Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 20, 2025

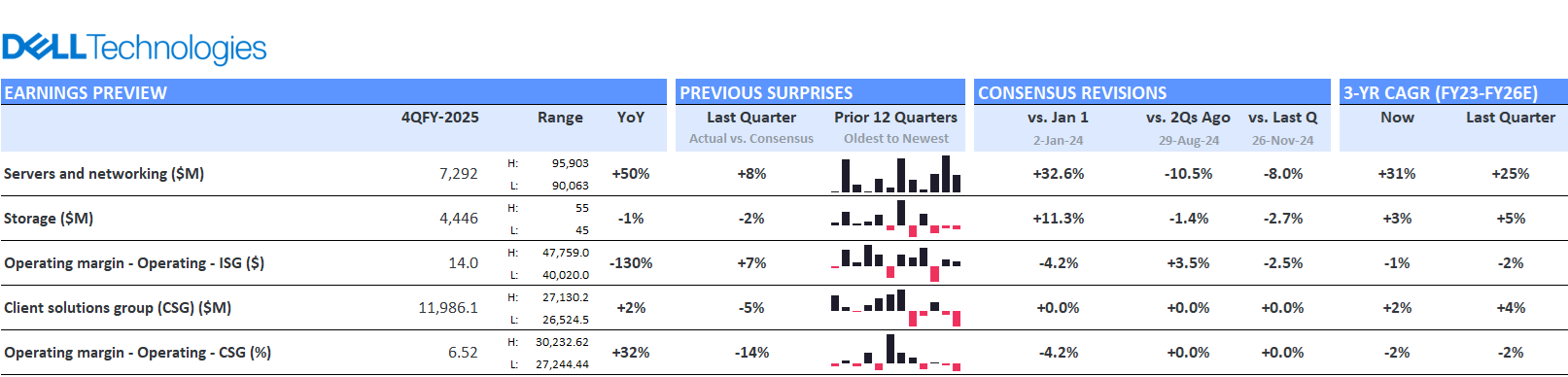

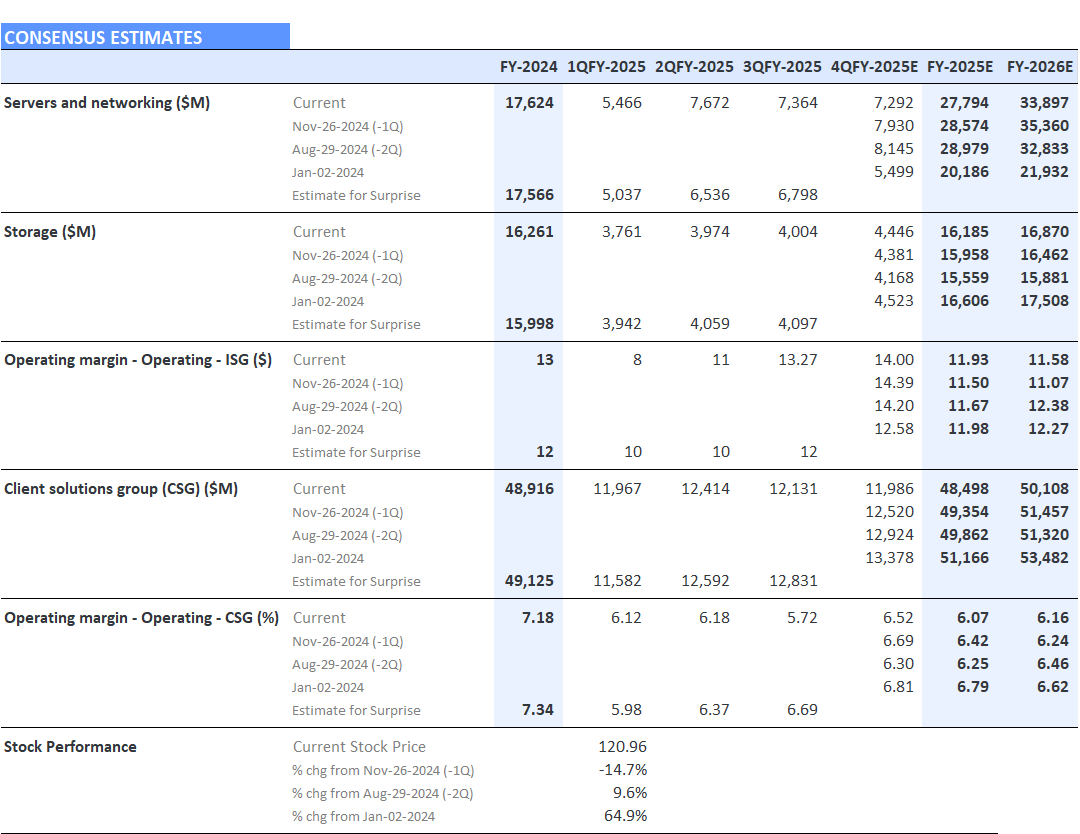

For fiscal Q4 2025, Dell guided to $24.0-25.0 billion in total revenue and diluted Non-GAAP EPS of $2.50 (plus or minus $.10), in line with expectations of $24.5 billion and $2.52, ahead of the release next week. The ISG segment revenue is projected to make up $11.7 billion, and to see its gross margin improve to 35.8% quarter over quarter. The ISG consensus operating margin for Q4 is now expected to be 14.0% but is down from the 14.4% expected at the end of last quarter.

