Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Jan, 2026

By Nick Lazzaro

Flyers are displayed in front of a home for sale Jan. 9, 2026, in California. Mortgage rates in January have fallen to their lowest levels in over a year, but any further declines this year could be limited if the 10-year US Treasury yield stays mostly rangebound above 4.0%. Source: Justin Sullivan/Getty Images News via Getty Images. |

Benchmark US Treasury yields are likely to stay in a fairly narrow range, which stands to limit further mortgage-rate declines in 2026.

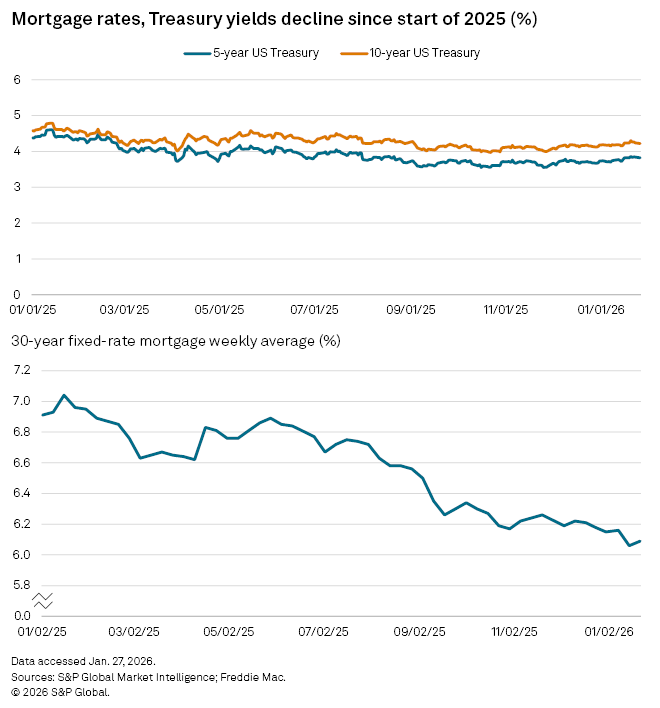

The 10-year US Treasury yield has traded between 4.15% and 4.30% so far in 2026, down from a range between 4.50% and 4.80% in January 2025, according to S&P Global Market Intelligence data. The 10-year note closed at 4.26% on Jan. 28.

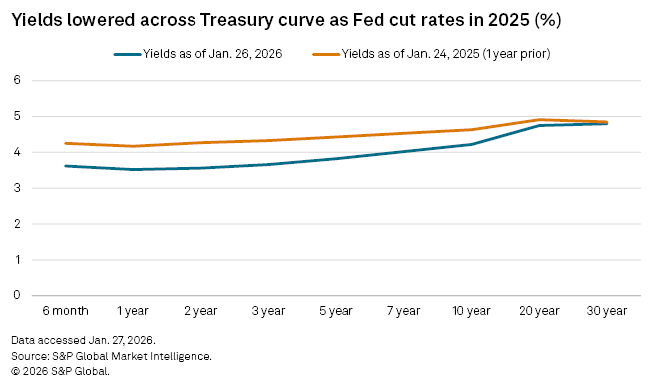

Treasury yields of all terms declined in 2025 as the US Federal Reserve cut its benchmark short-term interest rate six times between September 2024 and the end of 2025. The central bank kept the rate unchanged at a target range between 3.5% and 3.75% at its most recent meeting Jan. 28. While the Fed's easing policy puts negative pressure on short-term yields, economic factors could push up on longer-term yields.

"I expect long rates to be stickier and at least not fall the rest of the year," Steve Dean, chief investment officer for Compound Planning, told Market Intelligence. "Solid economic growth, high demand from AI investment and funding the high federal deficit should keep borrowing demand high and thus put upward pressure on longer rates."

Mortgage rates often trend with the 10‑year Treasury yield, which serves as a widely used benchmark for long‑term interest rates. The 5‑year Treasury also influences medium‑term rate expectations, though it plays a smaller role in mortgage pricing.

US mortgage rates have declined with the 5-year and 10-year Treasury yields over the past year. The weekly average for the 30-year fixed-rate mortgage was 6.10% on Jan. 29, down from 6.91% at the start of 2025. Despite the drop, mortgages remain well above the weekly rates seen from 2009 to late 2022.

"These borrowing rates, especially consumer credit and mortgages, have stayed high in the face of the Fed's rate cuts," Dean said. "I don't expect those rates to come down much on their own unless the Fed cuts more than expected."

Fed policy that influences short-term rates at the front end of the Treasury curve does not guarantee lower rates for medium-term Treasury yields.

"You can argue that by lowering the front end, the 5-year yield will go lower," Neil Sun, portfolio manager within the BlueBay Fixed Income team at RBC Global Asset Management, said in an interview. "But more often than not, the 5-year yield will stay rangebound, so mortgage rates can and will come down, but only to a limited extent."

