Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Jan, 2026

By Tom Jacobs and Jason Woleben

Investors' cool reaction to the announced change in CEOs at American International Group Inc. was reflected in a quick drop in the insurer's stock as questions remained about the direction in which the company was heading.

AIG announced on Jan. 6 that Peter Zaffino, the company's CEO since September 2021, would step down on June 1 in favor of Eric Andersen, an industry veteran who is currently a member of Aon PLC's executive committee. Andersen will join the company on Feb. 16 as CEO-elect and will report to Zaffino, who will transition to his role as the company's executive chairman.

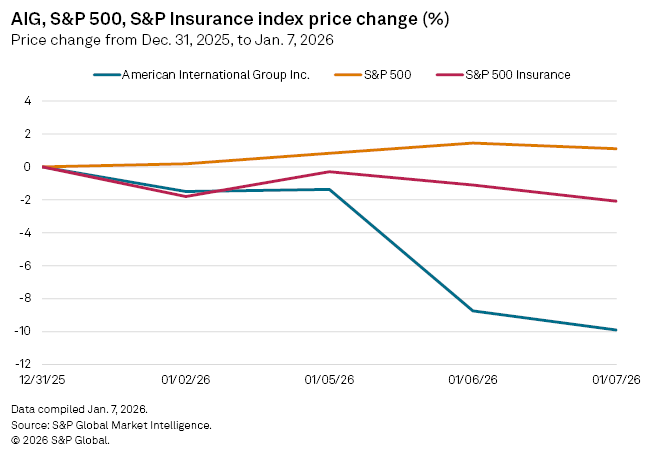

Investors reacted negatively to the news as AIG's stock fell 7.5% for the week by market close on Jan. 6. The stock fell further the following day, finishing the day down 8.3% for the week at the end of trading the following day, while the S&P 500 was up 0.91% and the S&P 500 Insurance Index was off by 0.29%.

Piper Sandler analyst Paul Newsome said investors were anticipating a rumored sale to Chubb Ltd., which was denied by both insurers, or at least a deal with another company.

"Bringing a new CEO suggests it's not for sale tomorrow and that the strategy is going to move more toward growth and less toward restructuring and other big changes that have happened in the past," Newsome said in an interview. "That's made investors concerned that when you're bringing in a new CEO, he's going to ... clean house and take charge, and make changes that are not always initially favorable to investors."

AIG did not respond to a request for comment.

Sudden change

Zaffino has worked over the past few years to fashion himself as the face of the company, Bank of America Securities analyst Josh Shanker said in a research note. Shanker said Zaffino's management style has been "very hands-on, active in day-to-day line underwriting, reinsurance purchasing, restructuring and technological development."

Zaffino's decision to step down had "come suddenly," Shanker said, adding that he doesn't believe the transition to Andersen "to be part of AIG's long-term planning."

Andersen's hiring was also a signal from AIG's board as to which direction the company was headed, said Keefe, Bruyette and Woods analyst Meyer Shields.

"What they're doing is communicating that they have confidence in AIG's ability to go it alone," Shields said in an interview. "Therefore, they're putting in a CEO who is highly respected and young enough [age 58] to, hopefully, have a long tenure ahead of him."

Shields added that bringing Andersen aboard "makes it very, very clear that the board has no interest at all in considering a sale for AIG because its current plans and medium-term prospects are more than adequate to reward shareholders."

Those plans were developed due to the work Zaffino has done to fix "the core of AIG, which is its status as a specialty P&C writer, Shields said, which allows the company to pursue growth.

"It's about optimizing the expense base or improving premium leverage, which is just a fancy way of saying writing more premium," Shields said. "Now that they've got that set, it's a matter of executing on it and making sure that the business that they're bringing on the books is good."