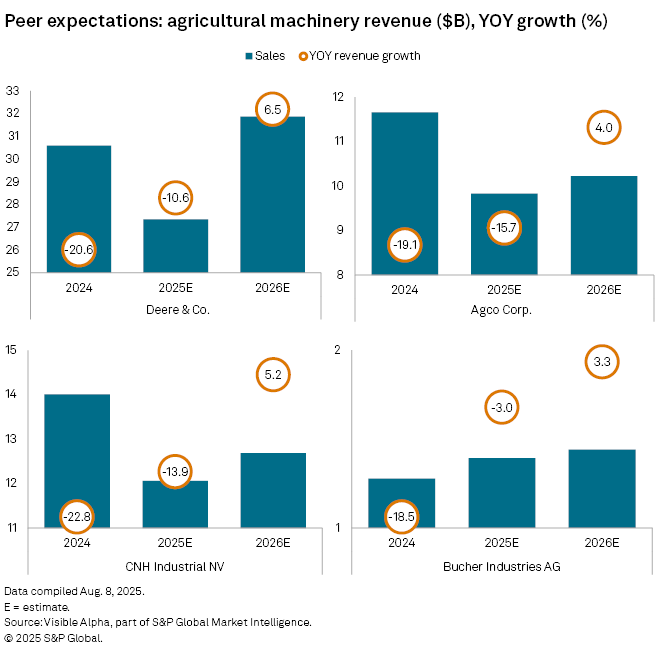

Deere’s full-year revenue is forecast to decline -15% in fiscal 2025, extending last year’s contraction as the industry faces a slowdown. Peers including AGCO Corp. (NYSE: AGCO), CNH Industrial NV (NYSE: CNHI), and Bucher Industries AG (SIX: BUCN) are also bracing for revenue declines, underscoring a broader downturn in agricultural machinery demand.

The company is set to report Q3 2025 earnings on Thursday, August 14.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Products & Offerings

Segment