Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 08, 2025

By Himani Tyagi

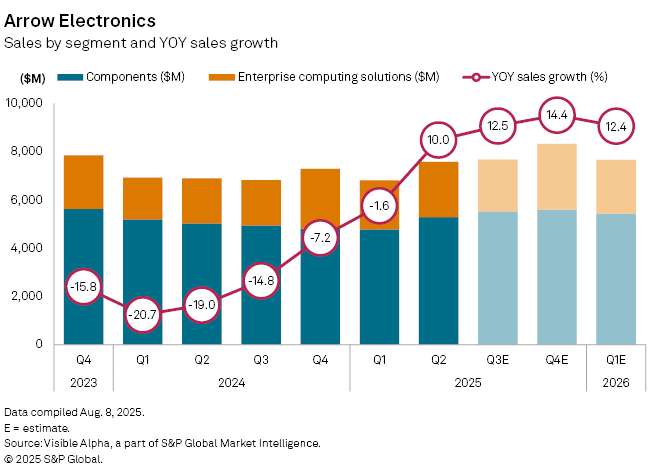

Arrow Electronics Inc. (NYSE: ARW) is poised to return to growth in 2025, following two years of sharp revenue declines that reflected a post-pandemic correction in global electronics demand.

Arrow, a global distributor of electronic components and enterprise computing solutions is expected to grow total sales by +9% year-on-year to $30 billion in 2025, according to Visible Alpha consensus. That would mark a notable rebound after revenues fell -11% in 2023 and a further -16% in 2024, weighed down by inventory overhangs and weakening industrial demand.

Arrow’s Components segment, which generates roughly 70% of total revenue, is forecast to grow +6% in 2025 to $21 billion, after contracting -21% in 2024 and -12% in 2023. Third quarter sales are expected to be up +12% year-on-year. The division has suffered from post-pandemic inventory corrections and sluggish demand across industrial markets. Second-quarter sales rose +5% year-on-year — the first uptick in two years — suggesting a potential bottoming out.

Arrow is also leaning on ArrowSphere, its cloud commerce platform, to drive momentum in enterprise technology distribution. The platform helped power a +23% year-on-year jump in second-quarter revenue for the enterprise computing solutions (ECS) segment. Analysts forecast ECS sales will rise +14% in the third quarter and +16% for the full year to $9.2 billion.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Products & Offerings

Segment