Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Jan, 2026

Real estate M&A activity involving US publicly traded equity real estate investment trusts picked up in the second half of 2025, with six announced deals totaling $16.28 billion in transaction value. By comparison, there were only two deals in the first half of 2025, with a combined transaction value of $1.72 billion, according to an S&P Global Market Intelligence analysis.

The analysis included real estate deals where either the buyer or target is an equity REIT listed on the Nasdaq, NYSE or NYSE American.

2025 deals

Mortgage REIT Rithm Capital Corp.'s acquisition of office REIT Paramount Group Inc. was 2025's largest equity REIT M&A transaction, with a deal value of $5.77 billion, including debt assumption. Under the terms of the deal, announced in September 2025, Rithm acquired all outstanding common shares of Paramount Group for $6.60 per share, totaling approximately $1.46 billion, and about $4.31 billion in assumed debt. The acquisition was completed in December.

Another office REIT acquisition in 2025 was announced in July, when City Office REIT Inc. agreed to be taken private by an affiliate of Elliott Investment Management LP and Morning Calm Management LLC. The transaction is valued at $1.10 billion, comprising approximately $293.1 million in cash and $746.6 million in assumed debt.

Three other REIT privatizations were announced in the fourth quarter of 2025.

In October 2025, industrial REIT Plymouth Industrial REIT Inc. agreed to be acquired in a $2.10 billion transaction by entities affiliated with Makarora Management LP and Ares Management Corp. Sotherly Hotels Inc., meanwhile, agreed to be taken private in a $516.4 million transaction by a joint venture backed by Kemmons Wilson Hospitality Partners LP and Ascendant Capital Partners LP.

In December 2025, Hawaii-focused REIT Alexander & Baldwin Inc. announced an agreement to be taken private in a $2.30 billion transaction by a joint venture formed by MW Group Ltd. and funds affiliated with Blackstone Inc. and Divco West Real Estate Services LLC.

Additionally, in October 2025, timber REITs Rayonier Inc. and PotlatchDeltic Corp. announced their agreement to merge in transaction valued at $4.49 billion.

– For further research, try the US/Canada Real Estate M&A Profile Excel template.

– Set email alerts for future Data Dispatch articles.

– Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

In the first half of 2025, two healthcare REIT deals were disclosed.

Welltower Inc. announced in January 2025 that it agreed to acquire nontraded REIT NorthStar Healthcare Income Inc. in an all-cash deal with an approximate enterprise value of about $900 million. CareTrust REIT Inc. disclosed in March 2025 that it agreed to acquire UK-based Care REIT PLC for approximately $817 million after accounting for $240 million of assumed net debt.

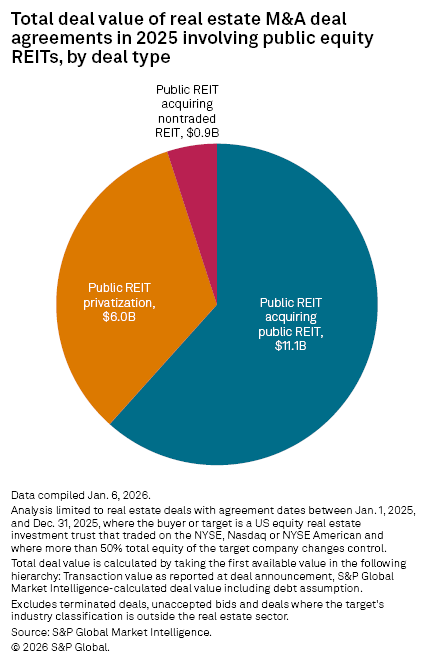

The total value of transactions where public REITs acquired other public REITs reached approximately $11.1 billion in 2025. Meanwhile, deals where public REITs were taken private amounted to about $6.0 billion.

While most REITs traded at discounts to their respective net asset value estimates as of year-end 2025, the market-cap-weighted Dow Jones Equity All REIT index closed the year at a 0.2% premium to net asset value.