Mortgage-backed security spreads

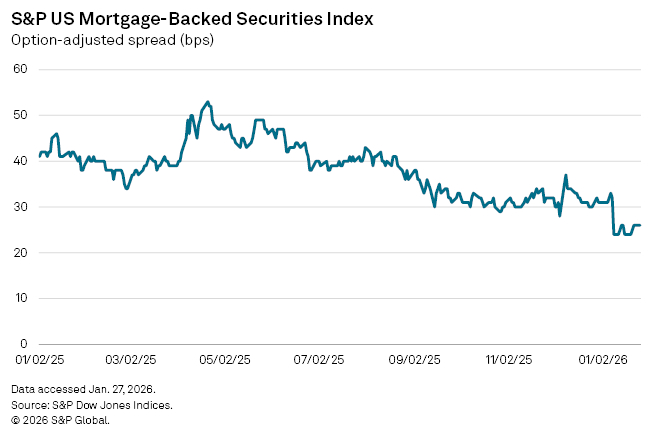

Lower mortgage rates could be aided by tightening spreads for agency mortgage‑backed securities (MBS), which are bonds backed by pools of hundreds or thousands of individual mortgages. Though their movements often correlate, mortgage rates are not set directly from the 10‑year Treasury yield. Rather, lenders determine rates based on the yields of MBS, which trade at a spread to Treasurys.

"One of the main drivers of mortgage rates going lower is the 10-year yield, which is very true, but agency mortgage spreads were extremely wide, and they have been normalizing rapidly," Clayton Triick, head of portfolio management at Angel Oak Capital, said in an interview.

The option-adjusted spread of the S&P US Mortgage-Backed Securities Index closed at 22 basis points Jan. 28, down from 31 bps at the start of 2026 and 41 bps at the start of 2025, according to S&P Dow Jones Indices data.

With the 10-year Treasury yield likely to remain between 4.0% and 4.5% alongside tighter MBS spreads, mortgage rates could settle below 6% in 2026, Triick said.

Affordability

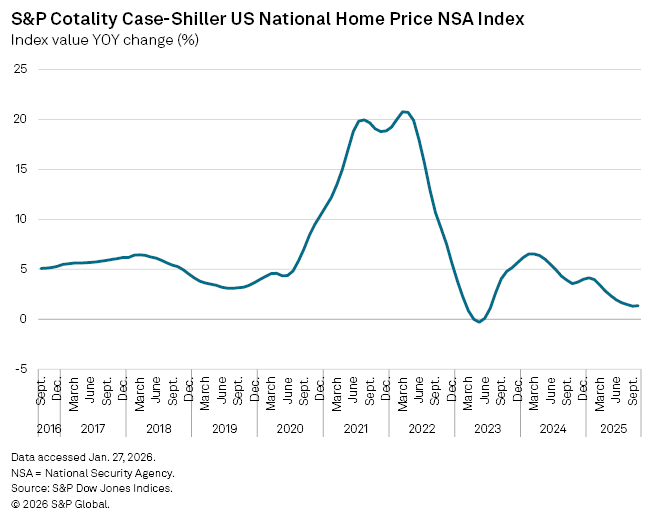

Mortgage rates may not fall much this year, but housing affordability could still improve due to projections of slower or negligible home value appreciation, according to Triick.

"If that happens, we are back to around the 35- or 40-year average for affordability when accounting for the median home price and median income," Triick said.

The S&P Cotality Case-Shiller US National Home Price NSA Index rose 1.36% year over year in November 2025, according to data from S&P Dow Jones Indices. This followed a 1.36% increase in October and a 1.32% increase in September, which was the lowest growth rate since mid-2023. The index is a composite of single-family home price indexes for the nine US Census divisions.

Affordability will face pressure from low housing supply and rising input costs.

"The lower mortgage rate will encourage more people to jump in to buy housing, and then your supply is set but your demand also suddenly increases, which will create another pressure to push home prices upwards," Sun with RBC Global Asset Management said. "And from the housing developers' perspective, the housing prices are not coming down because labor costs are elevated, and input costs continue to rise."

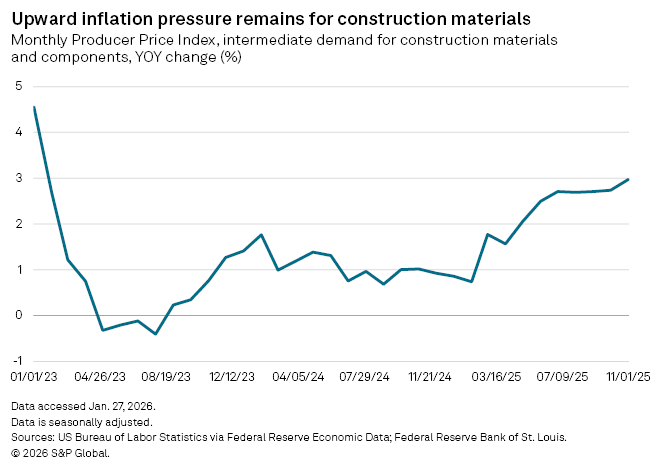

The producer price index of intermediate demand for construction materials and components rose nearly 3% year over year in November 2025, US Bureau of Labor Statistics data shows. That was the highest rate of increase since January 2023 but well below the price spikes in 2021 and 2022 during the worst of post-COVID-19 inflation.

The Trump administration has proposed potential policy initiatives to improve affordability in 2026. Proposals include a cap on credit card rates, increased government-sponsored purchases of MBS and regulation on large institutional investors to limit their purchases of single-family homes.

"We will see if or in what form these policies ultimately take, but I expect their impact on bringing down rates to be relatively small overall," said Dean with Compound Planning.