Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — July 03, 2025

By Anna Duquiatan

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

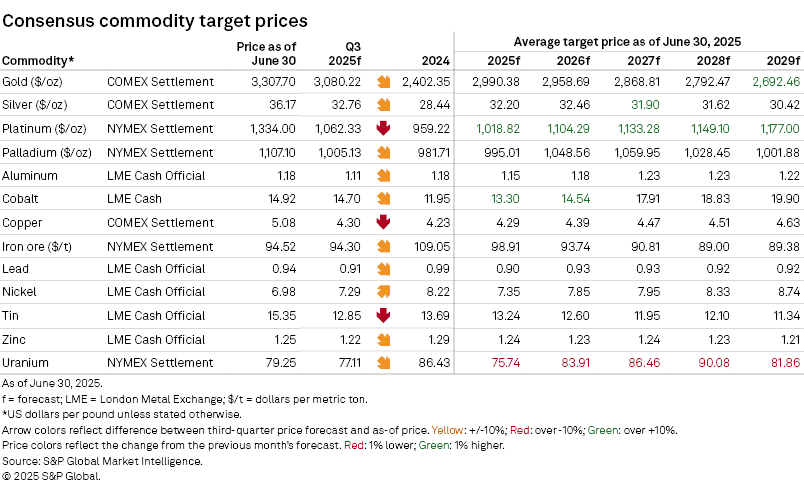

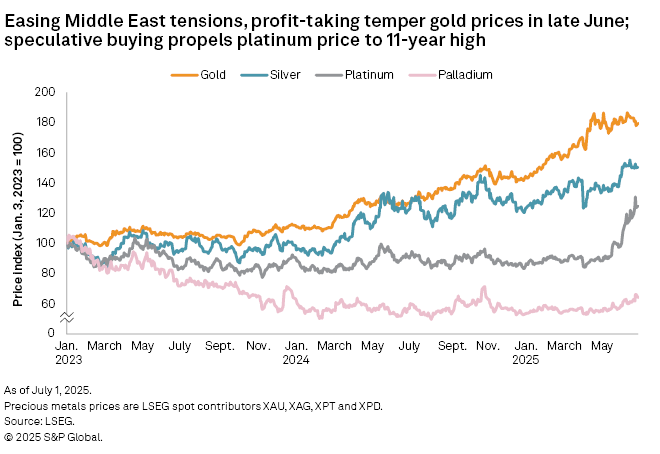

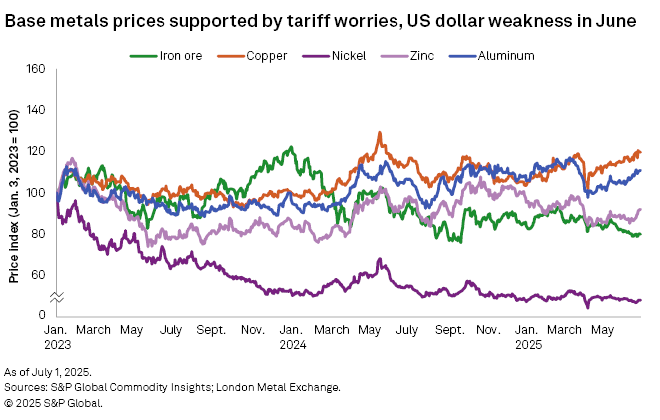

Gold and silver prices rallied early in June as war broke out between Israel and Iran, but subsequent news of a ceasefire limited the increase. Consensus price targets for 2025–29 for gold, silver and platinum have been raised, with ongoing geopolitical and macroeconomic risks driving safe-haven demand and speculative buying. Across the base metals markets, the ongoing deterioration of the US dollar bolstered prices, but tariff-related demand concerns continue to dampen market sentiments. Consensus price forecasts for base metals have been mostly downgraded amid uncertainties in the global trade landscape. Meanwhile, supply-side disruptions have provided upside momentum to cobalt price prospects.

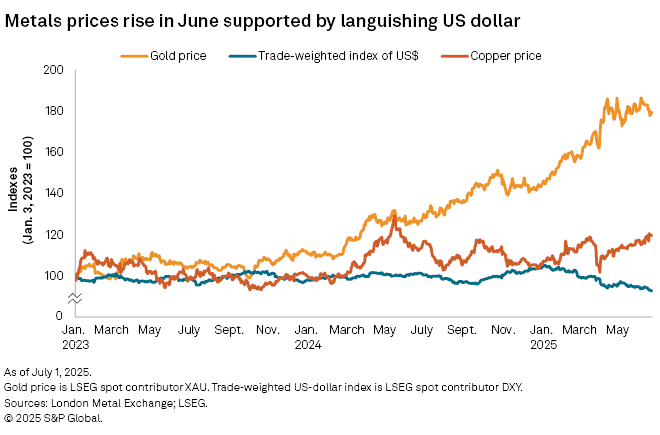

The US dollar has experienced prolonged weakness, with the trade-weighted index trailing below 100 since May 21 and reaching 96.9 on June 30 — a low not seen since February 2022. The greenback's index value has unraveled 10.7% in the January–June period, marking its worst first-half performance of any year since 1973. Investors' flight to safety after Israel's airstrikes on Iran's nuclear facilities on June 13 fueled some upside momentum for the dollar midmonth, although it was capped by news of a ceasefire and prevailing macroeconomic uncertainties.

