Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 5 May, 2022

By Nathan Stovall

Highlights

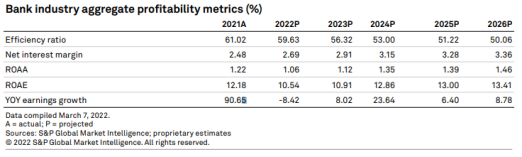

U.S. bank earnings will fall 8.4% in 2022 as the absence of reserve releases creates difficult year-over-year comparisons.

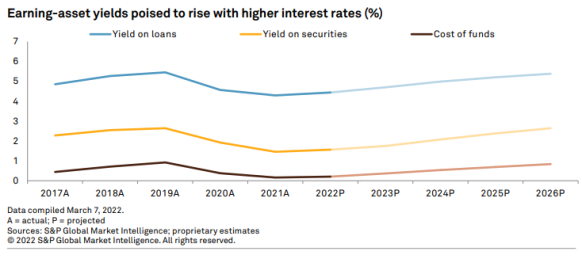

Fed actions to combat elevated inflation through rate hikes and the shrinkage of its $9 trillion balance sheet will boost net interest margins 21 basis points in 2022 and another 23 bps in 2023. Despite the expansion, margins would still remain 38 bps below pre-pandemic levels.

Deposit betas, or the percentage of rate changes banks pass on to customers, will be lower than in past tightening cycles due to the massive influx of liquidity into the banking system during the pandemic.

Bank margins will expand over the next few years as the Federal Reserve raises short-term interest rates and loan balances increase with the economic recovery, but the growth will not be significant enough to lever excess cash. At the same time, banks will no longer receive a massive tailwind to earnings from reserve releases, preventing earnings growth in 2022.

About the US Bank Market Report

S&P Global Market Intelligence examines the U.S. government’s and the Fed’s efforts to mitigate the economic blow of the pandemic, the inflation that followed during the economic recovery and the impact those actions have had on the banking industry’s profitability and credit quality. We acknowledge the likelihood of market-changing events occurring over a five-year period but have created projections for 2022 through 2026 based in part on IHS Markit economists’ expectations for interest rates, unemployment and economic growth. Projections are based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks’ quarterly call reports. While taking into consideration historical growth rates, Market Intelligence often excluded from its analysis the significant volatility experienced in the years around the credit crisis.

Returns close to pre-pandemic levels but margins remain depressed

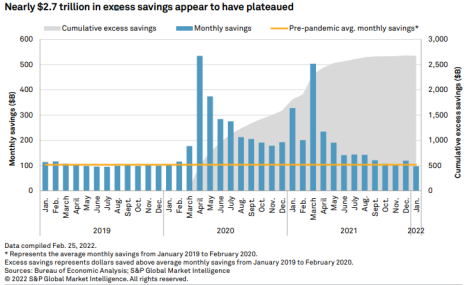

The banking industry remained sodden with excess liquidity as 2021 came to a close, putting considerable pressure on net interest margins.

The banking industry’s margin in 2021 was 81 bps below pre-pandemic levels, as historically low interest rates and a flood of deposits left institutions with pockets full of cash and few attractive places to put those funds to work. The pressure has been greatest on the nation’s largest institutions, which recorded the largest deposit growth over the last two years. This is in part due to the Fed’s quantitative easing, which in turn has increased the level of reserves in the banking system.

Banks seeking scale to compete

As the credit outlook improved, bank M&A activity resumed early in 2021 as buyers were no longer afraid of taking on undue credit risk when acquiring another institution. Bank M&A picked up considerably in the second quarter of 2021. Persistently low interest rates and soft loan demand prompted many institutions to look to deals as an opportunity to cut costs and use some of those savings to invest in technology to remain competitive in an increasingly digital world.

Deposit betas in focus amid rate hikes

While excess liquidity will remain a headwind to earnings, the mountain of cash sitting on bank balance sheets means institutions will not have to react that quickly to increases in short-term rates by raising their deposit costs.

Deposit betas, or the percentage of changes in the federal funds rate that banks pass through to depositors, will be far lower in the current rate hike cycle than in the past few tightening cycles. Banks have faced a different kind of funding problem heading into this rate cycle — institutions simply have too many deposits on their books. While banks face a host of new competition from digital banks, traditional institutions’ funding need is far lower today than in past rate hike cycles, which will allow for minimal increases in deposit costs as interest rates increase.