Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — June 30, 2025

By Husain Rupawala and Tim Zawacki

As the world grapples with the escalating impact of climate-related risks, various insurance industry stakeholders gathered during London Climate Action Week held June 21–29 to discuss its pivotal role in shaping the ongoing transition.

The key discussion at various events underscored the point that the insurance sector is too often relegated to the sidelines in conversations about climate risk and sustainability. But given the industry's central role in responding to increasingly frequent and severe natural catastrophes, insurers have emerged as both key stakeholders and drivers of change. Further, the ambitious goal to scale up climate finance into developing countries to $1.3 trillion per year by 2035 cannot be achieved without an active involvement of the insurance industry.

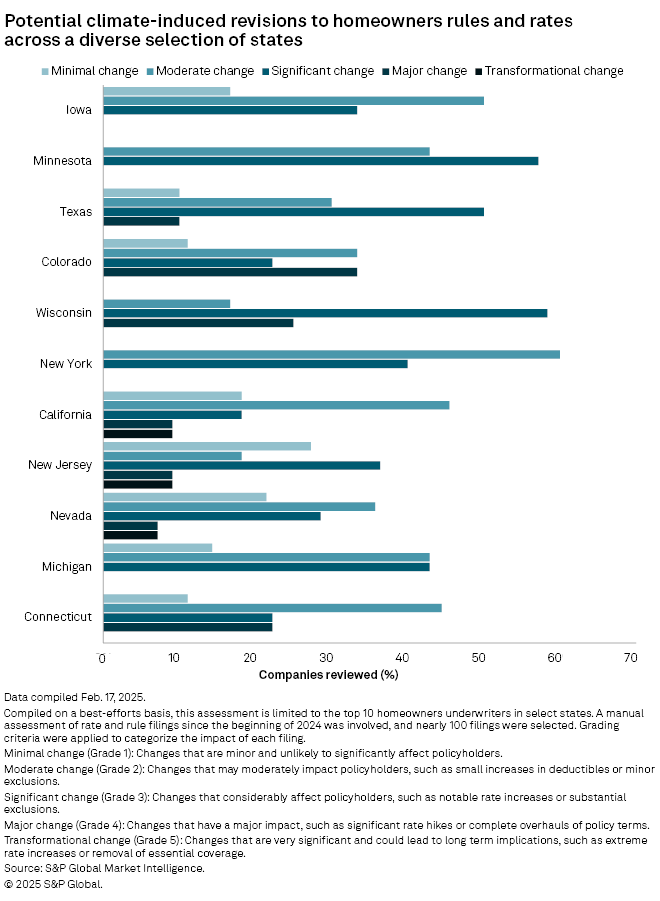

As the stakes rise, new urgency to adopt new strategies and practices to assess climate-related risks has taken hold, especially in the US homeowners insurance market. An S&P Global Market Intelligence analysis of rate and rule product filings in key states conducted earlier in 2025 revealed that insurers are actively revising homeowners policy forms and rules to address climate-induced risks. While actions of the sort have traditionally been focused on states like Florida and California, given their heightened exposure to hurricanes and wildfires, respectively, our analysis shows that insurers are taking a more cautious approach to other markets, pursuing actions that could have broader implications on the affordability and availability of coverage.

With carriers continually refining their appetites to write business in catastrophe-prone markets, society faces a series of difficult choices that ultimately will culminate in the greater sharing of risk. But much uncertainty remains about how that risk will be divvied up.

At their core, property insurers provide financial protection against unforeseen events and, in so doing, offer a safety net for key climate-related risks. But the frequency and severity of events such as wildfires and severe convective storms have reshaped that safety net through reassessment of underwriting guidelines, pricing and overall risk mitigation approaches. That reassessment, at the extreme, has resulted in wholesale withdrawals from challenging markets and moratoria on new business writings, such as State Farm General Insurance Co., but it has more commonly included new rules around eligibility for coverage, aspects of the underwriting process and the structure of deductibles.

A recent white paper from Howden Group Holdings Ltd. on insurability, which served as the basis for discussions held at several London Climate Action Week events, emphasizes that the ability to secure affordable and adequate insurance coverage is becoming a core determinant of investment readiness and operational continuity. As climate risks intensify, insurers must evolve their strategies to address the needs of policyholders while ensuring their own financial resilience.

This evolution, however, requires material changes to policy terms, conditions and pricing — outcomes we observed earlier in 2025 when conducting an analysis of select homeowners product filings in a cross-section of states.

In our analysis, we reviewed nearly 100 homeowners product filings and subjectively scored proposed changes based on their potential impact on policyholders, ranging from minimal to transformational. For instance, we considered changes classified as "minimal" to involve minor adjustments to policies and coverage terms that are unlikely to significantly affect policyholders, while "transformational" changes could entail very large rate increases and/or the removal or amendment of key policy terms and conditions.

We generally looked at rate and rule filings in the analysis, though the specific categorization of filings may vary from state to state. Some of the changes filed by individual carriers may be specific to certain catastrophe-prone states or regions, while others may be part of broader efforts to overhaul policy terms and conditions.