Concerns over President Donald Trump's vacillating trade policies and the overall health of the US economy have eroded confidence in the dollar as a safe-haven asset. In its June 18 Federal Open Market Committee meeting, the US Federal Reserve left the interest rate unchanged, opting for a cautious wait-and-see strategy, even as it acknowledged inflationary pressures stemming from rising US tariffs. The Fed lowered its US GDP growth projection for 2025 to 1.4% from 1.7% and upgraded forecasts for unemployment and inflation. Trump's mega budget bill — making its way through Congress as of the time of writing — is also weighing on investor confidence, with the legislation's major tax breaks and spending boosts for national security raising concerns about the US' mounting debt burden. The Congressional Budget Office has warned that the bill would add another $3.8 trillion of debt to the federal balance sheet.

Meanwhile, the 90-day suspension of Trump's steep country-specific reciprocal tariffs is set to expire in early July. Thus far, the UK is the only nation to reach an agreement with the US, while bilateral deals with the US' other trade partners are in various stages of negotiations. Ongoing volatility in the global trade landscape has already begun to impact businesses, with major economies' purchasing managers' indexes in contractionary territory across the board in May.

The London Bullion Market Association closing gold price briefly surged to a new all-time high of $3,435.35 per ounce June 13 as Israel's attack on Iran triggered investors' flight to safety. It pared gains as the month unfolded, following the release of better-than-expected US economic data, a de-escalation of the Israel-Iran war and muted physical buying. US data for May showed jobless claims soaring to multiyear highs, but the unemployment rate held steady and inflation came in lower than expected, not yet reflecting significant tariff impacts. In the physical markets, exchange-traded funds in May reflected net outflows for the first time since November 2024, while central bank buying slowed in April amid gold's high-price environment. Despite the recent price pullback, gold remained above $3,200/oz, supported by safe-haven demand stemming from ongoing global trade uncertainties and geopolitical risks. Consensus price forecasts for gold were lifted 0.7% on average across 2025–29.

Safe-haven demand catalyzed by the Israel-Iran conflict also propelled the COMEX silver price to $37.13/oz on June 17, its highest level since May 2011 and reflecting a 25.6% increase year to date. Silver consensus price outlooks have been upgraded 0.5% on average for the five-year forecast horizon, with the white metal expected to follow the trajectory of gold. Industrial applications in the green-energy transition and a persistent structural supply deficit drive fundamental support for silver, but its susceptibility to macroeconomic headwinds caps the upside.

The NYMEX platinum price rose steadily in June to reach $1,397/oz on June 26, its highest level in almost 11 years, as US dollar weakness combined with speculative buying in the US and China. With its applications in internal combustion vehicles, platinum has derived support from US automakers scaling back electrification targets amid the ongoing tariff turmoil and the Trump administration's proposal to roll back policy support for electric vehicles. In China, jewelry makers are looking to platinum as a substitute for gold, which has been trading at elevated prices. Adding to bullish fundamentals, the platinum market is expected to remain in a deficit for the third consecutive year in 2025. Palladium prices also climbed in June, albeit less than platinum, reaching a monthly peak of $1,145/oz on June 30. Consensus price forecasts for platinum have been upgraded 1.7% on average for 2025–29, while outlooks for palladium were adjusted 0.4% higher for 2025–26 but unchanged for 2027–29.

The London Metal Exchange three-month (LME 3M) copper price rallied past the key technical level of $9,800 per metric ton to reach $9,899.50/t on June 26, bolstered by a depreciating US dollar and supply-side tightness. The potential imposition of tariffs on US copper imports is keeping the COMEX-LME cash price arbitrage supported near $1,000/t, encouraging metal flow into the US and driving supply worries in markets outside of the US. As of June 18, COMEX copper stocks were at a near seven-year high but down 61.7% year to date at the LME. In China, rising copper prices dragged on domestic copper demand in May. Meanwhile, the concentrate market remains severely undersupplied, as China spot treatment charges remained in the negative territory in June. Adding pressure to the concentrate supply squeeze, production guidance for 2025 was reduced for the Kamoa-Kakula mine in the Democratic Republic of Congo, Africa's largest producing copper mine, after operations were temporarily halted due to seismic activity. Preemptive copper buying in the US ahead of imminent tariffs and its impact on the broader supply picture have driven near-term upside momentum for copper prices, but trade uncertainties and their implications for demand keep the downside viable. Copper consensus price forecasts have been upgraded 0.3% for 2025 but downgraded 0.6% on average for 2026–29.

