Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Jan, 2026

By Ben Dyson

Zurich Insurance Group AG's moves to buy Beazley PLC could draw out rival bidders for the London-listed insurer, according to analysts.

Beazley rejected Zurich's latest proposal to buy the company for £12.80 per share, which values it at £7.67 billion on Jan. 22, having already declined a £12.30 per share proposal on Jan. 16. Beazley also revealed Zurich had made a higher £13.15 per share proposal in June 2025, which it had also rebuffed.

"You could well see other suitors come out given the quality of the Beazley business," Ben Cohen, an analyst at RBC Capital Markets, said in an interview.

More to come

While Beazley has rejected Zurich's advances to date, and Zurich has yet to respond to the latest rejection, the story is unlikely to end here. Beazley's share price jumped nearly 43% to £11.70 on Jan. 19, when Zurich publicized its recent approaches, from £8.20 on Jan. 16, the last trading day before the announcement. The share price has since slipped back slightly, closing at £11.16 on Jan. 22.

"What the share price is suggesting is that the market thinks that this level of interest — or some interest from some party — is not now just going to go away," Cohen said.

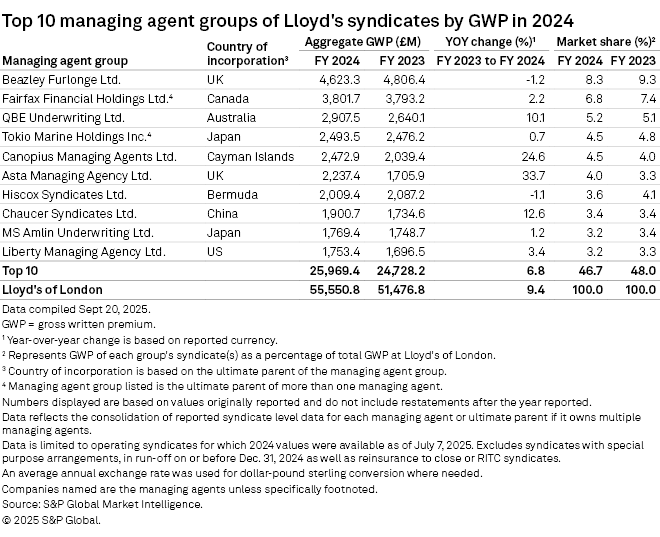

There has been an increasing interest in acquiring specialty businesses, particularly those operating in the Lloyd's of London marketplace. Beazley's Lloyd's operation, Beazley Furlonge Ltd., is the largest managing agent in the market by 2024 gross written premium, according to S&P Global Market Intelligence analysis.

Beazley is "clearly a very strong franchise" at Lloyd's of London, Cohen said, and "a lot of quite large companies have said that they want to grow in specialty in the longer term, both European- and North American-based." Recent deals indicate that "some of the interest has come from fairly left-field acquirers," the analyst said, citing examples such as wholesale broker CRC Insurance Group LLC's acquisition of Atrium Underwriting Group Ltd. and mortgage insurer Radian Group Inc.'s purchase of Inigo Ltd. This makes it difficult to pinpoint where interest could come from, according to Cohen.

Japanese insurers are a possible source of counterbid, Berenberg analyst Michael Christodoulou said in an interview. But he added that it is difficult to think of a European insurer that would have the size and valuation for the deal to make sense. A potential acquirer, if it wanted to fund the acquisition by issuing new shares, would need to have a price-to-earnings ratio greater than the implied valuation of Beazley to avoid diluting its own earnings, he said.

It would be possible to make an argument for Allianz SE being a suitor "just because they're so big," Christodoulou said. Munich Re is an unlikely candidate because it has just embarked on a new five-year plan, according to the analyst.

Wherever a potential suitor is based, they would need to beat the best Zurich could offer. "I don't really see a counterbid or a white knight being so much in play here," he said.

Axa SA is not a likely counterbidder, because of its "depressed multiples and history" and its already large presence in Lloyd's of London, Keefe Bruyette & Woods analysts said in a Jan. 19 research note. Zurich currently lacks a Lloyd's presence, although the Financial Times reported Jan. 20 that the insurer has a syndicate in the works.

Higher bids

There is still scope for Zurich to make a higher offer. The insurer has put five takeover proposals to Beazley in total so far — three in June 2025 in addition to the two in January 2026.

Zurich highlighted its $9.4 billion gross written premium specialty business as a key area for growth at an investor day on Nov. 18, 2025, where it outlined plans to set up a London-based global specialty unit helmed by Saad Mered.

In the Jan. 19 announcement of its proposal to acquire Beazley, Zurich said the transaction would allow it to create a "global leader" in specialty insurance with around $15 billion in gross written premiums. Beazley wrote $6.16 billion of premiums in 2024.

Speaking before Beazley rejected Zurich's latest bid, Christodoulou said a higher offer from Zurich is "highly likely," noting that he didn't think the £12.80 proposal would pass muster given that Beazley said the previous £12.30 bid significantly undervalued the company. A bid between £13.00 and £14.00 per share would make sense, he added.

The question now is whether Zurich will be willing to pay enough to satisfy Beazley's board and shareholders. Zurich will need to go higher than the £13.15 per share it offered back in June 2025. While Zurich is a large, global insurance company with $25.47 billion of shareholders' equity as of the end of 2024, there are limits to what it is willing to offer.

Zurich's shareholders may start questioning whether the company was overpaying if it offered more than £14.00 per share, Christodoulou said.

While Zurich faces few funding constraints, the deal would need to boost earnings per share by at least 4% to still be attractive to the company's shareholders, Christodoulou and fellow Berenberg analyst Michael Huttner estimated in a Jan. 20 research note. This assumes that the acquisition generates no synergies and is funded 40% by debt and cash, with the remainder coming from share issuance. Zurich could offer up to £14.30 and still be within the 4%, the analysts wrote.

An offer from Zurich of £13.40 per share "would be harder for Beazley's board to refuse," Peel Hunt analyst Andreas van Embden wrote in a Jan. 23 note. Beazley's underlying fair value of £9 per share, plus the excess capital on the insurer's balance sheet, would value the company at that level, according to Van Embden.

Other options

There are two other London-listed specialty insurers in addition to Beazley, namely Hiscox Ltd. and Lancashire Holdings Ltd.

Hiscox's share price increased 9.14% on Jan. 19th, when Zurich made its bid for Beazley public, and Lancashire's rose 4%. Hiscox's share price rose 1.2% on Jan. 22, after Beazley rejected Zurich's latest proposal, although Lancashire's remained flat.

However, these companies may not be as well-suited to Zurich's specialty ambitions, analysts said. A lot of Hiscox's value resides in its retail business serving small and medium-sized companies, Cohen said. This is "an attractive business but wouldn't ... necessarily fit as neatly into the specialty division as Zurich has set it out."

Zurich declined to comment beyond its Jan. 19 release. Beazley had not responded to a request for comment at the time of publication.