Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 07, 2025

By Sonam Sidana

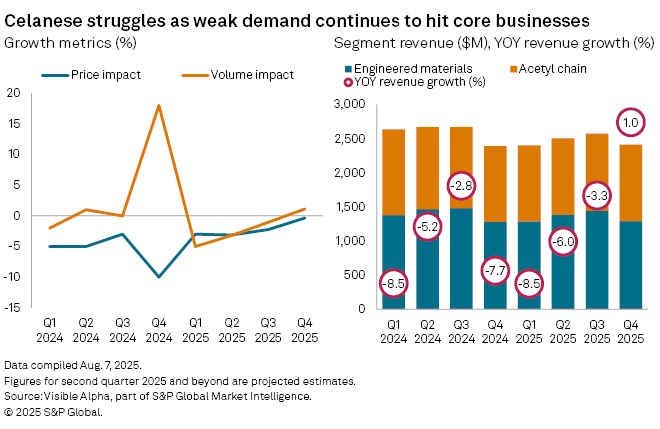

Celanese Corp. (NYSE: CE) is bracing for another tough quarter as soft demand across its key end markets continues to drag on performance. Visible Alpha consensus shows analysts expect second-quarter 2025 net sales to fall -6% year-on-year to $2.49 billion, down from $2.65 billion a year earlier, with ongoing weakness in the company’s Engineered Materials and Acetyl Chain segments.

The US-based chemicals and materials maker has been under pressure since last year, hit by a slowdown in construction, automotive, and industrial sectors. The broader backdrop—marked by global trade uncertainty, tariffs, and muted customer activity—has further dented pricing power and volumes.

In the first quarter of 2025, Celanese swung to a net loss of $21 million, compared with a $121 million profit a year ago. Still, the result marked an improvement from the $1.9 billion loss in the fourth quarter of 2024. Net sales declined -8.5% year-on-year to $2.39 billion.

Th company reports second-quarter results on August 11, with attention focused on the outlook for end-market recovery and margin stabilization.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Products & Offerings