An example of a "minimal" change would be an action by The Hartford Insurance Group Inc. subsidiaries to pass along interchange fees to customers who pay their insurance bills with a credit card. An example of a more meaningful change under our criteria involved the implementation of wind-and-hail deductibles by State Farm Fire and Casualty Co. on a sliding scale based, in part, on the age of a policyholder's roof.

More broadly, we found in Connecticut that certain insurers are revising their underwriting guidelines to incorporate aerial imagery assessments to evaluate property conditions, highlighting the importance of maintaining well-maintained homes in the face of climate risks and the susceptibility of roofs of certain ages and materials to wind and hail. Similarly, in Michigan, revisions to homeowners products are being made to address the growing concerns surrounding roof types and age, reflecting an increased sensitivity to the risks posed by severe weather events. Policyholders whose homes fail to meet certain requirements would face the prospect of higher rates and, in some cases, coverage exclusions.

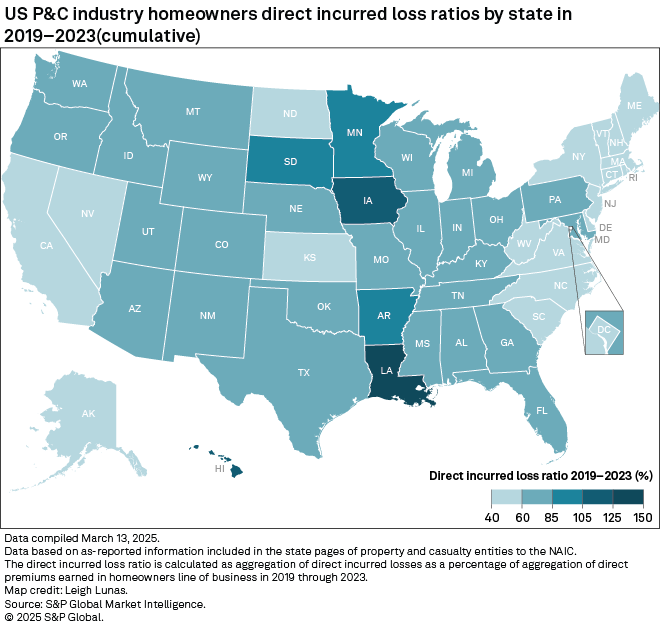

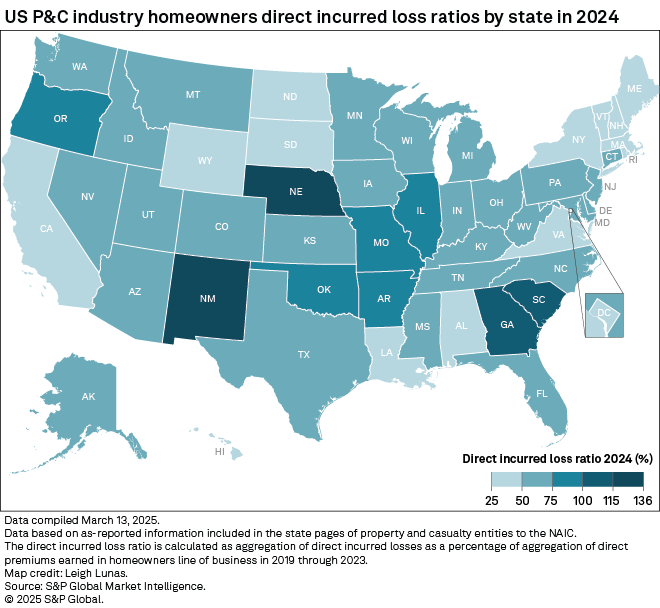

S&P Global Market Intelligence data shows both the susceptibility of homeowners insurance to climate-related factors and the degree of volatility that natural catastrophes can induce.

The P&C industry's homeowners insurance combined ratio was slightly better than break-even at 99.3% following Hurricane Helene and other severe weather-related events, excluding state funds and residual markets like Florida's Citizens Property Insurance Corp. But only days into 2025, any momentum in underwriting profitability was derailed by the Los Angeles wildfires, which sent the first-quarter 2025 homeowners direct loss ratio to a multi-year peak of 101.2%.

At the individual state level, climate-induced volatility from period to period can be enormous. By way of example, Louisiana's direct loss ratio in the homeowners business was a mere 37.7% in 2024 as compared with a cumulative result of 149.8% between 2019 and 2023. Nebraska's 2024 homeowners direct loss ratio spiked to 135.7% from a cumulative total of 77.3% during the previous five years. California is likely to experience a similar dichotomy in 2025 relative its cumulative result for the previous five years.

It was discussed at several points during London Climate Action Week that the insurance industry has the opportunity to position themselves as leaders in the climate transition by developing innovative products and services that align with sustainability goals. The presence of insurance industry at the summits of COP, or the Conference of the Parties to the United Nations Framework Convention on Climate Change, further emphasizes its growing role in addressing climate change and building resilience. But as the Howden paper highlights, insurers and the concept of insurability must be viewed as critical components of the conversation.

This has become challenging in some states where headlines about large rate increases and market retreats have shined a negative light on the industry, complicating the political dynamics associated with constructive dialogues among carriers, regulators and policymakers. Given the significance of the resulting societal challenge, however, it is critical for all key stakeholders to find common ground.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Content Type

Theme

Location

Segment

Language