Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Jan, 2026

By Tom Jacobs and KRIS ELAINE FIGURACION

|

Vehicles and equipment are among the debris scattered in Louise Hays Park on July 5 in Kerrville, Texas, after flooding from heavy rainfall along the Guadalupe River in central Texas. The event caused over 130 deaths and between $18 billion and $22 billion in damage and economic losses. |

A softening pricing environment and increased competition in the personal auto space are among the issues facing US property and casualty insurers in 2026.

Private auto and homeowners insurers in 2025 continued to reap the benefits of their 2024 pursuit of rate increases. Loss ratios fell over the first three quarters of 2025, while net underwriting gains reached record levels in the third quarter, thanks in part to a milder-than-feared Atlantic hurricane season.

Insurers' private auto lines had a leading role in pushing profitability. The sector booked $278.04 billion in direct premiums written in the first three quarters of 2025.

The landscape of the property and casualty (P&C) sector, however, is on the verge of changing as competition intensifies in the personal auto space and catastrophe risks rise for property carriers.

Premium growth

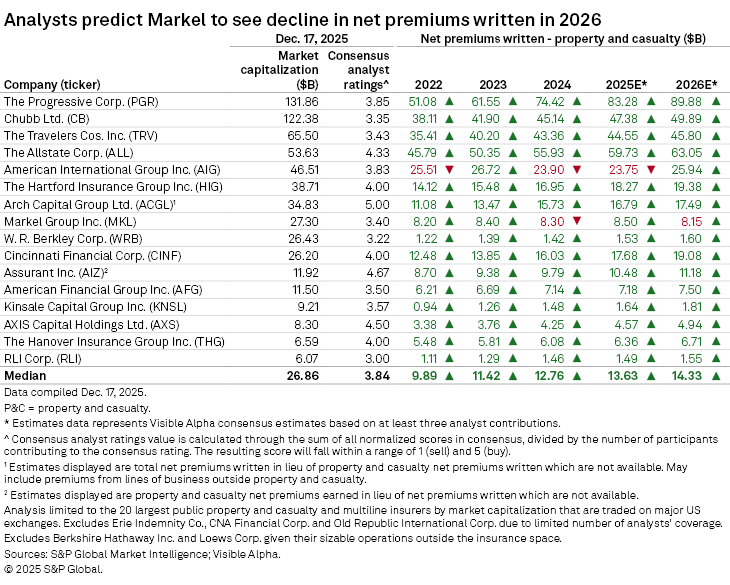

Nearly all of the largest US personal lines and commercial lines insurers saw increases in their net premiums written through the first nine months of 2025, according to an S&P Global Market Intelligence analysis.

The Progressive Corp. had the largest increase at 14.8%, while Auto-Owners Insurance Co. Inc. saw a 10.7% rise. State Farm Mutual Automobile Insurance Co. leads personal lines carriers with $79.50 billion in net premiums written, followed by Progressive with $53.06 billion and The Allstate Corp. with $41.12 billion.

The Travelers Cos. Inc. had the largest increase among the commercial lines carriers in the analysis at 14.8%, followed by W. R. Berkley Corp. with 10.7%. Chubb Ltd. had the highest total at $21.21 billion, slightly ahead of Travelers at $20.77 billion.

While restraint is possible in the new year, sell-side analysts expect net written premiums in 2026 to improve year over year for 15 of the 16 largest publicly traded US property and casualty and multiline insurers.

Under pressure

Opinions vary among analysts in terms of the prospects for the P&C sector. CFRA Research analyst Cathy Seifert sees the outlook as "mixed," citing a combination of a softening in commercial lines pricing, increased competition in personal auto underwriting and the impact of severe weather on homeowners lines.

"Homeowners coverage continues to be impacted by adverse climate change-driven weather patterns that are likely to produce a lot of weather-related losses that don't necessarily bubble up into catastrophes," Seifert said in an interview. "That means the primary insurer is likely to bear more of the cost."

An analysis from AccuWeather reported that seven major weather disasters that hit the US in 2025 resulted in $378 billion to $424 billion in total damage and economic losses. Its chief meteorologist, Jonathan Porter, said the financial impact from extreme weather was "staggering, even without a single hurricane landfall or a major fire impacting a highly populated area during the peak of the wildfire season."

Along with those factors, Seifert anticipates decreases in Treasury yields by the end of 2026, impacting "a significant revenue contributor for many insurers in the form of investment income." She said that would lead to insurers not feeling the need to cash flow underwrite to maintain market share.

"I just get the sense that as this cycle softens, there is a greater sense of restraint on the part of insurers from a competitive standpoint," Seifert said.

"[The cycle] is created by the industry itself, which just can't help itself and must lower rates as soon as they reach a point where they are making at least an adequate return," Newsome said in an interview.

Newsome also raised a red flag on costs rising from social inflation, which he said were "temporarily masked" by the COVID-19 pandemic.

"I think it's been there all along," Newsome said. "What you're seeing is the relentless increase in liability costs caused by all of the things that just haven't changed in the environment."

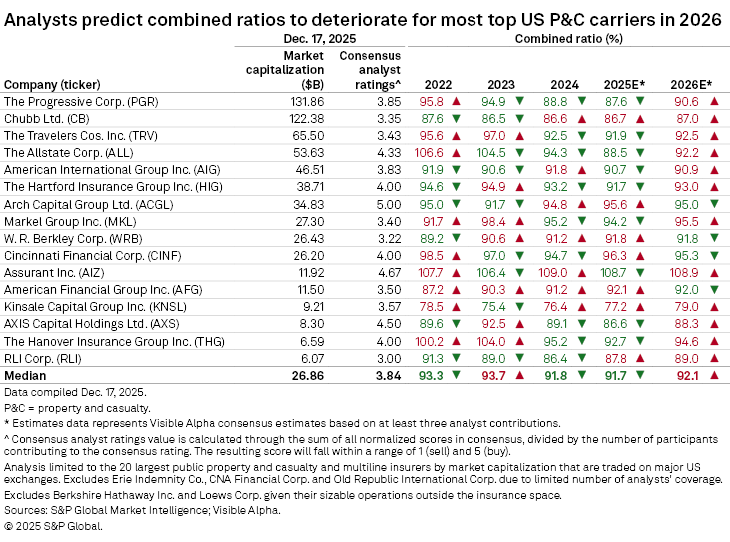

Underwriting profitability

The increase in liability is reflected in sell-siders' 2026 estimates for the industry's combined ratio — a key metric of underwriting profitability. They project that 12 of the 16 largest US P&C insurers will see a year-over-year deterioration in their ratios, while the median estimated ratio in the analysis, 92.1%, would be a slight increase from the 2025 estimate of 91.7%.

Assurant Inc. has the highest estimated ratio at 108.9%, while Kinsale Capital Group Inc. has the lowest, 79.0%.

Moody's views the 2026 outlook for the US P&C personal insurance sector as "stable." The company said in its 2026 P&C Personal Insurance Outlook that the rating "reflects strong profitability following years of pricing increases, offset by increasing competition in personal auto as some leading insurers seek to regain market share."

Moody's said that while capital adequacy has improved based on strong earnings, some insurers are returning capital to shareholders. Reserves are "expected to continue to develop favorably and asset quality remains good," the outlook said.