A languishing US dollar drove the LME 3M zinc price to a monthly peak of $2,779/t on June 27, after trading rangebound between $2,620/t and $2,720/t for most of the month. Investor funds turned net long on LME zinc in June, while exchange stocks continued to decline, likely influenced by recent metal flows into the US amid expectations of potential tariffs on US imports of critical minerals, which include zinc. Frontloading is also expected to have influenced rising shipments into China, where zinc concentrate imports in April were at their highest level since 2022, and refined zinc imports also rose after declining for two months in a row. By contrast, US refined zinc imports slumped 13% month over month in April after a significant 28% jump in the previous month, helped by preemptive buying amid tariff threats. Beyond near-term demand support, changing tariff schemes continue to feed concerns over a further slowdown in economic activity following the recent manufacturing contraction. In terms of supply, China spot treatment charges for zinc concentrate remained on an uptrend in May, signaling an ongoing loosening of the zinc concentrate market squeeze. Zinc consensus price outlooks have been lowered 0.4% on average for 2025–28 and unchanged for 2029.

The LME 3M nickel price declined throughout much of June to reach a monthly low of $14,804/t on June 23 amid a dearth of fundamental support. It then found upside momentum from a weakened US dollar to end the month at $15,215/t. The nickel market continues to grapple with stubborn oversupply, while demand prospects are stifled by the potential imposition of tariffs on US imports and production curtailments for stainless steel, which accounts for two-thirds of global primary nickel demand. Major stainless steel producer Tsingshan Holding Group Co. Ltd. has suspended some of its production lines in Indonesia since May in response to falling stainless steel prices, while China stainless steel output marked its second consecutive decline on a monthly basis in May. A lingering supply glut in China's stainless steel industry is squeezing mill margins, which could prompt further cuts. Despite demand headwinds, global primary nickel production is expected to continue growing into 2030, led by Indonesia. Consensus price forecasts for nickel have been downgraded 0.4% on average for the five-year forecast horizon.

The LME 3M aluminum price climbed in June to end the month at $2,597.50/t, propped up by the supply disruption worries triggered by the Israel-Iran war and dwindling stockpiles. A vote by Iran's parliament to block the Strait of Hormuz sparked concerns over maritime shipments from the Middle East, which accounts for about 10% of global primary aluminum output. Worries somewhat ebbed as a ceasefire was reached. In the US, the tariff hike on steel and aluminum imports from 25% to 50% and depleting domestic stocks drove up the Platts benchmark US Midwest premium to a new all-time high of 68 cents per pound in early June. Platts is part of S&P Global Commodity Insights. Elsewhere, weak demand in the automotive and construction industries is dragging on Japan aluminum premiums, while China demand is in a seasonal lull. Although rising tariffs are expected to adversely impact consumption levels, potential trade deals could also improve demand prospects. Already, there are reports of Canadian aluminum shipments being diverted from the US into other markets, while US imports of secondary aluminum — which are not subject to steep import duties — surged in the March–April period. Aluminum consensus price targets have been downgraded roughly 0.1% on average for 2025–26 and adjusted 0.6% higher for 2027.

The Platts-assessed European cobalt metal price held at $16/lb throughout much of June, bolstered by the extended DRC cobalt export ban. On June 21, the DRC announced it is extending the initial four-month export ban through September, bringing the total duration of the ban to seven months. If exports do not resume soon, disruptions from the prolonged export ban are expected to be significant enough to bring the market to a supply deficit in 2025, contrary to a previously anticipated surplus. It is widely expected that the DRC will eventually transition to a quota-based system for its cobalt exports, but the effectiveness of this mechanism will depend on how it is implemented and how the stockpiled inventories are handled. Top producer CMOC Group Ltd. reported a 14.6% quarterly rise in its cobalt inventory in the March quarter, marking its sixth consecutive quarterly increase. Combined passenger plug-in electric vehicle sales across top markets rose 9.9% month over month in May, but increased tariffs on US auto imports and waning policy support for EV adoption could curb demand prospects going forward. The Trump administration is seeking to rescind US tax credits for EVs and renewable energy installations, posing a significant downside risk to US battery metals demand. Nevertheless, supply worries prevailed, with consensus price forecasts for cobalt upgraded 2.2% on average for 2025–26.

The Platts IODEX 62% Fe iron ore price declined 4.7% month over month in June to a monthly average of $94.47 per dry metric ton, pressured by pessimistic demand sentiment. Rising US import duties on steel are expected to shift trade flows away from the US, but new market destinations could be limited by the adoption of protectionist policies, as in the case of South Korea, Vietnam and India. Trade tensions have impacted steel production in Europe and Japan, where steel output for the January–May period faltered 2.5% and 5.2% year over year, respectively, consequently deflating iron ore pellet imports. China steel output dropped 1.7% over the same period, while iron ore imports fell 27.4 million metric tons in January–May compared to the prior-year period. Steel prices in China are subdued by manufacturing weakness and a sluggish recovery in the property sector, as the steel market remains oversupplied. Expectations for further steel output cuts that would align supply with demand have dampened demand prospects for iron ore. Exports of iron ore from Brazil in May were the highest since October 2024, but January–April shipments from Australia, India and Ukraine were lower year over year, helping to slow the growth in seaborne iron ore supply. Further out, anticipated difficulties in the development of the Simandou project in Guinea are expected to delay production ramp-up. Iron ore consensus price targets have been downgraded 0.5% on average for 2025–29.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Content Type

Theme

Location

Segment

Language