Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 12, 2025

By Kanika Garg

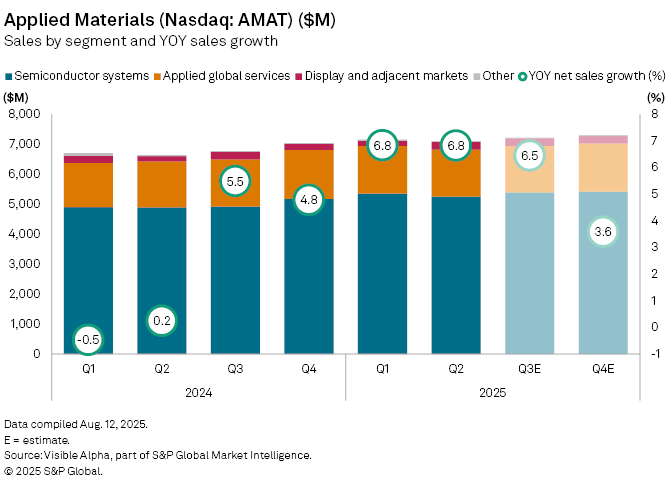

Applied Materials Inc. (NASDAQ: AMAT) is forecast to deliver a +6.5% year-on-year rise in third-quarter net sales to $7.2 billion, supported by strong demand for the advanced semiconductors powering artificial intelligence, cloud computing, automotive electronics and next-generation connectivity.

The company’s semiconductor systems division — its largest segment — is expected to post a +9.6% sales increase to $5.4 billion. Growth is projected across all major product categories within semiconductor systems: foundry and logic chips, which underpin most modern processors, are set to climb +3.3% year-on-year to $3.7 billion; DRAM memory chips are expected to rise +11% to $1.3 billion; and NAND flash storage is forecast to more than double to $439 million.

While AI investment continues to bolster demand for advanced tools, performance outside the core systems unit is expected to soften. Analysts expect the applied global services segment to see sales slip -1.6% to $1.6 billion, while the display and adjacent markets division is forecast to dip -0.2% to $251 million, as the company contends with tariff pressures and intensifying competition in China.

Analysts expect earnings per share of $2.33, with net income estimated at $1.9 billion — down from $2.1 billion last quarter but up from $1.7 billion a year earlier.

The company will report fiscal third-quarter results on Thursday, August 14.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Products & Offerings

Segment