Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 30, 2025

By Husain Rupawala and Tim Zawacki

The US insurance industry continues to play a prominent role in the extraordinary growth in growth of the private markets as what previously were classified as alternative investment strategies have become increasingly critical components of carriers' approaches to asset management.

|

– Access the full 2025 US Insurance Investments Market Report. - Register for a webinar in partnership with Clearwater Analytics to be held 10:30 am ET on July 24: 2025 Trends in Insurer Investments, Public and Private Allocations and Use of External Managers – Access a refreshable spreadsheet containing key data points featured in the report. |

The 2025 US Insurance Investments Market Report, newly released by S&P Global Market Intelligence, tracks the evolution of the property and casualty and life sectors' asset allocation strategies through the first quarter of 2025 at a high level, and then more granularly across bonds, equities, mortgage loans, real estate equity, and other long-term invested assets. The report, which is sourced largely from the annual investment detail sections of annual statutory filings, also analyzes the expanded intersection of insurance and the private markets, particularly as it pertains to investments in various positions classified in regulatory filings as bonds.

Under the National Association of Insurance Commissioners' formal definition of private bonds, which include freely tradable securities issued under Rule 144A, allocations remained at or near historical highs in 2024: 45.6% of total bonds for the life sector and 19.8% for the P&C sector, up from 44.4% and 19.7%, respectively, a year prior. When limiting the analysis to bonds with CUSIPs, or Committee on Uniform Security Identification Procedures identifiers, that contain special characters to signify their status as private placements, the percentages are lower and significantly more divergent across sectors at 21.6% for life and just 2.8% for P&C. Both figures represent the byproduct of continual expansion during the past decade.

Private investments may offer higher yields but can also introduce layers of complexity and liquidity risk, which helps account for the wide gap between life and P&C sector allocations. The increased exposure also underscores the importance of appropriate asset-liability matching strategies and explains the expansion of regulatory scrutiny.

Increased supply of private markets issuance, the continuing transformation of US insurance company balance sheets, especially in the life sector, and insurers' rising reliance on both affiliated and third-party asset managers that specialize in private originations favors the extension of this trend in 2025 and beyond. New disclosure requirements may provide some additional transparency amid a rapid diversification of investment strategies.

Insurers lead the private markets push

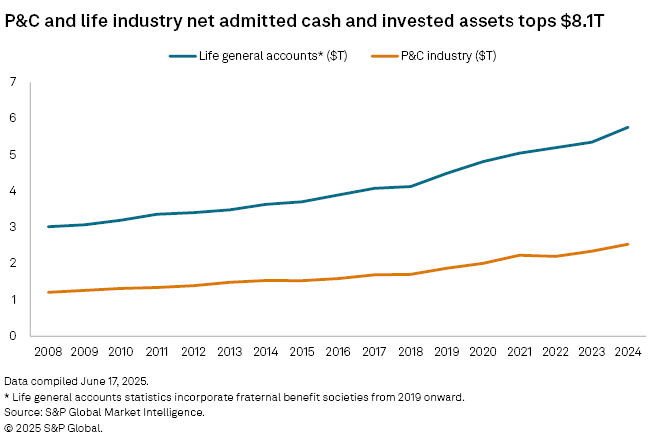

With more than $8 trillion in cash and investable assets, the P&C sector and life general accounts represent fertile ground for alternative asset managers seeking to drive growth in their assets under management. At the same time — and particularly in the annuity market — insurance carriers have become increasingly reliant on outsized investment returns as a means of enhancing their competitive positions.

This confluence of supply and demand has propagated a range of business models ranging from full balance sheet integration to long-term third-party asset management mandates involving some of the biggest names in the alternatives space, including the likes of Apollo Global Management Inc., KKR & Co. Inc., The Carlyle Group Inc., Ares Management Corp. and Blackstone Inc. Asset managers large and small have also gained traction marketing more tailed solutions focused on specific products or strategies such as rated-note feeder funds and related structures.

Another key element of the industry's transformation has been the rise of asset-intensive reinsurance, where insurers have increasingly turned to offshore reinsurers in Bermuda and elsewhere to facilitate the creation of less-capital-intensive balance sheets and to support new business production. A number of these reinsurance vehicles are sponsored and/or controlled by alternative asset managers.

Traditional asset managers have also found considerable success in capitalizing in a broader push for outsourcing by insurance companies, including through the pursuit of organic and inorganic growth. BlackRock Inc. specifically cited opportunities in the insurance space upon the December 2024 announcement of an agreement to acquire alternative credit manager HPS Investment Partners LLC as well as a July 2025 follow-on deal where HPS agreed to purchase real estate-focused investment firm ElmTree Funds LLC. During BlackRock's June 2025 investor day, for example, CFO and Global Head of Corporate Strategy Martin Small said that insurance companies are leading the push to "fuse public and private markets" through a transition to a mix of public and private credit from a traditional emphasis on core, public fixed income.

"What used to be distinct lines between insurance and asset management is becoming more and more blurred over time," said Tarek Chouman, BlackRock's global head of Aladdin client business, during the investor day, citing strategies such as greater use of whole-business outsourcing and the rise of private equity-backed insurers.

In a number of cases, asset managers have purchased non-controlling stakes in insurers in conjunction with the entry of long-term investment management mandates and, as we saw earlier in 2025, through The Northwestern Mutual Life Insurance Co.'s new partnership with Sixth Street Partners LLC, vice versa.

Given the durability of these structures and the pervasiveness of the related strategic transformations, we view these developments as permanent shifts in the industry's structure.

Allocations vary widely by ownership structures

Relatively modest shifts in allocation among the major categories of assets (with the notable exception in the P&C sector of the movement by subsidiaries of Berkshire Hathaway Inc. into cash, cash equivalents and short-term investments) do not adequately reflect the significance of these developments. The private markets transition among life general accounts has manifest itself primarily through meaningful changes in allocation within bond portfolios reported on Schedule D, Part 1 and Schedule BA of annual statutory statements. Bonds, broadly speaking, continue to account for a substantial majority of invested assets across the P&C sector and life general accounts.

The 2025 US Insurance Investments Market Report breaks the largest holders of life general accounts into four categories of companies based on ownership structure: publicly traded stock companies such as Prudential Financial Inc. and MetLife Inc., mutual insurers and fraternal benefit societies such as Northwestern Mutual and Thrivent Financial for Lutherans, private equity-backed insurers like Athene and Global Atlantic Financial Limited, and other private insurers such as Teachers Insurance & Annuity Association of America and Sammons Enterprises Inc.

This exercise uncovered significant differences in relative allocation, including in the areas of affiliated assets and emphasis of what through year-end 2024 was classified as other loan-backed and structured securities.

New NAIC reporting for 2025 and beyond, as detailed in the report, will provide additional granularity into the nature of investments previously included in the other loan-backed category.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.