Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 07, 2025

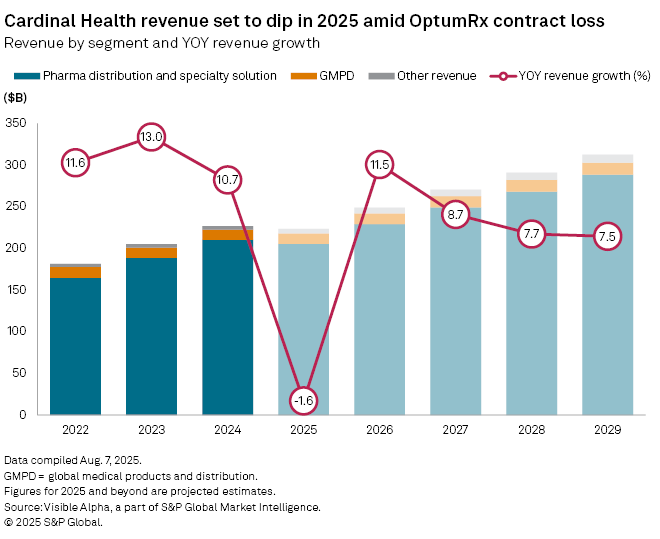

Cardinal Health Inc. (NYSE: CAH) is forecast to post a -1.6% drop in annual revenue to $223 billion in fiscal 2025, reversing the double-digit growth seen last year, as the loss of a major distribution contract weighs on performance.

According to Visible Alpha consensus estimates, the decline stems largely from the termination of its key supply deal with OptumRx, the pharmacy benefits arm of UnitedHealth, which shifted the contract to competitor McKesson (NYSE: MCK). The reversal follows an +11% jump in revenue in fiscal 2024, driven by strong pharmaceutical distribution and rising demand for GLP-1 drugs used in diabetes and obesity treatment.

Cardinal’s core Pharmaceutical Distribution and Specialty Solutions segment—which accounts for more than 90% of revenue—is projected to fall -2.3% to $205.3 billion in 2025. The Global Medical Products and Distribution (GMPD) unit, by contrast, is expected to grow +2.4% to $12.7 billion, while other revenue is forecast at $5.3 billion.

Fourth-quarter results, due August 12, are expected to show modest year-on-year growth of +1.5% in total revenue to $60.8 billion, with pharmaceutical distribution up just +0.7%—an indication that recovery is still uneven.

Despite the near-term headwinds, Cardinal has been actively reshaping its business. Over the past year, the group has executed a string of acquisitions aimed at bolstering its capabilities in oncology, gastroenterology, and home-based care. These include Integrated Oncology Network (ION), a 71% stake in GI Alliance (GIA), and Advanced Diabetes Supply Group (ADSG)—deals that closed between late 2024 and early 2025.

Analysts expect these moves to support a return to growth in fiscal 2026, with revenue projected to rise 12% to $248.9 billion. The pharmaceutical segment is also expected to rebound, climbing +12% to $228.9 billion as the company begins to realize the full benefit of its recent acquisitions and stabilizes its distribution operations following the OptumRx exit.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Products & Offerings

Segment