Commentary on the company’s AI server backlog and any indications that enterprise customers are planning to refresh PCs will be important for assessing the outlook. In Q3, the company shipped $2.9 billion of AI servers and the AI server backlog remained at ~$4.5 billion. The company saw a rapid shift of the order towards their Blackwell design last quarter and has said that it will continue to ramp. The potential timing of the refresh cycle and AI pipeline will be key issues for FY 2026. In addition, it will be interesting to hear management’s perspective on the trajectory of demand for storage from the AI opportunity.

Source: Visible Alpha consensus (February 19, 2025)

Revisions of DELL Estimates

Source: Visible Alpha consensus (February 19, 2025). Stock price data courtesy of S&P Global. Dell’s current stock price is as of the market close on February 18, 2025.

Looking further out, analysts remain bullish on the demand for AI servers. Analysts expect to see AI server revenue generate $16.4 billion in FY 2026. ISG revenue is expected to grow to $50.8 billion in FY 2026, with nearly all of the year-over-year increase coming from the AI servers. ISG’s operating profit margin is expected to be 11.9% this year and to decrease to 11.6% by the end of FY 2026. Questions remain about how long it will take to return to the previous 13% levels.

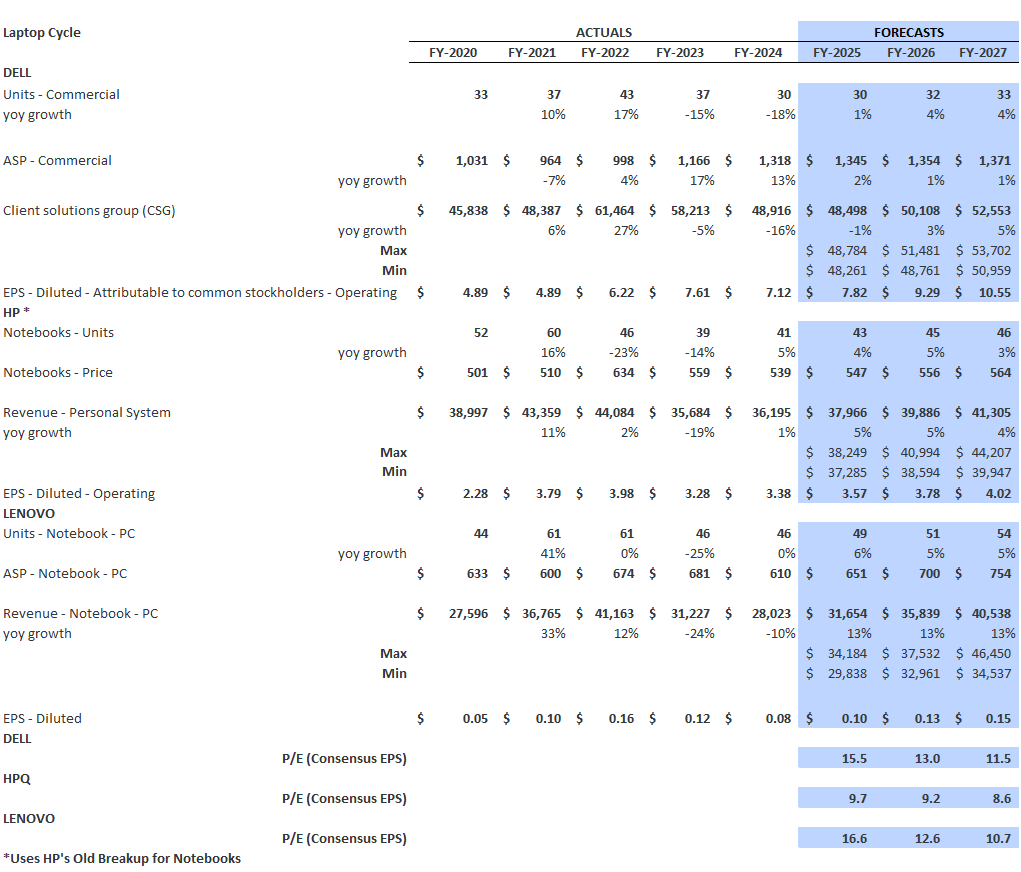

According to Visible Alpha consensus, EPS is expected to grow nearly 20% from $7.82/share in FY 2025 to $9.29/share in FY 2026. Estimates range from $8.30/share to $9.62/share, putting the FY 2026 P/E consensus at 13x, and in the 13x-15x range.

DELL stock has traded down around 15% since the last earnings release but is up 63% since January 2024. The consensus target price is $149.

Laptop Cycle

Source: Visible Alpha consensus (February 19, 2025). Stock price data courtesy of S&P Global. Dell’s current stock price is as of market close on February 18, 2025.

DELL Segment Details

Source: Visible Alpha consensus (February 19, 2025). Stock price data courtesy of S&P Global. Dell’s current stock price is as of the market close on February 18, 2025.

Content Type

Products & Offerings

Segment